Welcome to our digital detoxing series! A series on how to stop addictions toFortnite,Facebook,Instagram,porn,Netflix, Youtube,Tinder… Findall the posts about digital addiction. Today, let’s talk about how to quit the stock market addiction.

- What’s the stock market addiction?

- Addiction to stock market, a “real” addiction?

- What’s considered stock market addiction

- How much stock market is too much?

- Some finance addiction facts & statistics

- Symptoms & Causes of the stock market addiction

- Why is stock market so addictive?

- Possible causes of stock market dependency

- Symptoms, Causes and Signs of stock market addiction

- Problems, impacts & bad effects of stock market

- Some benefits of stock market

- health problems

- impact on brain & mental health

- impact on relationships

- How to stop & quit your stock market addiction

- Main steps and solutions to break the stock market addiction

- Best stock market blocker apps & functionalities

- where to seek extra help?

- Conclusion

- To Go Further

- How to help someone with stock market addiction

- Best books about finance addiction

- Research about finance addiction

What is the stock market addiction?

About stock market

A stock market is a collection of markets where stocks (pieces of ownership in businesses) are traded between investors. It usually refers to the exchanges where stocks and other securities are bought and sold.

Addiction to stock market, a “real” addiction?

Officially an addiction?

First, let’s have a look to the DSM-5,the Diagnostic and Statistical Manual of Mental Disorders. Does it includes stock market addiction?

There is no specific listing for stock market addiction in the DSM-5, but it could be classified under a number of different disorders, such as gambling disorder, impulse control disorder, or substance-related and addictive disorders.

So what means “stock market addiction”?

There is no formal definition of stock market addiction, but it could be generally described as an excessive preoccupation or obsession with stocks and investments. This may manifest as compulsively checking stock prices, excessively buying and selling stocks, or engaging in other risky behaviors in pursuit of profits. Stock market addiction can lead to financial ruin, and it may be considered a type of impulse control disorder.

What is considered stock market addiction?

- 1. Preoccupation with the stock market: thinking about it constantly or obsessively following news and changes in prices.

- 2. Loss of control: an inability to stick to set investment goals or limits, often leading to excessive buying or selling.

- 3. Risky behavior: taking on excessive risks in pursuit of profits, or continuing to invest despite heavy losses.

- 4. Continued investment despite negative consequences: neglecting work, family, or other important obligations in order to trade stocks, or continuing to invest despite financial ruin.

- 5. Neglect of other interests and hobbies: losing interest in previously enjoyed activities and withdrawing from social interactions in order to focus on the stock market.

- 6. Tolerance: needing to trade more and more frequently or to take on greater risks in order to achieve the same level of satisfaction.

- 7. Withdrawal: feeling irritable, restless, or anxious when unable to trade or when the market is not moving in the desired direction.

- 8. Persistent thoughts about the market: feeling like one can’t get the market out of one’s head, even when trying to focus on other things.

How much stock market is too much?

There is no one answer to this question. Some people may spend a lot of time on the stock market and still feel that they are not spending too much time. Other people may feel that they are spending too much time if they spend more than a few hours a week on the stock market.

Some finance addiction facts & statistics

Here are some statistics related to finance addiction:

- 1. According to a survey by CreditCards.com, around 6% of Americans are addicted to checking their bank account balances, while 4% check their investments obsessively.

- 2. A study conducted by the University of Cambridge found that approximately 14% of traders in the financial industry exhibited symptoms of addiction.

- 3. According to a report by the National Council on Problem Gambling, around 2 million adults in the United Stateshave a gambling addiction that involves the stock market or other financial instruments.

- 4. A survey by Charles Schwab found that 25% of Americans said they were losing sleep over financial stress, while 30% said they were constantly worried about their financial situation.

Is the stock market addiction widespread?

Some people may become addicted to the stock market due to the potential for high returns and the excitement of trading, but it is important to practice responsible investing and not let it become a harmful addiction.

Symptoms, Causes and Signs of stock market addiction

Why is stock market so addictive?

There are a number of reasons why the stock market can be addictive. For some people, it is the thrill of the game and the possibility of making a lot of money quickly that is most appealing. For others, it may be the sense of power and control that comes with owning a stake in a company. Whatever the reason, the stock market can be a very addictive activity.

Possible causes of stock market dependency

There is no definitive answer to this question as there can be many different reasons why someone might become addicted to the stock market. Some possible causes could include a need for excitement or thrills, a desire to make quick and easy money, or a belief that one can always beat the market. Whatever the reason, stock market addiction can be a dangerous and costly habit.

Signs & Symptoms of stock market addiction

Now let’s see if you have the stock market addiction problem.

- 1. You can’t help but check your portfolio several times a day, even when there’s no reason to.

- 2. You have endless discussions with friends and family about stocks and the market.

- 3. You spend more time reading about stocks and the market than anything else.

- 4. You have multiple stock-related apps on your phone and visit multiple websites daily to check stock prices.

- 5. You get anxious when the market is down and feel elated when it’s up.

- 6. You frequently day trade or make other short-term trades.

- 7. You have more money invested in the stock market than you can afford to lose.

Problems, impacts & bad effects of stock market: should you quit?

What are some benefits of stock market

Some people view the stock market as a great way to make money, while others view it as a necessary evil. Here are some pros and cons of the stock market:

Pros:

-The stock market can be a great way to make money. If you pick the right stocks, you can make a lot of money in a short period of time.

-The stock market is also a great way to diversify your investments. By investing in different stocks, you can spread your risk around and potentially reduce your overall losses.

-Another pro of the stock market is that it can provide you with a sense of ownership in a company. If you invest in a company that you believe in, it can be gratifying to see the company do well.

Cons:

-Of course, the stock market can also be a great way to lose money. If you pick the wrong stocks, you can quickly lose a lot of money.

-The stock market is also very volatile. This means that the value of your investments can go up and down very quickly, which can be stressful.

-Finally, the stock market can be difficult to understand. If you’re not familiar with how it works, you could easily make some bad investment decisions.But at the opposite, what can be some stock market addiction problems addicts suffer from?

general health problems

There is no definitive answer to this question as the effects of the stock market on health can vary depending on the individual. Some people may experience increased levels of stress and anxiety if their portfolio is heavily invested in the stock market, while others may find that tracking their investments helps them to better understand their finances and feel more in control. Ultimately, it is important to monitor your own emotional and physical response to stock market activity and make adjustments to your investment strategy as needed in order to maintain your health and well-being.

stock market and sleep disorder

Yes, stock market can create sleep disorders or sleep problems for individuals who are heavily invested or involved in the market. The stress and anxiety related to market fluctuations, financial losses, and the fear of missing out (FOMO) can cause sleep disturbances such as insomnia, nightmares, and restless sleep.

Additionally, constantly checking stock prices and news updates can disrupt sleep patterns and lead to sleep deprivation. It is important for individuals to manage their exposure and engagement with the stock market to maintain a healthy sleep routine.

stock market affecting your brain & mental health: bad for brain and mental health?

Some effects of stock market on your brain

- 1. You may become more impulsive.

- 2. You may become more short-sighted.

- 3. You may take on more risk.

- 4. You may become more emotional.

- 5. You may become less rational.

Some effects of stock market on your mental health

The stock market can have a negative effect on your mental health if you allow it to. The stress of trying to make money in the stock market can lead to anxiety and depression. The stock market can also be a source of negative emotions such as fear and greed. If you are not careful, the stock market can take a toll on your mental health.

Does stock market cause stress and anxiety?

Yes, the stock market can cause stress or anxiety to individuals who are heavily invested in it. Fluctuations in the market can lead to financial losses, which can cause worry and anxiety.

Additionally, the unpredictable nature of the stock market can lead to a sense of uncertainty and lack of control, which can exacerbate feelings of stress and anxiety. It is important for individuals to manage their investment portfolios wisely and to have a solid financial plan in place to minimize the potential negative effects of stock market fluctuations.

Can stock market addiction lead to sadness and depression?

Yes, stock market addiction can lead to sadness and depression. When someone becomes addicted to the stock market, they may become overly obsessed with their investments, constantly checking their portfolio and making impulsive trades. This can lead to intense emotional highs and lows, depending on how the market is performing. When the market is up, they may feel elated and euphoric, but when it’s down, they may feel anxious, stressed, and depressed.

Additionally, if someone has invested a significant amount of money and experiences losses or financial setbacks, this can exacerbate their feelings of sadness and depression. It’s important for individuals to maintain a healthy balance and perspective when it comes to investing in the stock market.

Dopamine and stock market

Dopamine is a neurotransmitter that is associated with pleasure, motivation, and reward. It is released in the brain in response to certain stimuli, such as food, sex, and drugs. It has also been linked to the stock market and investing.

Studies have shown that the anticipation of a financial reward can trigger the release of dopamine in the brain. This can lead to feelings of pleasure and motivation, which can encourage individuals to continue investing in the stock market.

Additionally, the success of an investment can also trigger the release of dopamine, leading to feelings of reward and satisfaction.

However, it is important to note that dopamine is not the only factor that influences stock market behavior. Other factors, such as economic indicators, company performance, and global events, can also have a significant impact on the stock market. Therefore, it is important for investors to consider a variety of factors when making investment decisions, rather than relying solely on the release of dopamine in response to potential rewards.

stock market effects on Focus, productivity, attention span, academic performance…

Yes, the stock market can affect focus, productivity, attention span, and academic performance. This is because the stock market can cause a lot of stress and anxiety for individuals who are invested in it, and this stress can lead to difficulty focusing, decreased productivity, and a shorter attention span.

Additionally, the stock market can be a distraction for individuals who are constantly checking their investments and tracking market trends, which can take away from their ability to focus on other tasks. Finally, financial stress caused by the stock market can impact an individual’s academic performance as they may be preoccupied with their investments rather than their studies.

A word about ADHD and stock market

There is no definitive answer to this question as everyone with ADHD is different and may interact with the stock market in different ways. However, some research suggests that people with ADHD may be more likely to engage in impulsive behavior and take risks, which could lead to more impulsive investing decisions.

Additionally, people with ADHD may struggle with focusing on complex financial information, which could make it harder for them to make informed investing decisions. However, there are also many successful investors with ADHD, and some experts believe that the hyperfocus and creativity that can come with ADHD may actually be an asset in the stock market. Ultimately, the impact of ADHD on investing will depend on the individual and how they manage their symptoms.

affecting your relationships

stock market and self-esteem

The stock market can affect self-esteem in a few ways:

1. Personal Investments: If an individual has invested in the stock market and their investments are doing well, it can boost their self-esteem. They may feel proud of their investment choices and confident in their ability to make smart financial decisions.

2. Career: For individuals who work in the finance industry or have a job that is tied to the stock market, their self-esteem may be impacted by the performance of the market. If the market is doing well, they may feel more secure in their job and confident in their skills. On the other hand, if the market is doing poorly, they may feel uncertain about their job security and question their abilities.

3. Social Comparison: The stock market can also impact self-esteem through social comparison. If an individual perceives that their peers or colleagues are doing well in the market, they may feel inferior or inadequate in comparison. This can lead to feelings of insecurity and low self-esteem.

Overall, the stock market can have both positive and negative effects on self-esteem depending on an individual’s personal investments, career, and social comparisons.

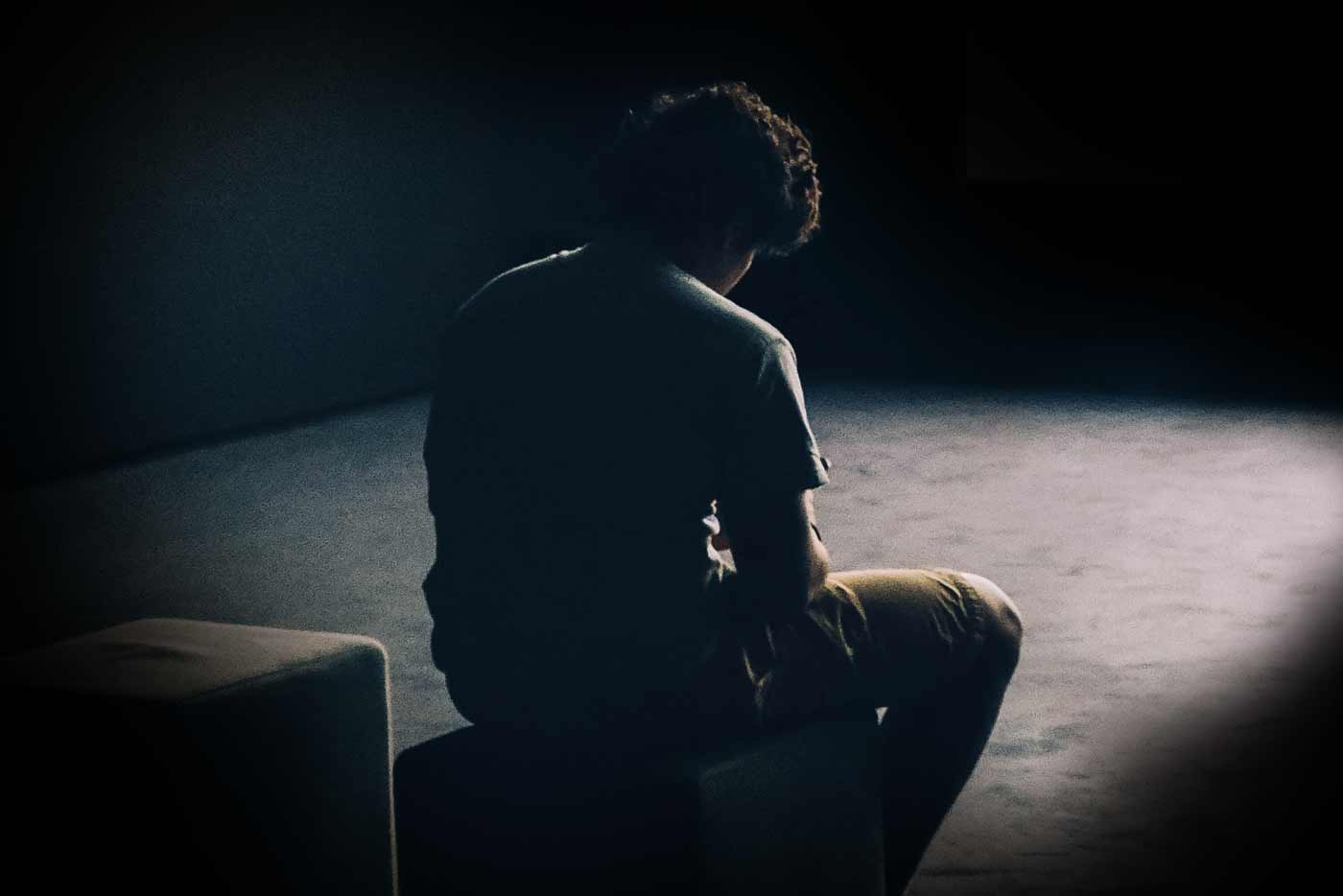

stock market addiction leads to isolation and loneliness?

.jpg)

Yes, stock market addiction can lead to isolation and loneliness. When someone becomes addicted to the stock market, they may spend long hours researching and analyzing the market, and may become so consumed with trading and investing that they neglect other aspects of their life, such as socializing and spending time with friends and family. This can lead to feelings of isolation and loneliness, as well as a lack of support and connection with others.

Additionally, if someone’s stock market investments do not perform as expected, they may become anxious and withdrawn, further exacerbating feelings of isolation and loneliness. It’s important for individuals who are interested in the stock market to maintain balance in their lives and prioritize maintaining social connections and relationships.

Effects of stock market on your relationship

Positive effects:

- 1. Financial stability: If both partners are invested in the stock market and their investments perform well, it can lead to financial stability and security, which can strengthen the relationship.

- 2. Shared interests: Investing in the stock market can be a shared interest for couples, which can increase their bonding and communication.

- 3. Learning opportunities: Investing in the stock market can be a learning opportunity for couples to learn about finances and investments, which can improve their financial literacy and decision-making skills.

Negative effects:

- 1. Financial stress: If one partner is invested in the stock market and their investments perform poorly, it can lead to financial stress and strain on the relationship.

- 2. Differences in risk tolerance: Couples may have different risk tolerance levels when it comes to investing, which can lead to disagreements and conflicts.

- 3. Time commitment: Investing in the stock market requires time and attention, which can lead to neglect of the relationship and less quality time spent together.

How To Stop & quit Your stock market Addiction

Finally you think you are addicted to stock market and you are wondering how to quit it? How to break and overcome your cravings for stock market?

Here are the best solutions, steps, supports, resources and help you can get to treat your stock market addiction.

Main steps and solutions to break the stock market addiction

The first step is to realize that you have a problem. Second, is to seek help from a professional. third is to make a plan to change your behavior. fourth is to stick to your plan. fifth is to stay away from trigger situations. sixth is to stay positive and believe in yourself.

Actually, that’s what most documentation out there is about… However, quitting a digital addiction can be a bit trickier than that.

So our team, after testing many ways, designed a bulletproof way to overcome them. Here are some clear and practical steps that are very powerful to quit a digital addiction, including stock market:

1. Purge temptations: Get rid of stock market

First, cleaning your life from temptations is much easier than resisting to them. Disable or delete your stock market accounts, change the password and hide it somewhere you can’t access easily, keep your phone / computer far away… Out of sight out of mind.

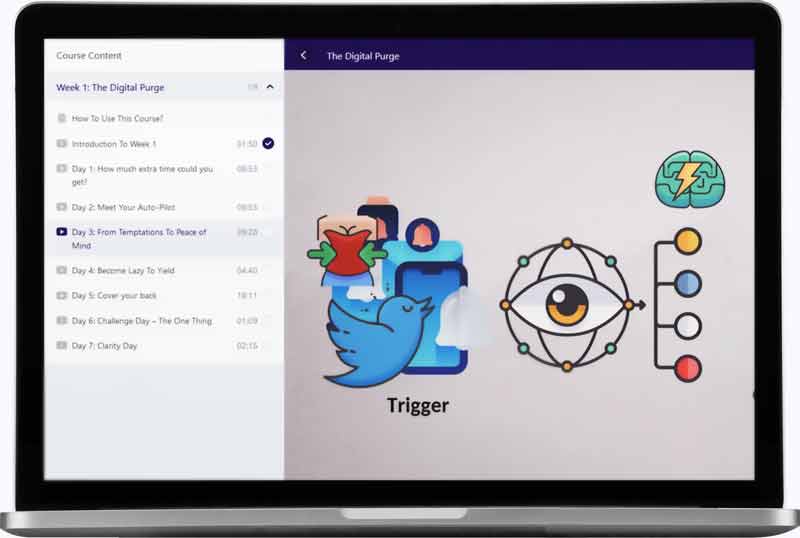

Here is a video from our course the The Digital Purge. on how to add resistance to your temptations, so you become so lazy to engage with them that you give them up: