Trying to quit stock market addiction? Welcome to our digital detox series! This series focuses on how to stop digital and screen addictions. Findall our posts about digital addictions. Today, let’s talk about how to quit the stock market addiction.

- What’s the stock market addiction?

- Addiction to stock market, a “real” addiction?

- What’s considered stock market addiction?

- How much stock market is too much?

- Some Gambling addiction facts & statistics

- Symptoms & Causes of the stock market addiction

- Why is stock market so addictive?

- Possible causes of stock market dependency

- Symptoms, Causes, and Signs of stock market addiction

- Problems, impacts & bad effects of stock market

- Some benefits of stock market

- Health problems

- Impact on brain & mental health

- Impact on relationships

- How to stop & quit your stock market addiction

- Main steps and solutions to break the stock market addiction

- Best stock market blocker apps & functionalities

- Where to seek extra help?

- Conclusion

- To Go Further

- How to help someone with stock market addiction

- Best books about Gambling addiction

- Research about Gambling addiction

What is the stock market addiction?

About stock market

The stock market is a platform where investors buy and sell shares of publicly traded companies, enabling businesses to raise capital and investors to potentially earn profits through dividends and market value appreciation. It reflects economic trends and investor sentiment.

Addiction to stock market, a “real” addiction?

Officially an addiction?

First, let’s have a look at the DSM-5,the Diagnostic and Statistical Manual of Mental Disorders. Does it include stock market addiction?

As of the latest update, stock market addiction is not specifically listed as a distinct disorder in the Diagnostic and Statistical Manual of Mental Disorders, Fifth Edition (DSM-5.. The DSM-5 is a publication by the American Psychiatric Association that categorizes and defines mental health disorders. While it includes a range of behavioral addictions, such as gambling disorder, it does not explicitly recognize stock market addiction as a separate condition.

However, behaviors related to excessive stock market trading could potentially be considered under broader categories of behavioral addictions or impulse control disorders. If someone’s engagement with the stock market leads to significant distress or impairment in their daily functioning, it might be addressed in a clinical setting by focusing on underlying issues such as compulsive behavior, anxiety, or other related mental health concerns.

For individuals experiencing problems related to stock market trading, seeking guidance from a mental health professional can be beneficial to address any underlying issues and develop healthier coping strategies.

So what does “stock market addiction” mean?

Understanding Stock Market Addiction: What You Need to Know

Hey there! If you’ve ever found yourself glued to stock tickers, obsessively checking your portfolio, or feeling an adrenaline rush from every market move, you might be curious about something called stock market addiction. Let’s break it down in simple terms.

### What Is Stock Market Addiction?

Stock market addiction is when someone becomes overly obsessed with buying and selling stocks to the point where it negatively impacts their daily life. It’s similar to other forms of addiction where the behavior takes precedence over everything else, including personal relationships, work, and health.

### Signs You Might Be Addicted

- 1. Constant Monitoring: You can’t stop checking stock prices, even during meals or social events.

- 2. Emotional Rollercoaster: Your mood swings with the market—feeling elated when stocks rise and devastated when they fall.

- 3. Neglecting Responsibilities: Important tasks or obligations are ignored because you’re preoccupied with trading.

- 4. Financial Strain: Making impulsive trades that lead to significant financial losses.

- 5. Withdrawal Symptoms: Feeling anxious or restless when you’re not trading or thinking about the market.

### Why It Happens

The stock market can be thrilling. The potential for high returns, the excitement of trading, and the challenge of predicting market movements can create a powerful allure. For some, this excitement can turn into an addictive behavior, especially if they use trading as a way to escape stress or other emotional issues.

### How to Manage It

If you think you might be struggling with stock market addiction, here are a few tips:

– Set Limits: Allocate specific times for checking your portfolio and stick to them.

– Seek Support: Talk to friends, family, or a professional if you feel overwhelmed.

– Diversify Activities: Find other hobbies or interests to balance your focus away from the market.

– Educate Yourself: Understanding the risks and realities of trading can help keep things in perspective.

### Takeaway

Investing can be a great way to build wealth, but it’s important to keep it healthy and balanced. Being aware of the signs of stock market addiction is the first step toward enjoying the market without letting it take over your life. If you ever feel like it’s becoming too much, don’t hesitate to reach out for help!

Stay smart and happy investing!

What is considered stock market addiction?

Diagnosing a stock market addiction is not as straightforward as diagnosing a medical condition, but there are certain criteria and behaviors that can indicate a problematic relationship with stock trading. It’s important to note that while the term “addiction” is often used colloquially, it may not be recognized as a formal addiction like substance abuse disorders. However, problematic behaviors can still have significant impacts on an individual’s life. Here are some criteria that might suggest a stock market addiction:

- 1. Preoccupation with Trading: Constantly thinking about the stock market, spending excessive amounts of time researching stocks, or feeling compelled to check stock prices frequently throughout the day.

- 2. Neglecting Responsibilities: Ignoring work, family, or social obligations in favor of trading or researching stocks. This might include missing deadlines, skipping family events, or neglecting personal relationships.

- 3. Emotional Distress: Experiencing significant mood swings based on market performance, such as euphoria during gains and depression or anxiety during losses.

- 4. Financial Problems: Engaging in risky trading behaviors that lead to significant financial losses, borrowing money to invest, or using funds meant for essential expenses.

- 5. Failed Attempts to Cut Back: Making unsuccessful attempts to reduce trading activities or feeling unable to stop trading despite recognizing its negative impact.

- 6. Chasing Losses: Continuously investing more money in an attempt to recover previous losses, often leading to further financial problems.

- 7. Withdrawal Symptoms: Feeling restless, irritable, or anxious when unable to trade or follow the stock market.

- 8. Tolerance: Needing to trade more frequently or with larger amounts of money to achieve the same level of excitement or satisfaction.

- 9. Lying or Concealing Behavior: Hiding the extent of trading activities from family or friends, or lying about the financial impact of trading.

- 10. Impact on Mental Health: Experiencing increased stress, anxiety, or depression related to trading activities and their outcomes.

If you or someone you know is exhibiting these behaviors, it may be beneficial to seek professional help. Financial counselors, therapists, or support groups specializing in behavioral addictions can provide guidance and support. It’s important to address these issues early to prevent further negative consequences.

How much stock market is too much?

The amount of time one should spend on the stock market varies greatly depending on individual goals, experience, and investment strategy. However, there are some general guidelines and considerations that can help determine if you’re spending too much time on it.

### Factors to Consider

1. Investment Strategy:

– Long-term Investors: Those who invest for the long term typically do not need to check the market daily. A few hours a month to review portfolios and make adjustments is often sufficient.

– Active Traders: Day traders or those involved in short-term trading may need to spend several hours a day monitoring the markets, but this is part of their strategy.

2. Experience Level:

– Beginners: New investors should spend time learning and understanding the market, but this should be balanced with other educational resources and not just watching stock prices.

– Experienced Investors: They may require less time monitoring the market as they have a clearer understanding of their strategies and market movements.

3. Emotional Impact:

– If the time spent on the stock market is causing stress, anxiety, or affecting your mental health, it might be a sign to reduce the time spent.

– Constantly checking stock prices can lead to impulsive decisions, which may not align with your investment goals.

4. Opportunity Cost:

– Consider what other productive activities you might be missing out on by spending excessive time on the stock market. This could include career development, personal hobbies, or spending time with family.

5. Performance Impact:

– More time spent does not necessarily equate to better investment performance. Sometimes, overanalyzing can lead to decision paralysis or frequent trading, which can erode returns due to transaction costs and taxes.

6. Lifestyle Balance:

– Ensure that your time spent on the stock market does not interfere with your work-life balance. It’s important to maintain a healthy lifestyle and relationships outside of investing.

### Recommendations

– Set Boundaries: Allocate specific times for market activities and stick to them. This could be checking the market once in the morning and once in the evening.

– Automate Where Possible: Use tools and apps for alerts and automated trading to reduce the need for constant monitoring.

– Focus on Learning: Spend time reading books, taking courses, or following expert analyses rather than just watching stock prices.

– Regular Reviews: Instead of daily monitoring, consider weekly or monthly portfolio reviews.

Ultimately, the right amount of time to spend on the stock market is subjective and should align with your personal goals, lifestyle, and investment strategy. Regularly reassess your approach to ensure it remains effective and healthy.

Some Gambling addiction facts & statistics

Gambling addiction, also known as compulsive gambling or gambling disorder, is a significant public health issue affecting millions of people worldwide. Here are some key statistics and insights related to gambling addiction:

### Prevalence

- 1. Global Impact: It’s estimated that around 1-3% of the global population suffers from gambling addiction. The prevalence can vary significantly depending on the region and the availability of gambling opportunities.

- 2. United States: In the U.S., approximately 1% of the adult population is estimated to have a severe gambling problem, while another 2-3% have a mild or moderate gambling problem.

- 3. United Kingdom: The UK Gambling Commission reports that around 0.5% of the adult population is classified as problem gamblers, with a further 3.8% identified as at-risk gamblers.

- 4. Australia: Australia has one of the highest rates of gambling participation in the world, with about 1% of the adult population experiencing severe gambling problems.

### Demographics

- 1. Gender: Men are more likely to develop gambling problems than women. However, the gap is narrowing, with an increasing number of women engaging in gambling activities.

- 2. Age: Young adults, particularly those aged 18-24, are at a higher risk of developing gambling problems. This age group is often targeted by online gambling platforms.

- 3. Socioeconomic Factors: Individuals from lower socioeconomic backgrounds are more susceptible to gambling addiction, often due to the allure of quick financial gains.

### Economic Impact

- 1. Financial Losses: Problem gamblers can incur significant financial losses, sometimes resulting in bankruptcy. The average debt of a problem gambler can range from $40,000 to $70,000.

- 2. Cost to Society: The societal costs of gambling addiction, including healthcare, legal issues, and lost productivity, can be substantial. In the U.S., these costs are estimated to be in the billions of dollars annually.

### Psychological and Social Impact

- 1. Mental Health: Gambling addiction is often associated with mental health issues such as depression, anxiety, and substance abuse. The risk of suicide is also higher among problem gamblers.

- 2. Relationships: Gambling addiction can lead to strained relationships with family and friends, often resulting in social isolation and domestic conflicts.

### Treatment and Recovery

- 1. Treatment Options: Effective treatments for gambling addiction include cognitive-behavioral therapy (CBT), support groups like Gamblers Anonymous, and, in some cases, medication.

- 2. Barriers to Treatment: Many individuals with gambling problems do not seek help due to stigma, lack of awareness, or denial of the issue.

### Trends

- 1. Online Gambling: The rise of online gambling has made it more accessible and has contributed to an increase in gambling addiction cases, particularly among younger demographics.

- 2. Regulation and Awareness: Governments and organizations are increasingly recognizing the need for regulation and public awareness campaigns to address gambling addiction.

### Conclusion

Gambling addiction is a complex issue with wide-ranging effects on individuals and society. Understanding the statistics and underlying factors can help in developing effective prevention and treatment strategies. As gambling opportunities continue to expand, particularly online, ongoing research and policy efforts are essential to mitigate the risks associated with gambling addiction.

Is the stock market addiction widespread?

The stock market can indeed be addictive for some individuals, although the extent of this issue is not as widely discussed as other forms of addiction, such as gambling or substance abuse. Several factors contribute to why some people might develop an addiction to trading or investing in the stock market:

- 1. Thrill and Excitement: The stock market can be highly volatile, and the rapid changes in stock prices can provide a rush similar to gambling. The potential for quick gains can be exhilarating, leading some individuals to become addicted to the excitement.

- 2. Financial Incentives: The possibility of making significant financial gains can be a powerful motivator. For some, the desire to achieve financial success or recover losses can lead to compulsive trading behaviors.

- 3. Technology and Accessibility: With the rise of online trading platforms and mobile apps, trading has become more accessible than ever. This ease of access can encourage frequent trading, increasing the risk of developing addictive behaviors.

- 4. Psychological Factors: Some individuals may have underlying psychological issues, such as anxiety or depression, that they attempt to manage through trading. The stock market can provide a temporary distraction or sense of control, which can be appealing to those struggling with these issues.

- 5. Social Influence: The influence of social media and online communities can amplify the pressure to trade frequently. Stories of others’ successes can create a fear of missing out (FOMO), leading individuals to engage in more risky trading behaviors.

While there is limited research specifically on stock market addiction, it is important for individuals to be aware of their trading habits and seek help if they feel their behavior is becoming problematic. Financial advisors, mental health professionals, and support groups can provide guidance and support for those who may be struggling with this issue.

Symptoms, Causes, and Signs of stock market addiction

Why is stock market so addictive?

Why Is the Stock Market So Addictive?

The stock market has a way of drawing people in and keeping them hooked. But what makes it so addictive? Let’s break it down in simple terms:

- 1. The Thrill of the Game

– Excitement: Watching stocks rise and fall can be exhilarating. Every tick of the market brings new opportunities and surprises.

– Risk and Reward: The possibility of making quick profits adds a rush similar to gambling, keeping traders coming back for more.

- 2. Potential for Financial Gain

– Wealth Building: The stock market offers a chance to grow your money significantly over time, which is a strong motivator.

– Success Stories: Hearing about people who have made fortunes can inspire others to try their luck and chase similar success.

- 3. Psychological Hooks

– Instant Feedback: Unlike other investments, the stock market provides immediate results. This instant gratification can be very satisfying.

– Sense of Control: Making your own investment decisions can give a feeling of empowerment and control over your financial future.

- 4. Social Influence

– Community and Competition: Engaging with other investors, sharing tips, and competing can create a sense of belonging and encourage continued participation.

– Media Coverage: Constant news and updates keep the stock market top-of-mind, making it hard to ignore or step away.

- 5. Learning and Growth

– Knowledge Acquisition: The stock market is complex and ever-changing, prompting continuous learning and personal development.

– Strategic Thinking: Developing strategies and seeing them play out can be intellectually stimulating and rewarding.

- 6. Technological Advances

– Easy Access: Online trading platforms and apps make it simple to buy and sell stocks anytime, anywhere.

– Real-Time Information: Access to real-time data and analysis tools helps investors make informed decisions quickly.

In summary, the stock market’s blend of excitement, financial potential, psychological satisfaction, social interaction, continuous learning, and technological convenience creates a powerful mix that can make it incredibly addictive. Whether you’re a seasoned investor or just starting out, understanding these factors can help you navigate the market more effectively and maintain a healthy relationship with your investments.

Possible causes of stock market dependency

Stock market addiction, much like other forms of behavioral addiction, can be driven by a combination of psychological, social, and economic factors. Here are some of the primary causes:

- 1. Psychological Factors:

– Thrill and Excitement: The stock market can provide an adrenaline rush similar to gambling. The unpredictability and potential for large gains or losses can be exhilarating.

– Reward System: The brain’s reward system can be activated by financial gains, releasing dopamine, which reinforces the behavior.

– Overconfidence: Some individuals may develop an overinflated belief in their ability to predict market movements, leading to excessive trading.

- 2. Behavioral Factors:

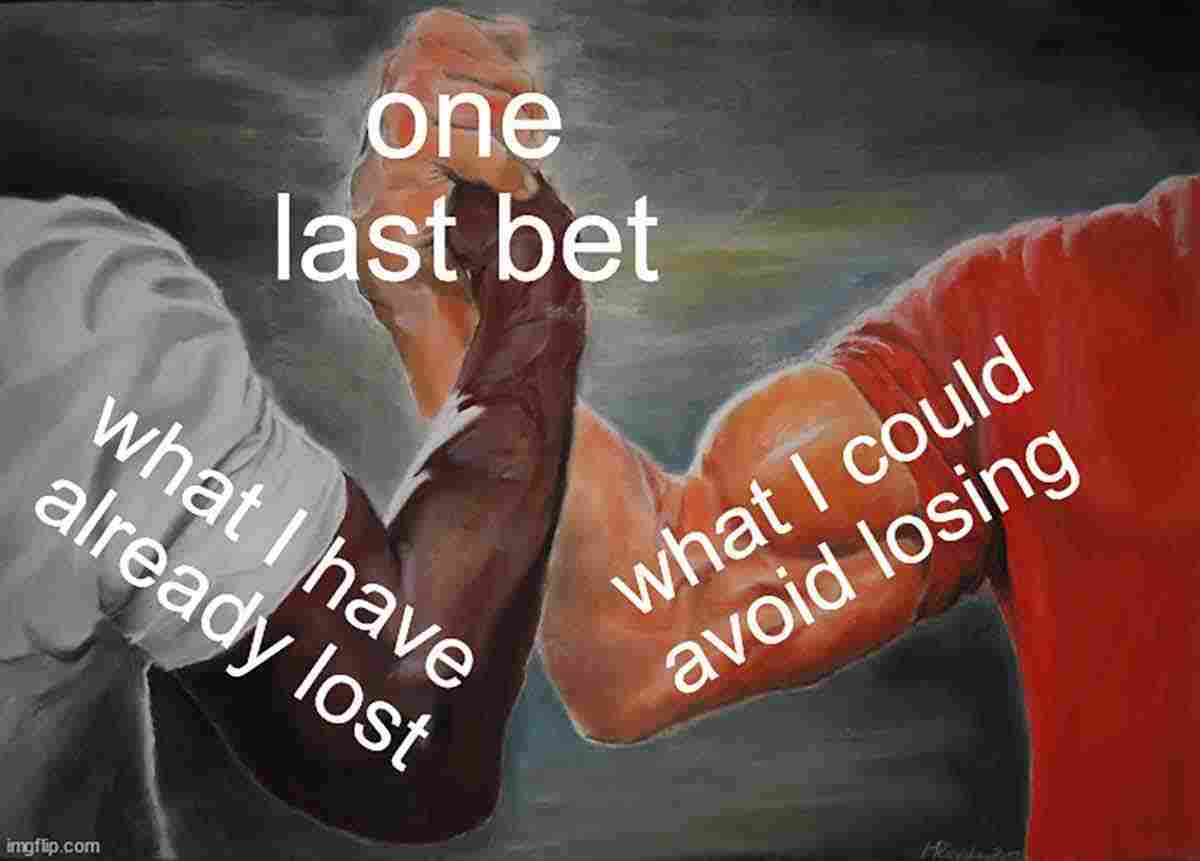

– Compulsive Behavior: The need to constantly check stock prices and make trades can become compulsive, similar to checking social media or email.

– Chasing Losses: After experiencing losses, some individuals may feel compelled to continue trading in an attempt to recover their losses, leading to a cycle of addiction.

- 3. Social and Cultural Factors:

– Peer Influence: Being part of communities or social circles that emphasize trading success can pressure individuals to engage more frequently in the stock market.

– Media Influence: Constant exposure to financial news and stock market analysis can create a sense of urgency and fear of missing out (FOMO).

- 4. Economic Factors:

– Financial Incentives: The potential for high financial returns can be a significant motivator, especially in volatile markets.

– Accessibility: With the rise of online trading platforms and apps, trading has become more accessible, making it easier for individuals to engage frequently.

- 5. Emotional Factors:

– Stress Relief: Some individuals may use trading as a way to cope with stress or escape from personal issues, similar to other forms of addiction.

– Ego and Identity: Success in trading can become tied to an individual’s self-esteem and identity, making it difficult to disengage.

Understanding these factors can help in identifying and addressing stock market addiction. Those who suspect they have a problem should consider seeking professional help, such as therapy or support groups, to manage their behavior and regain control over their financial decisions.

Signs & Symptoms of stock market addiction

Now let’s see if you have the stock market addiction problem.

Investing in the stock market can be an exhilarating experience, offering the potential for significant financial gains. However, for some individuals, this excitement can evolve into an addiction. Here are seven signs that you might be a stock market addict:

- 1. Constant Monitoring: If you find yourself checking stock prices and market news multiple times a day, even during non-trading hours, it could be a sign of addiction. The need to constantly stay updated may indicate an unhealthy obsession.

- 2. Emotional Roller Coaster: Experiencing extreme highs and lows based on market fluctuations is another red flag. If your mood is heavily influenced by the stock market’s performance, it might be time to reassess your relationship with investing.

- 3. Neglecting Responsibilities: When trading or researching stocks starts to interfere with your job, family, or social life, it’s a clear indication of a problem. Prioritizing the market over important life aspects can have serious consequences.

- 4. Financial Overextension: An addict might invest more money than they can afford to lose, often dipping into savings or taking on debt. If you find yourself in this situation, it’s crucial to seek help and reevaluate your financial strategy.

- 5. Chasing Losses: Similar to gambling, stock market addicts may try to recoup losses by making riskier investments. This behavior can lead to a vicious cycle of increasing losses and desperation.

- 6. Ignoring Long-term Goals: A focus on short-term gains at the expense of long-term financial planning is another sign of addiction. If you’re constantly seeking quick profits without considering your overall financial health, it might be time to step back.

- 7. Denial and Secrecy: If you find yourself hiding your trading activities or downplaying the extent of your involvement in the stock market, it could be a sign of addiction. Denial and secrecy often accompany addictive behaviors.

If you recognize these signs in yourself, it may be beneficial to seek advice from a financial advisor or mental health professional. Balancing your investment activities with a healthy lifestyle is crucial for both your financial and personal well-being.

Try our digital habit & screen addiction test:

Problems, impacts & bad effects of stock market: should you quit?

What are some benefits of stock market

The stock market is often lauded as a cornerstone of modern finance and a critical component of the global economy. Its significance is underscored by various advantages and benefits it offers to investors, companies, and the economy at large. Here are some of the key pros and advantages of the stock market:

### For Investors:

- 1. Wealth Creation:

– Historically, the stock market has provided substantial returns over the long term, often outperforming other asset classes like bonds or real estate. This potential for capital appreciation makes it an attractive option for wealth accumulation.

- 2. Liquidity:

– Stocks are generally more liquid than other investments like real estate. Investors can buy and sell shares relatively quickly and easily, allowing them to access their money when needed.

- 3. Diversification:

– The stock market offers a wide range of investment opportunities across different sectors and geographies, enabling investors to diversify their portfolios and mitigate risk.

- 4. Dividend Income:

– Many companies distribute a portion of their earnings as dividends. This provides investors with a regular income stream in addition to potential capital gains.

- 5. Ownership and Influence:

– Buying shares in a company gives investors ownership rights, including voting rights on important corporate decisions, thereby allowing them to influence the company’s direction.

### For Companies:

- 1. Capital Raising:

– The stock market provides companies with a platform to raise capital by issuing shares to the public. This capital can be used for expansion, research and development, or other business activities.

- 2. Visibility and Prestige:

– Being listed on a stock exchange can enhance a company’s visibility and prestige, potentially attracting more customers, partners, and talented employees.

- 3. Employee Incentives:

– Companies can offer stock options and other equity-based compensation to attract and retain employees, aligning their interests with the company’s success.

- 4. Acquisition Currency:

– Publicly traded companies can use their stock as currency for mergers and acquisitions, facilitating strategic growth.

### For the Economy:

- 1. Economic Growth:

– The stock market plays a critical role in economic growth by facilitating the flow of capital to businesses, which in turn can lead to job creation, innovation, and increased productivity.

- 2. Efficient Allocation of Resources:

– The stock market helps in the efficient allocation of resources by directing capital to companies that are expected to perform well, based on investor sentiment and market analysis.

- 3. Market Indicators:

– Stock indices serve as economic indicators, reflecting the overall health of an economy. Policymakers and analysts use these indicators to make informed decisions.

- 4. Encouragement of Savings and Investment:

– By providing a platform for investment, the stock market encourages individuals to save and invest their money, contributing to capital formation.

### Conclusion:

The stock market’s multifaceted benefits make it an indispensable part of the financial ecosystem. While it offers substantial opportunities, it’s important for investors to be aware of the risks and conduct thorough research or seek professional advice to make informed decisions. Despite its complexities, the stock market remains a powerful tool for wealth creation, business growth, and economic development.But on the other hand, what are some stock market addiction problems that addicts suffer from?

General health problems

The stock market, a cornerstone of the global economy, can significantly impact an individual’s health in various ways. While the financial implications of stock market fluctuations are well-documented, the psychological and physical health effects are often overlooked. Here are some key ways in which the stock market can affect your health:

### Psychological Effects

- 1. Stress and Anxiety:

– Volatility and Uncertainty: The inherent volatility of the stock market can lead to significant stress and anxiety. Investors may experience heightened stress levels during market downturns or periods of uncertainty, fearing financial loss.

– Decision-Making Pressure: The pressure to make quick investment decisions can exacerbate feelings of anxiety, particularly for those who are heavily invested or rely on the market for their livelihood.

- 2. Mood Swings:

– Market Performance: Positive market performance can lead to feelings of euphoria and optimism, while downturns can result in depression and pessimism. These mood swings can affect overall mental health and well-being.

- 3. Obsessive Behavior:

– Constant Monitoring: Some individuals may develop an obsession with monitoring stock prices, which can lead to compulsive behavior and interfere with daily life and relationships.

### Physical Health Effects

- 1. Sleep Disturbances:

– Worry and Insomnia: Concerns about market performance can lead to insomnia or disrupted sleep patterns, which in turn can affect physical health, leading to fatigue and decreased immune function.

- 2. Cardiovascular Health:

– Increased Risk of Heart Problems: Chronic stress and anxiety associated with stock market investments can increase the risk of hypertension, heart attacks, and other cardiovascular issues.

- 3. Lifestyle Changes:

– Neglect of Healthy Habits: Stress and time spent on monitoring investments may lead to neglect of healthy habits such as regular exercise, balanced nutrition, and social interactions, further impacting physical health.

### Social and Behavioral Effects

- 1. Impact on Relationships:

– Financial Stress: Financial stress can strain personal relationships, leading to conflicts and communication breakdowns.

– Isolation: An obsession with the stock market might lead to social withdrawal, reducing support networks and increasing feelings of isolation.

- 2. Risky Behavior:

– Gambling Addiction: The thrill of investing in stocks can sometimes lead to gambling-like behavior, where individuals take excessive risks in pursuit of high returns, potentially leading to significant financial and emotional distress.

### Mitigating Negative Effects

- 1. Education and Planning:

– Understanding the nature of the stock market and having a well-thought-out investment strategy can reduce anxiety and improve decision-making.

- 2. Mindfulness and Stress Management:

– Practices such as mindfulness, meditation, and regular exercise can help manage stress and improve mental health.

- 3. Professional Guidance:

– Seeking advice from financial advisors can provide reassurance and help in making informed decisions, reducing the burden on individual investors.

- 4. Balanced Approach:

– Diversifying investments and maintaining a balanced portfolio can mitigate risks and reduce the emotional impact of market fluctuations.

In conclusion, while the stock market can offer financial opportunities, it is crucial to be aware of its potential health impacts. By adopting strategies to manage stress and maintain a balanced lifestyle, individuals can protect their mental and physical health while navigating the complexities of the financial world.

stock market and sleep disorders

The stock market, with its inherent volatility and unpredictability, can indeed contribute to sleep disorders or sleep problems for some individuals. Here are several ways in which the stock market might impact sleep:

- 1. Stress and Anxiety: The stock market’s fluctuations can lead to significant stress and anxiety, particularly for investors who have a lot at stake. The fear of financial loss or the pressure to make quick decisions can result in heightened anxiety levels, which are known to interfere with sleep.

- 2. 24/7 Access and Global Markets: With the advent of technology, investors can now access stock market information at any time of day or night. This constant connectivity can lead to compulsive checking of stock prices and news, disrupting normal sleep patterns.

Additionally, global markets operate in different time zones, which might prompt some investors to stay awake during odd hours to track international developments.

- 3. Financial Losses: Experiencing significant financial losses can lead to insomnia or disrupted sleep. The emotional impact of losing money can be profound, causing worry and rumination during the night.

- 4. Cognitive Overload: The complexity of financial markets requires investors to process a large amount of information. This cognitive overload can lead to mental fatigue, making it difficult to unwind and fall asleep.

- 5. Lifestyle Changes: Some investors might adopt unhealthy lifestyle habits as a result of their focus on the stock market, such as consuming excessive caffeine to stay alert or neglecting physical activity, both of which can negatively impact sleep quality.

- 6. Performance Pressure: For professional traders and those whose livelihoods depend on market performance, the pressure to achieve favorable results can be immense. This pressure can translate into stress and worry, which are detrimental to sleep.

To mitigate these effects, individuals involved in the stock market can adopt strategies such as setting boundaries on trading hours, practicing stress-reduction techniques like mindfulness or meditation, and maintaining a healthy lifestyle.

Additionally, seeking professional advice from financial advisors or mental health professionals can provide support in managing the psychological impact of market activities.

stock market affecting your brain & mental health: bad for brain and mental health?

Some effects of stock market on your brain

The Hidden Strain: How the Stock Market Can Take a Toll on Your Brain

Hey there, savvy investors and curious minds! 📈 While the stock market offers exciting opportunities to grow your wealth, it’s essential to recognize that it can also impact your brain in some not-so-great ways. Let’s dive into a few of the bad effects the stock market might have on your mental well-being:

- 1. Stress Overload

😰

– Why It Happens: Watching your investments fluctuate can be nerve-wracking, especially during volatile market days.

– Impact: Chronic stress can lead to anxiety, trouble sleeping, and even physical health issues like high blood pressure.

- 2. Decision Fatigue

🧠

– Why It Happens: Constantly analyzing stocks and making buy or sell decisions can wear down your mental energy.

– Impact: You might find yourself making impulsive choices or avoiding important decisions altogether because your brain is simply exhausted.

- 3. Obsessive Behavior

📊

– Why It Happens: The allure of making money can lead to obsessively checking stock prices and news updates.

– Impact: This can interfere with your personal life, relationships, and overall happiness, making it hard to disconnect and relax.

- 4. Emotional Rollercoaster

🎢

– Why It Happens: Market ups and downs can trigger a wide range of emotions, from euphoria to despair.

– Impact: These mood swings can affect your day-to-day interactions and long-term mental health, leading to feelings of instability.

- 5. Fear of Missing Out (FOMO)

😟

– Why It Happens: Seeing others succeed in the market can create pressure to jump in, even when it’s not the right time.

– Impact: FOMO can lead to poor investment choices and increased anxiety about your financial future.

- 6. Cognitive Overload

🧩

– Why It Happens: The sheer amount of information, data, and news related to the stock market can be overwhelming.

– Impact: Your brain can become overloaded, making it harder to process information clearly and make sound decisions.

- 7. Impact on Self-Esteem

🚫

– Why It Happens: Losses or poor investment performance can make you question your abilities and judgment.

– Impact: This can lower your self-esteem and confidence, not just in investing but in other areas of your life as well.

Takeaway: Engaging with the stock market is exciting, but it’s crucial to be mindful of how it affects your brain and mental health. Setting boundaries, taking breaks, and seeking support when needed can help you enjoy investing without the hidden strain.

Stay balanced and invest wisely, both financially and mentally! 🌟

Some effects of stock market on your mental health

Investing in the stock market can be a rewarding endeavor, but it also comes with its share of psychological challenges. The volatile nature of the market can have several adverse effects on mental health. Here are some of the key ways in which stock market activities can negatively impact mental well-being:

- 1. Stress and Anxiety: The unpredictability of stock prices can lead to significant stress and anxiety. Investors often worry about market fluctuations, potential losses, and the impact on their financial future. This constant state of worry can lead to chronic stress, which is detrimental to mental health.

- 2. Obsessive Behavior: The fast-paced nature of the stock market can lead to obsessive monitoring of stock prices and market news. This behavior can become compulsive, consuming significant amounts of time and mental energy, and detracting from other important aspects of life.

- 3. Emotional Rollercoaster: The stock market is known for its highs and lows, and these fluctuations can lead to emotional instability. The excitement of gains can quickly turn into despair over losses, creating a cycle of emotional highs and lows that can be exhausting and damaging over time.

- 4. Depression: Significant financial losses can lead to feelings of hopelessness and depression. For some, the impact of losing money can be profound, affecting self-esteem and leading to a negative outlook on life.

- 5. Fear of Missing Out (FOMO): The fear of missing out on lucrative investment opportunities can lead to impulsive decision-making and increased anxiety. This pressure to constantly stay ahead can be mentally taxing and lead to poor investment choices.

- 6. Risk of Addiction: Similar to gambling, the stock market can become an addiction for some individuals. The thrill of making money can lead to compulsive trading behaviors, which can have serious financial and psychological consequences.

- 7. Sleep Disturbances: Anxiety and stress related to stock market investments can lead to sleep disturbances. Poor sleep quality can exacerbate stress and anxiety, creating a vicious cycle that is difficult to break.

- 8. Social Isolation: The time and energy spent on managing investments can lead to social withdrawal, as individuals may prioritize market activities over social interactions. This isolation can contribute to feelings of loneliness and exacerbate mental health issues.

- 9. Cognitive Overload: The need to constantly analyze market trends, financial reports, and economic indicators can lead to cognitive overload. This mental fatigue can impair decision-making and lead to burnout.

- 10. Impact on Relationships: Financial stress and obsession with the stock market can strain personal relationships. Conflicts may arise over financial decisions, leading to tension and resentment among family and friends.

To mitigate these negative effects, it is important for investors to maintain a balanced approach to investing. Setting clear financial goals, diversifying investments, and practicing mindfulness and stress management techniques can help maintain mental well-being while navigating the complexities of the stock market.

Additionally, seeking professional advice from financial advisors and mental health professionals can provide support and guidance.

Does stock market cause stress and anxiety?

The stock market, with its inherent volatility and unpredictability, can indeed be a significant source of stress and anxiety for many individuals. Here are several ways in which the stock market might contribute to these feelings:

###

- 1. Financial Pressure

Investors often put substantial amounts of money into the stock market with the hope of achieving financial growth. The fear of losing money due to market downturns or poor investment choices can lead to significant stress. This pressure is particularly intense for those who have invested their life savings or are relying on their investments for retirement.

###

- 2. Market Volatility

The stock market is known for its fluctuations. Sudden drops or unexpected shifts can create a sense of uncertainty and lack of control, which are common triggers for anxiety. The 24/7 news cycle and constant updates on market performance can exacerbate these feelings, as investors may feel compelled to constantly monitor their investments.

###

- 3. Decision-Making Stress

Investing in the stock market requires making numerous decisions, such as when to buy, hold, or sell stocks. The fear of making the wrong decision and the potential financial consequences can be overwhelming. This decision-making stress is often compounded by the vast amount of information available, which can be difficult to sift through and analyze.

###

- 4. Impact on Personal Life

For some, the stress and anxiety caused by stock market investments can spill over into personal life, affecting relationships and overall well-being. Constant worry about financial matters can lead to sleep disturbances, irritability, and decreased focus on other important aspects of life.

###

- 5. Psychological Factors

Certain psychological factors, such as risk tolerance and emotional resilience, play a role in how individuals react to stock market fluctuations. Those with a lower risk tolerance may experience higher levels of stress and anxiety when faced with market volatility.

###

- 6. Media Influence

Media coverage of the stock market can amplify stress and anxiety. Sensational headlines and dramatic reporting of market downturns can create a heightened sense of panic, even if the individual’s investments are not directly affected.

### Coping Strategies

To mitigate stress and anxiety related to the stock market, individuals can consider the following strategies:

– Diversification: Spreading investments across various asset classes can reduce risk and provide a sense of security.

– Long-Term Perspective: Focusing on long-term investment goals rather than short-term market fluctuations can help maintain perspective.

– Education: Gaining a better understanding of market dynamics and investment strategies can empower investors and reduce uncertainty.

– Professional Guidance: Consulting with financial advisors can provide reassurance and expert advice tailored to individual needs.

– Mindfulness and Stress-Reduction Techniques: Practices such as meditation, exercise, and deep breathing can help manage stress levels.

In conclusion, while the stock market can indeed be a source of stress and anxiety, understanding the factors at play and employing effective coping strategies can help individuals navigate these challenges more effectively.

Can stock market addiction lead to sadness and depression?

Yes, stock market addiction can indeed lead to sadness and depression. Like other forms of addiction, an unhealthy obsession with the stock market can have detrimental effects on a person’s mental health and overall well-being. Here are several ways in which this addiction can contribute to emotional distress:

- 1. Emotional Rollercoaster: The stock market is inherently volatile, with prices fluctuating based on a myriad of factors. For someone addicted to trading, these constant ups and downs can lead to intense emotional highs and lows, which can be exhausting and contribute to feelings of sadness or depression.

- 2. Financial Stress: An addiction to the stock market often involves taking significant financial risks. When trades do not go as planned, it can result in substantial financial losses, leading to stress, anxiety, and depression as individuals struggle with the consequences of their decisions.

- 3. Neglect of Personal Life: People addicted to trading may spend excessive amounts of time monitoring the markets, researching stocks, and making trades. This can lead to neglect of personal relationships, hobbies, and self-care, resulting in isolation and a decrease in overall life satisfaction.

- 4. Loss of Control: Addiction often involves a loss of control over one’s actions. When individuals feel they cannot stop trading despite negative consequences, it can lead to feelings of helplessness and despair, which are closely associated with depression.

- 5. Identity and Self-worth: For some, success in the stock market becomes closely tied to their self-worth. When trades fail, it can lead to a diminished sense of self-esteem and identity, contributing to feelings of sadness and depression.

- 6. Addictive Behavior Cycle: The cycle of addiction often involves a pattern of compulsive behavior followed by regret and guilt. This cycle can exacerbate feelings of depression as individuals struggle with the consequences of their actions and their inability to change their behavior.

- 7. Impact on Mental Health: The stress and anxiety associated with constant trading can exacerbate pre-existing mental health conditions or contribute to the development of new ones, including depression.

It’s important for individuals who suspect they may have a stock market addiction to seek help. This can involve talking to a mental health professional, joining support groups, or seeking financial counseling. Addressing the root causes of the addiction and developing healthier coping mechanisms can significantly improve mental health and overall quality of life.

Dopamine and stock market

The connection between dopamine and the stock market might not be immediately obvious, but it is a fascinating intersection of neuroscience and finance that sheds light on human behavior and decision-making. Dopamine, a neurotransmitter in the brain, plays a crucial role in how we experience pleasure, motivation, and reward. Its influence extends to various aspects of life, including financial decision-making and stock market behavior.

### Dopamine’s Role in Decision-Making

- 1. Reward System: Dopamine is integral to the brain’s reward system. When individuals engage in activities that are perceived as rewarding, such as making a successful investment, dopamine levels increase, reinforcing the behavior and encouraging repetition.

- 2. Risk and Reward: The stock market is inherently risky, and the potential for high rewards can trigger dopamine release. This release can lead to increased risk-taking behavior, as the brain becomes focused on the potential for reward rather than the possibility of loss.

- 3. Addictive Behaviors: Just as dopamine is involved in addiction to substances like drugs or alcohol, it can also contribute to addictive behaviors in trading. The thrill of the market, the highs of winning, and even the lows of losing can create a cycle of addiction, where traders become compulsively involved in the market.

### Impact on Stock Market Behavior

- 1. Market Volatility: The emotional highs and lows driven by dopamine can contribute to market volatility. Traders driven by dopamine-induced euphoria may push stock prices higher, while fear-driven sell-offs can cause sharp declines.

- 2. Herd Behavior: Dopamine can also play a role in herd behavior, where investors follow the actions of others, driven by the fear of missing out (FOMO) on potential gains. This can lead to bubbles or crashes as collective behavior amplifies market movements.

- 3. Overconfidence: Increased dopamine levels can lead to overconfidence, where traders overestimate their ability to predict market movements. This overconfidence can result in poor decision-making and increased risk-taking.

### Strategies to Mitigate Dopamine Influence

- 1. Mindfulness and Awareness: Being aware of the emotional and neurological influences on decision-making can help traders make more rational choices. Mindfulness practices can reduce impulsive reactions driven by dopamine.

- 2. Diversification and Risk Management: Implementing strategies that focus on diversification and risk management can help mitigate the impact of dopamine-driven decisions. By spreading investments across various assets, traders can reduce the emotional impact of any single investment’s performance.

- 3. Algorithmic Trading: Some investors turn to algorithmic trading to minimize emotional influence on trading decisions. Algorithms can execute trades based on predefined criteria, reducing the impact of human emotions like those driven by dopamine.

### Conclusion

Understanding the role of dopamine in stock market behavior highlights the complex interplay between neuroscience and finance. While dopamine can drive irrational and risky behavior, awareness and strategic approaches can help mitigate its influence, leading to more balanced and rational investment decisions. As research continues to explore this intersection, it may offer further insights into improving financial decision-making and market stability.

stock market effects on focus, productivity, attention span, academic performance…

Do Stock Markets Affect Your Focus, Productivity, Attention Span, and Academic Performance?

Have you ever wondered if the ebb and flow of the stock market has any impact on your daily life, especially your focus, productivity, attention span, or academic performance? While it might seem like the stock market operates in its own world, there are some interesting ways it can influence these aspects of your life. Let’s break it down!

###

- 1. Financial Stress and Mental Clarity

If you have investments tied to the stock market, a sudden drop can lead to financial stress. This stress can clutter your mind, making it harder to concentrate on tasks, whether they’re work-related or academic. A clear mind is essential for maintaining focus and productivity, so financial worries can be a significant distraction.

###

- 2. Economic Climate and Job Security

The stock market often reflects the broader economic health. When the market is doing well, businesses tend to thrive, which can mean better job security and more opportunities. Conversely, a struggling market might signal economic downturns, leading to worries about job stability. This uncertainty can distract you from your work or studies, reducing your overall productivity and attention span.

###

- 3. Access to Resources

A robust stock market can boost the economy, leading to increased funding for education, research, and development. This can translate to better resources for students, such as scholarships, updated technology, and enhanced learning environments, positively impacting academic performance. On the flip side, a weak market might lead to budget cuts in educational institutions, limiting these resources.

###

- 4. Psychological Impact

Market volatility can influence your mood and mental well-being. If you’re closely watching your investments and see them declining, it can lead to feelings of anxiety or frustration. These emotions can make it challenging to stay focused and productive, both in your personal and academic life.

###

- 5. Time Management and Distractions

Keeping an eye on the stock market can become a time-consuming habit, especially if you’re actively trading or monitoring daily trends. This can take time away from studying, working on projects, or even relaxing, affecting your overall attention span and productivity levels.

### In a Nutshell

While the stock market doesn’t directly control your focus, productivity, attention span, or academic performance, its ripple effects on the economy and your personal finances can indirectly influence these areas. Managing financial stress, staying informed but not obsessed, and maintaining a balanced lifestyle can help mitigate any negative impacts and keep you on track toward your goals.

Remember, it’s all about finding the right balance and not letting external factors dictate your inner peace and productivity!

A word about ADHD and stock market

Attention Deficit Hyperactivity Disorder (ADHD) is a neurodevelopmental disorder characterized by symptoms such as inattention, hyperactivity, and impulsivity. These traits can influence how individuals with ADHD interact with various aspects of life, including financial markets like the stock market. While there is no one-size-fits-all behavior pattern for individuals with ADHD, certain tendencies may be more prevalent among them when it comes to stock market interactions.

###

- 1. Impulsivity in Decision-Making:

– Quick Trades: Individuals with ADHD may be more prone to making impulsive decisions, leading to frequent buying and selling of stocks without thorough analysis.

– High-Risk Tolerance: The impulsivity associated with ADHD might result in a higher tolerance for risk, leading to investments in volatile or speculative stocks.

###

- 2. Focus and Attention:

– Difficulty in Long-Term Planning: Maintaining focus on long-term investment strategies may be challenging, potentially resulting in a preference for short-term gains.

– Overlooked Details: Inattention may lead to missing critical details in financial reports or market trends, affecting investment decisions.

###

- 3. Hyperfocus:

– Intense Research: On the flip side, some individuals with ADHD experience hyperfocus, allowing them to dive deeply into specific topics, such as stock analysis, for extended periods.

– Specialized Knowledge: This hyperfocus can lead to acquiring specialized knowledge about certain stocks or sectors, potentially benefiting investment decisions.

###

- 4. Emotional Responses:

– Emotional Trading: People with ADHD might react more emotionally to market fluctuations, leading to panic selling or euphoric buying.

– Stress Management: The stress of market volatility might be more pronounced, requiring strategies to manage emotional responses effectively.

###

- 5. Use of Technology and Tools:

– Preference for Apps and Tools: Technology, such as trading apps with alerts and reminders, can help manage ADHD symptoms by providing structure and timely information.

– Automated Trading: Some may prefer automated trading systems to mitigate impulsive decision-making and maintain a consistent strategy.

###

- 6. Learning and Adaptation:

– Continuous Learning: The dynamic nature of the stock market may appeal to individuals with ADHD, encouraging continuous learning and adaptation.

– Innovative Strategies: Creative and unconventional thinking often associated with ADHD might lead to innovative investment strategies.

### Conclusion:

While ADHD can present challenges in interacting with the stock market, it also offers unique strengths that can be leveraged. Individuals with ADHD can benefit from tailored strategies that harness their hyperfocus, manage impulsivity, and utilize technology to support their investment activities. As with any investment approach, understanding personal tendencies and seeking professional advice when necessary can enhance decision-making and financial outcomes.

Affecting your relationships

stock market and self-esteem

How the Stock Market Can Impact Your Self-Esteem

Hey there! 🌟 Let’s dive into a topic that affects many of us, whether we’re seasoned investors or just dipping our toes into the world of stocks: how the stock market can influence our self-esteem. It’s fascinating how something like market movements can play a role in how we feel about ourselves. Let’s break it down!

###

- 1. Financial Success Boosts Confidence

When your investments perform well, it often leads to a sense of accomplishment. Seeing your portfolio grow can reinforce your decision-making skills and financial savvy, giving your self-esteem a nice little boost. It’s like getting a thumbs-up from the universe saying, “You’ve got this!”

###

- 2. Experiencing Losses Can Challenge Self-Worth

On the flip side, experiencing losses in the stock market can take a toll on your self-esteem. It’s easy to start questioning your choices or feel like you’re not good enough at managing your money. Remember, fluctuations are normal, and one downturn doesn’t define your worth or abilities.

###

- 3. Investment Knowledge Enhances Self-Efficacy

Learning about the stock market and understanding how it works can make you feel more empowered. This increased self-efficacy—the belief in your ability to succeed—can positively impact your overall self-esteem. The more you know, the more confident you become!

###

- 4. Stress Levels and Emotional Health

The stock market can be a rollercoaster of emotions. High stress from market volatility can affect your emotional well-being, which in turn can influence how you feel about yourself. It’s important to manage stress through healthy habits like exercise, meditation, or talking to friends.

###

- 5. Comparing Yourself to Others

In the age of social media, it’s easy to compare your investment success to others’. Seeing friends or influencers making big gains can sometimes make you feel inadequate if your portfolio isn’t performing the same way. Remember, everyone’s financial journey is unique, and comparison can be a tricky game!

###

- 6. Goal Achievement and Personal Growth

Setting and achieving financial goals through investing can provide a sense of purpose and achievement. Reaching milestones, whether it’s saving for a vacation or building a retirement fund, can significantly boost your self-esteem by showcasing your ability to plan and execute.

### Final Thoughts

The stock market is more than just numbers and charts—it’s intertwined with our emotions and sense of self. Whether you’re riding high on gains or navigating through losses, it’s essential to keep things in perspective. Your self-worth isn’t tied to stock performance, but understanding and managing how the market affects you can lead to healthier financial and emotional well-being.

Stay confident, stay informed, and remember that your value goes beyond any market trend! 💪😊

stock market addiction leads to isolation and loneliness?

.jpg)

Stock market addiction, like any form of addiction, can indeed lead to isolation and loneliness. While investing in the stock market is a common and often beneficial financial activity, when it becomes an addiction, it can have detrimental effects on an individual’s social life and mental health. Here are several ways in which stock market addiction can lead to isolation and loneliness:

- 1. Obsessive Behavior: Individuals addicted to stock trading may become obsessed with monitoring the markets. This constant need to check stock prices, news, and market trends can consume a significant amount of time, leaving little room for social interactions or maintaining relationships.

- 2. Neglect of Relationships: As the addiction intensifies, individuals may begin to neglect personal relationships. They might miss family gatherings, social events, or even everyday interactions with friends and family, leading to feelings of isolation.

- 3. Financial Strain: Stock market addiction can lead to significant financial losses, which can cause stress and anxiety. The financial strain may also lead to withdrawal from social activities that require spending money, further isolating the individual.

- 4. Emotional Turmoil: The highs and lows of the stock market can create emotional instability. The stress and anxiety associated with potential losses or the thrill of gains can lead to mood swings, making it difficult for individuals to maintain stable relationships.

- 5. Secretive Behavior: To hide their addiction, individuals may become secretive about their trading activities. This secrecy can create a barrier between them and their loved ones, fostering feelings of loneliness.

- 6. Reduced Real-World Interaction: The digital nature of stock trading means that much of the activity occurs online. This can reduce face-to-face interactions, as individuals may prefer the virtual world of trading to real-world socialization.

- 7. Loss of Interest in Other Activities: As the addiction deepens, individuals may lose interest in hobbies and activities they once enjoyed. This can lead to a lack of common ground with friends and family, further contributing to isolation.

Addressing stock market addiction requires awareness and intervention. Individuals who recognize these patterns in themselves or others should consider seeking professional help. Therapy, support groups, and financial counseling can be effective in managing the addiction and rebuilding social connections. It’s important to foster a balanced approach to investing, ensuring that it remains a healthy part of one’s life rather than an all-consuming obsession.

Effects of stock market on your relationships

The stock market is a significant component of the global economy, influencing not only financial portfolios but also personal relationships. Here’s a look at both the positive and negative effects it can have on relationships:

### Positive Effects

- 1. Shared Goals and Planning:

– Investing in the stock market can encourage couples or family members to work together towards common financial goals, such as saving for a home, retirement, or a child’s education. This collaboration can strengthen bonds as individuals align their efforts and celebrate milestones together.

- 2. Financial Literacy and Growth:

– Engaging with the stock market often requires learning about economics, industries, and financial strategies. Couples or friends who invest together can grow intellectually and financially, fostering a sense of partnership and mutual respect.

- 3. Enhanced Communication:

– Discussing investments and financial strategies can improve communication skills. Regular conversations about market trends, asset allocation, and risk management can lead to more open and effective communication in other areas of the relationship.

- 4. Increased Trust and Support:

– Successfully navigating the stock market requires trust and support. Partners who trust each other’s judgment and support each other during market fluctuations can deepen their relationship, building a strong foundation of mutual reliance.

### Negative Effects

- 1. Financial Stress:

– The inherent volatility of the stock market can lead to stress and anxiety, which may spill over into personal relationships. Significant losses or market downturns can create tension, especially if one partner feels responsible or if there are disagreements on investment strategies.

- 2. Conflicting Financial Goals:

– Differences in risk tolerance and investment goals can lead to conflicts. One partner may prefer aggressive growth strategies, while the other may prioritize stability and security, leading to disagreements and potential resentment.

- 3. Time Consumption:

– Monitoring investments and staying informed about market trends can be time-consuming. If one partner spends excessive time on stock-related activities, it may lead to feelings of neglect or imbalance in the relationship.

- 4. Financial Disparities:

– If one partner experiences significant financial gains from the stock market while the other does not, it can create disparities in financial power and decision-making, potentially leading to feelings of inadequacy or dependency.

- 5. Risk of Addiction:

– The excitement of trading and the potential for quick profits can become addictive for some individuals. This addiction can lead to neglect of personal relationships, as the individual prioritizes market activities over time with loved ones.

### Conclusion

The stock market can have a profound impact on personal relationships, offering opportunities for growth and collaboration but also posing risks of stress and conflict. To harness the positive effects while mitigating the negatives, open communication, mutual understanding, and a balanced approach to investing are essential. By aligning financial strategies with shared goals and maintaining a healthy perspective on market activities, individuals can strengthen their relationships while pursuing financial success.

How To Stop & Quit Your stock market Addiction

Finally, you think you are addicted to stock market and you are wondering how to quit it? How to break and overcome your cravings for stock market?

Here are the best solutions, steps, supports, resources, and help you can get to treat your stock market addiction.

Main steps and solutions to break the stock market addiction

Overcoming a stock market addiction can be challenging, but with the right approach and support, it is possible to regain control over your financial and personal life. Here are some steps to help you address and manage stock market addiction:

1. Acknowledge the Problem: The first step is recognizing and admitting that you have an addiction to trading or investing in the stock market. This self-awareness is crucial for initiating change.

2. Understand the Triggers: Identify what triggers your urge to trade excessively. It could be stress, boredom, a desire for excitement, or financial pressure. Understanding these triggers can help you develop strategies to manage them.

3. Set Clear Boundaries: Establish specific rules for your trading activities, such as setting a budget, limiting the time spent on trading, and defining acceptable levels of risk. Stick to these boundaries to prevent impulsive decisions.

4. Seek Professional Help: Consider consulting with a therapist or counselor who specializes in addiction or behavioral finance. They can provide guidance and support tailored to your situation.

5. Educate Yourself: Increase your financial literacy to make more informed decisions. Understanding the risks and realities of the stock market can help reduce impulsive and emotionally-driven trading.

6. Diversify Interests: Find alternative activities or hobbies that can provide fulfillment and distract you from the urge to trade. Engaging in physical activities, creative pursuits, or social events can be beneficial.

7. Join Support Groups: Connecting with others who have faced similar challenges can be empowering. Support groups, whether online or in-person, provide a platform to share experiences and coping strategies.

8. Monitor Emotional Health: Pay attention to your emotional well-being. Practice stress-reduction techniques such as mindfulness, meditation, or yoga to help manage anxiety related to trading.

9. Implement a Trading Plan: Develop a structured trading plan that includes clear goals, strategies, and risk management techniques. This plan should be based on rational analysis rather than emotional impulses.

10. Regularly Review Progress: Evaluate your progress regularly to ensure you are adhering to your boundaries and trading plan. Adjust your strategies as needed to maintain control over your trading behavior.

11. Consider a Financial Advisor: Engage a professional financial advisor to help manage your investments. This can provide an objective perspective and reduce the temptation to make impulsive trades.

12. Limit Access: Consider limiting your access to trading platforms and financial news. This can help reduce the temptation to trade frequently and impulsively.

By taking these steps, you can work towards overcoming stock market addiction and achieving a healthier relationship with investing. Remember, change takes time, and seeking support from professionals and peers can significantly aid in the recovery process.Actually, that’s what most documentation out there is about… However, quitting a digital addiction can be a bit trickier than that.

So our team, after testing many ways, designed a bulletproof way to overcome them. Here are some clear and practical steps that are very powerful to quit a digital addiction, including stock market:

1. Purge temptations: Get rid of stock market

First, cleaning your life from temptations is much easier than resisting them. Disable or delete your stock market accounts, change the password and hide it somewhere you can’t access easily, keep your phone / computer far away… Out of sight, out of mind.

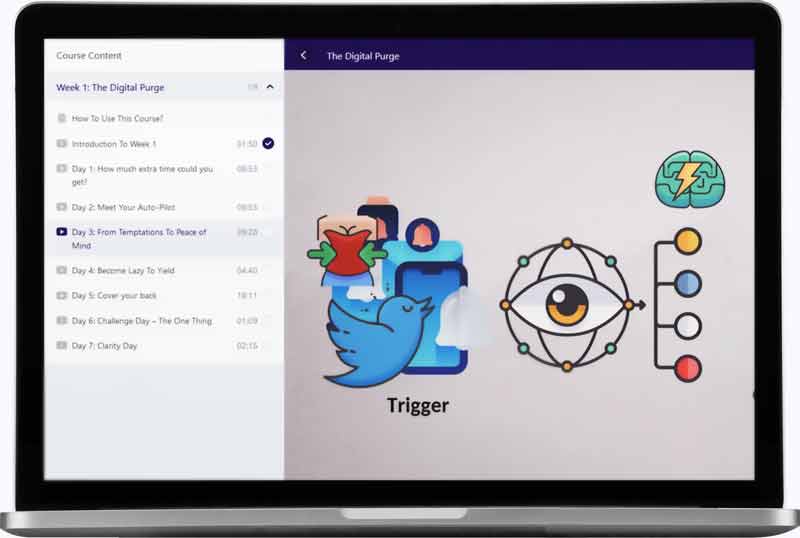

Here is a video from our course The Digital Purge. on how to add resistance to your temptations, so you become so lazy to engage with them that you give them up:

2. Spot & Reveal your emotional triggers

Second, there are some reasons, often hidden ones, that your brain and your heart love so much stock market. Those reasons act as triggers to pull your cravings. Rather than chasing the addiction, it’s a more efficient strategy to look at the feelings driving you toward it. That way you can cure and heal the feeling. You’ll feel better, and the cravings will magically disappear. Just get away.

3. Rewire to life

An addiction FOMO (fear of missing out) can be huge and really painful to resist, especially if it was here for a long time. However, learning to live with it is necessary to build a life full of peace and joy. Strategies to fight FOMO and rewire to life include meditation, nature activities, social interaction, intellectual and creative projects, meaningful adventures… basically anything that fills your soul.

4. How to not relapse and fully recover from stock market?

Finally, it’s important to acknowledge that quitting may take days, weeks, months, or even years. Getting over and quitting stock market forever can be difficult. You may relapse a few times, but the most important thing is that you keep engaging less and less with stock market. Each day you resist it is a day weakening your brain connections with stock market. From your patience and discipline will arise incredible mind strength, hope, and wisdom.

Best stock market blocker apps & functionalities

Additionally, you can increase your chance of withdrawal by limiting or blocking access to stock market using these apps.

They will help you filter, reduce, or block stock market:

Gambling can be a source of entertainment for many, but for some, it can become a problematic habit. Fortunately, technology offers solutions to help individuals manage or limit their gambling activities. Here are five of the best apps designed to limit or block gambling access:

- 1. BetBlocker:

– Overview: BetBlocker is a free tool that allows users to restrict their access to gambling websites and applications. It’s particularly useful for those who feel they need to take a break from gambling.

– Features: Users can set a self-exclusion period ranging from 24 hours to 5 years. The app covers thousands of gambling sites, ensuring comprehensive protection.

– Compatibility: Available on Windows, Mac, Linux, iOS, and Android.

- 2. GamBan:

– Overview: GamBan is a popular app that blocks access to gambling sites and apps across multiple devices. It’s designed to help individuals struggling with gambling addiction by removing the temptation.

– Features: It offers a simple installation process and blocks thousands of gambling sites. It also provides support and resources for users seeking help.

– Compatibility: Works on Windows, Mac, iOS, and Android.

- 3. Net Nanny:

– Overview: While primarily known as a parental control app, Net Nanny can be effectively used to block gambling sites. It provides robust internet filtering capabilities.

– Features: Customizable filters allow users to block specific websites or categories, including gambling. It also offers real-time alerts and activity reports.

– Compatibility: Available on Windows, Mac, iOS, and Android.

- 4. Betfilter:

– Overview: Betfilter is designed specifically to help users block access to online gambling sites. It’s a straightforward tool for those looking to control their gambling habits.

– Features: Once installed, Betfilter cannot be removedCheck our full Gambling addiction tool list (ranked):

Where to seek extra help?

Do you need some support and help to stop, overcome, and recover from your stock market addiction? If you or someone you know is struggling with stock market addiction, there are a few places to seek help.

The Ultimate Rewiring Program For stock market Addicts

Our course The Digital Purge. This course has already helped many digital addicts to rewire to what matters.

Is there a “treatment” to cure Gambling addiction?

Absolutely, there are effective treatments available to help overcome gambling addiction! While it might feel overwhelming, many people have successfully managed their gambling habits through various strategies. Here are some common treatments:

- 1. Cognitive Behavioral Therapy (CBT):

– What it is: A type of talk therapy that helps you identify and change negative thought patterns and behaviors related to gambling.

– How it helps: By understanding triggers and developing healthier coping mechanisms, CBT can reduce the urge to gamble.

- 2. Support Groups:

– Examples: Gamblers Anonymous, SMART Recovery.

– Benefits: Connecting with others who are going through similar challenges provides encouragement, accountability, and a sense of community.

- 3. Medication:

– When it’s used: Sometimes prescribed to help manage urges or treat underlying issues like anxiety or depression.

– Note: Always consult a healthcare professional to discuss the best options for your situation.

- 4. Self-Exclusion Programs:

– What they do: Allow you to ban yourself from casinos, online gambling sites, and other gambling facilities for a set period.

– Effectiveness: Helps create a barrier between you and gambling opportunities, reducing the temptation to gamble.

- 5. Financial Counseling:

– Purpose: Helps you manage debts and create a plan to regain financial stability.

– How it works: A financial advisor can provide strategies to budget, reduce spending, and handle debts responsibly.

- 6. Mindfulness and Stress-Reduction Techniques:

– Methods: Practices like meditation, yoga, or deep-breathing exercises.

– Benefits: Helps manage stress and reduce the impulse to gamble as a way to cope with emotions.

- 7. Educational Programs:

– What they offer: Information about the risks of gambling and strategies to avoid relapse.

– Goal: Increase awareness and provide tools to maintain long-term recovery.

Taking the First Step:

If you or someone you know is struggling with gambling addiction, reaching out to a healthcare professional or a support group is a great first step. Recovery is possible, and with the right support and resources, you can take control and build a healthier, happier future.

Remember, you’re not alone, and help is available!

Does Gambling therapy exist?

Yes, therapy to address and manage gambling addiction does exist, and it can be highly effective for many individuals. Gambling addiction, also known as compulsive gambling or gambling disorder, is a recognized mental health condition characterized by an uncontrollable urge to gamble despite negative consequences. Various therapeutic approaches can help individuals overcome this addiction:

- 1. Cognitive Behavioral Therapy (CBT): CBT is one of the most common and effective forms of therapy for gambling addiction. It helps individuals recognize and change their negative thought patterns and behaviors related to gambling. By identifying triggers and developing coping strategies, CBT can significantly reduce the urge to gamble.

- 2. Motivational Interviewing (MI): This therapeutic approach aims to enhance an individual’s motivation to change their gambling behavior. It involves exploring the individual’s ambivalence about gambling and encouraging them to commit to positive change.

- 3. Group Therapy: Support groups like Gamblers Anonymous (GA) offer a community-based approach to recovery. These groups provide a safe space for individuals to share their experiences, gain support from others facing similar challenges, and build a network of accountability.

- 4. Family Therapy: Since gambling addiction often affects family dynamics, family therapy can be beneficial. It helps family members understand the addiction, improve communication, and develop strategies to support the individual in recovery.

- 5. Medication: In some cases, medication may be prescribed to help manage symptoms of gambling addiction, especially if there are co-occurring mental health issues such as depression or anxiety. Medications like antidepressants or mood stabilizers can be part of a comprehensive treatment plan.

- 6. Self-Exclusion Programs: Many casinos and gambling establishments offer self-exclusion programs, which allow individuals to voluntarily ban themselves from gambling venues. This can be a practical step in combination with therapy.

- 7. Online and Teletherapy Options: With the rise of digital health services, online therapy and teletherapy have become accessible options for those seeking help for gambling addiction. These platforms can provide flexibility and privacy for individuals who prefer remote sessions.

It’s important for individuals struggling with gambling addiction to seek help from qualified mental health professionals who can tailor treatment plans to their specific needs. Early intervention and a comprehensive approach that includes therapy, support groups, and possibly medication can significantly improve outcomes for those dealing with gambling addiction.

Where to find support groups if you are addicted to stock market?

Finding support groups for gambling addiction can be a crucial step towards recovery. Here are several resources and avenues you can explore to find the right support group:

- 1. Gamblers Anonymous (GA): This is one of the most well-known support groups for individuals struggling with gambling addiction. GA follows a 12-step program similar to Alcoholics Anonymous. You can visit their website to find local meetings or online support.