Trying to quit spending addiction? Welcome to our digital detox series! This series focuses on how to stop digital and screen addictions. Findall our posts about digital addictions. Today, let’s talk about how to quit the spending addiction.

- What’s the spending addiction?

- Addiction to spending, a “real” addiction?

- What’s considered spending addiction?

- How much spending is too much?

- Some online shopping addiction facts & statistics

- Symptoms & Causes of the spending addiction

- Why is spending so addictive?

- Possible causes of spending dependency

- Symptoms, Causes, and Signs of spending addiction

- Problems, impacts & bad effects of spending

- Some benefits of spending

- Health problems

- Impact on brain & mental health

- Impact on relationships

- How to stop & quit your spending addiction

- Main steps and solutions to break the spending addiction

- Best spending blocker apps & functionalities

- Where to seek extra help?

- Conclusion

- To Go Further

- How to help someone with spending addiction

- Best books about online shopping addiction

- Research about online shopping addiction

What is the spending addiction?

About spending

Spending refers to the act of using money to purchase goods, services, or to pay for obligations. It encompasses personal, business, and government expenditures, impacting economic activity and financial planning.

Addiction to spending, a “real” addiction?

Officially an addiction?

First, let’s have a look at the DSM-5,the Diagnostic and Statistical Manual of Mental Disorders. Does it include spending addiction?

Spending addiction, often referred to as compulsive buying disorder, is not specifically listed as a distinct disorder in the Diagnostic and Statistical Manual of Mental Disorders, Fifth Edition (DSM-5.. However, it is often discussed in the context of behavioral addictions and impulse control disorders. While the DSM-5 includes gambling disorder as a recognized behavioral addiction, other behaviors like compulsive buying are still subjects of research and debate within the mental health community.

Compulsive buying disorder is characterized by an overwhelming urge to shop and spend money, leading to distress and impairment in personal, social, or occupational functioning. Although not officially recognized in the DSM-5, mental health professionals may address it by considering related disorders, such as obsessive-compulsive disorder (OCD), impulse control disorders, or mood disorders, when diagnosing and treating individuals exhibiting symptoms of spending addiction.

For those experiencing issues related to compulsive spending, it is advisable to seek professional help from mental health practitioners who can provide guidance and support based on individual needs.

So what does “spending addiction” mean?

Understanding Spending Addiction: A Friendly Guide

Have you ever found yourself relentlessly shopping, even when your wallet says no? If so, you might be experiencing what’s known as spending addiction. But what exactly is it?

Spending addiction is a behavioral pattern where individuals feel a compulsive urge to spend money, often beyond their means. It goes beyond occasional splurges or treating yourself; it becomes a habitual response to emotions like stress, boredom, or sadness.

Why Does It Happen?

Several factors can contribute to spending addiction:

– Emotional Relief: Shopping can provide a temporary boost in mood or a distraction from negative feelings.

– Social Pressure: The desire to keep up with friends or societal standards can drive excessive spending.

– Easy Access: With online shopping and credit cards, buying things is more convenient than ever, making it easier to overspend.

Signs You Might Be Struggling:

– Constantly feeling the need to buy something, even when you don’t need it.

– Experiencing guilt or regret after making purchases.

– Hiding purchases or lying about spending habits.

– Financial stress due to unpaid bills or mounting debt.

Effects of Spending Addiction:

Unchecked, spending addiction can lead to serious consequences, including:

– Financial Problems: Accumulating debt and struggling to pay bills.

– Emotional Strain: Feelings of anxiety, shame, or depression.

– Relationship Issues: Tension with family and friends over money matters.

Taking Control:

If you think you might have a spending addiction, don’t worry—you’re not alone, and help is available. Consider:

– Seeking Support: Talking to a counselor or joining a support group.

– Creating a Budget: Tracking your expenses to understand where your money goes.

– Finding Alternatives: Engaging in activities that don’t involve spending, like exercising or reading.

Remember, recognizing the problem is the first step toward overcoming it. With the right strategies and support, you can regain control and build a healthier relationship with money.

What is considered spending addiction?

Diagnosing a spending addiction, also known as compulsive buying disorder (CBD), involves identifying patterns of behavior and emotional responses related to shopping and spending. While there is no universally accepted set of criteria, mental health professionals often look for specific signs and symptoms. Here are some common criteria that might be considered:

- 1. Preoccupation with Shopping and Spending: An individual frequently thinks about shopping and plans purchases, often at the expense of other responsibilities or activities.

- 2. Emotional Spending: Shopping is used as a way to cope with negative emotions such as anxiety, depression, or stress. The individual may feel a temporary high or relief after making purchases.

- 3. Loss of Control: The person often buys items they do not need or cannot afford, and they find it difficult to stop or control their spending habits despite negative consequences.

- 4. Financial Problems: Persistent financial difficulties arise due to excessive spending, including accumulating debt, borrowing money, or experiencing financial strain.

- 5. Interference with Daily Life: The spending behavior negatively impacts personal relationships, work, or other areas of life. It may lead to arguments with family or friends or cause problems at work.

- 6. Guilt and Regret: After shopping, the individual often feels guilt, regret, or shame about their purchases, leading to a cycle of negative emotions and further spending.

- 7. Hiding Purchases: The person may hide evidence of their purchases from family members or friends, indicating awareness of the problematic nature of their behavior.

- 8. Failed Attempts to Cut Back: Repeated unsuccessful attempts to reduce spending or shopping frequency, often accompanied by promises to oneself or others to stop.

- 9. Tolerance and Escalation: Over time, the individual needs to spend more money or shop more frequently to achieve the same emotional effect, similar to the concept of tolerance in substance addictions.

- 10. Withdrawal Symptoms: Feelings of irritability, restlessness, or anxiety when unable to shop or spend money, indicating a psychological dependence.

If someone exhibits several of these criteria, it may suggest a spending addiction, and seeking help from a mental health professional is advisable. Treatment options may include cognitive-behavioral therapy, support groups, and financial counseling to address both the psychological and financial aspects of the disorder.

How much spending is too much?

Determining how much time spent on spending is “too much” can be subjective and varies depending on individual circumstances, financial goals, and lifestyle. However, there are some general guidelines and considerations that can help you assess whether you’re spending too much time on spending-related activities.

### Signs You Might Be Spending Too Much Time on Spending

1. Neglecting Other Responsibilities: If managing your spending is causing you to neglect important responsibilities, such as work, family, or personal well-being, it might be time to reassess your priorities.

2. Emotional Stress: Spending too much time worrying about finances or shopping can lead to emotional stress. If you find yourself constantly anxious about spending decisions, it could be a sign of imbalance.

3. Impulse Buying: Spending excessive time browsing online stores or visiting shopping centers can lead to impulse buying, which might indicate you’re spending more time on spending than necessary.

4. Financial Strain: If your spending habits are leading to financial strain, such as debt or inability to save, it’s crucial to evaluate how much time you’re dedicating to spending and whether it’s productive.

5. Lack of Time for Other Activities: If spending activities are taking time away from hobbies, social interactions, or self-care, it might be beneficial to reconsider how much time you allocate to spending.

### Tips for Managing Time Spent on Spending

1. Set a Budget: Establishing a clear budget can help you focus your spending time more effectively and reduce unnecessary browsing or shopping.

2. Plan Purchases: Make a list of what you need before shopping to minimize time spent on unnecessary items.

3. Limit Online Browsing: Set specific times for online shopping to prevent it from becoming a time-consuming habit.

4. Use Financial Tools: Utilize budgeting apps or tools to streamline financial management and reduce the time needed for tracking expenses.

5. Evaluate Spending Habits: Regularly review your spending habits to identify areas where you can cut back on time and money.

6. Seek Professional Advice: If managing spending becomes overwhelming, consider consulting a financial advisor for personalized guidance.

Ultimately, the goal is to strike a balance where you are in control of your spending without it dominating your time or causing undue stress. By being mindful of your spending habits and setting clear boundaries, you can ensure that your time spent on spending is both efficient and aligned with your broader life goals.

Some online shopping addiction facts & statistics

Online shopping addiction, often referred to as compulsive buying disorder in the context of e-commerce, has become an increasingly prevalent issue with the rise of digital marketplaces. Here are some statistics and insights that highlight the scope and impact of online shopping addiction:

- 1. Prevalence: Various studies suggest that between 5% to 8% of adults in the developed world may suffer from compulsive buying disorder. With the convenience of online shopping, these numbers could be higher in the digital space.

- 2. Demographics: While shopping addiction affects both genders, research indicates that women are more likely to be affected than men. However, the gap is narrowing with the rise of online shopping platforms that cater to diverse interests, including electronics and gadgets, which are more popular among men.

- 3. Age Groups: Younger adults, particularly those in the age range of 18-34, are more prone to online shopping addiction. This demographic is more tech-savvy and comfortable with digital transactions, making them more susceptible to online shopping habits.

- 4. Psychological Impact: Online shopping addiction can lead to significant psychological issues, including anxiety, depression, and stress. The instant gratification of online purchases can create a cycle of dependency, where individuals shop to alleviate negative emotions.

- 5. Financial Consequences: Compulsive online shopping can lead to severe financial problems, including mounting credit card debt and bankruptcy. Many individuals with this addiction report spending beyond their means and experiencing financial distress as a result.

- 6. Triggers and Influences: Sales, discounts, and promotional emails are significant triggers for online shopping addiction. The ease of access to online stores and the constant availability of shopping apps on smartphones exacerbate the issue.

- 7. COVID-19 Pandemic Impact: The COVID-19 pandemic significantly increased online shopping activity, with many turning to e-commerce for both essential and non-essential goods. This shift has potentially increased the number of individuals struggling with online shopping addiction.

- 8. Treatment and Support: Cognitive-behavioral therapy (CBT) is one of the most effective treatments for compulsive buying disorder. Support groups and financial counseling can also be beneficial in managing the addiction and its consequences.

- 9. Awareness and Education: Increasing awareness about the signs and risks of online shopping addiction is crucial. Educational programs and resources can help individuals recognize their shopping habits and seek help if needed.

- 10. Technological Solutions: Some apps and browser extensions are designed to help manage online shopping habits by tracking spending, setting budgets, and even blocking certain shopping websites.

These statistics underscore the importance of recognizing online shopping addiction as a serious issue that requires attention from both individuals and mental health professionals. As e-commerce continues to grow, addressing this addiction will become increasingly important.

Is the spending addiction widespread?

Yes, there are a significant number of people who struggle with compulsive spending, often referred to as shopping addiction or compulsive buying disorder. This behavior is characterized by an overwhelming urge to shop and spend money, often leading to financial difficulties and emotional distress. Several factors contribute to this condition:

- 1. Psychological Factors: Many individuals use shopping as a way to cope with emotional issues such as stress, anxiety, depression, or low self-esteem. The temporary pleasure or relief gained from purchasing items can create a cycle of addiction.

- 2. Cultural and Social Influences: In many societies, consumerism is heavily promoted, and there is a strong cultural emphasis on material wealth and possessions as symbols of success and happiness. This can encourage compulsive spending behaviors.

- 3. Marketing and Advertising: Aggressive marketing strategies and targeted advertising can exploit psychological triggers, making it difficult for some individuals to resist the urge to buy.

- 4. Easy Access to Credit: The availability of credit cards and online shopping platforms has made it easier for people to spend money they do not have, leading to debt accumulation and financial strain.

- 5. Neurological Factors: Some research suggests that compulsive shopping may be linked to neurological factors, similar to other addictive behaviors, where the brain’s reward system is activated during shopping.

Addressing compulsive spending often requires a multifaceted approach, including psychological counseling, financial education, and support groups. Cognitive-behavioral therapy (CBT) is commonly used to help individuals understand and change their spending habits.

Additionally, financial planning and budgeting can provide practical tools to manage and reduce spending.

Raising awareness about the issue and promoting healthy financial habits can also play a crucial role in helping individuals overcome compulsive spending.

Symptoms, Causes, and Signs of spending addiction

Why is spending so addictive?

Spending can feel surprisingly addictive, and you’re not alone in feeling this way! Here are a few simple reasons why it hooks so many of us:

###

- 1. The Dopamine Hit

Every time you make a purchase, your brain releases dopamine, the “feel-good” chemical. This creates a temporary sense of happiness and satisfaction, encouraging you to seek that feeling again through more spending.

###

- 2. Instant Gratification

In our fast-paced world, we crave quick rewards. Buying something new offers immediate pleasure, unlike saving money, which provides rewards in the long run. This instant gratification can make spending feel irresistible.

###

- 3. Social Influence

Seeing friends, family, or influencers with the latest gadgets, fashion, or experiences can create a desire to keep up. Social media especially amplifies this, showing curated highlights that make spending seem essential for fitting in.

###

- 4. Emotional Comfort

Sometimes, shopping serves as a way to cope with stress, sadness, or boredom. Making a purchase can momentarily distract from negative feelings, making spending a go-to emotional escape.

###

- 5. Marketing Magic

Businesses are experts at making products irresistible. Clever advertising, sales, and limited-time offers create a sense of urgency, making it harder to resist the urge to buy now rather than later.

###

- 6. Habit Formation

Repeated spending behaviors can become habits. Just like any other habit, once it’s established, it’s harder to break free from the cycle of spending regularly without much thought.

###

- 7. Sense of Accomplishment

Buying something new can give a sense of achievement or reward. Whether it’s treating yourself or reaching a personal goal, the act of spending can feel like a deserved reward.

### What Can You Do?

Understanding why spending feels addictive is the first step to managing it. Here are a few tips:

– Set a Budget: Allocate specific amounts for different categories and stick to them.

– Pause Before Purchasing: Wait 24 hours before making non-essential purchases to see if you still want it.

– Find Alternative Rewards: Engage in activities that bring joy without spending money, like hobbies or exercise.

– Reflect on Purchases: Keep a journal of what you buy and how it makes you feel to identify patterns.

Remember, it’s all about finding a balance that keeps your happiness without causing financial stress. You’re in control, and making small changes can lead to big rewards!

Possible causes of spending dependency

Spending addiction, also known as compulsive buying disorder (CBD), is a behavioral addiction characterized by an overwhelming urge to shop and spend money, often leading to financial distress and personal problems. Several factors can contribute to the development of spending addiction:

- 1. Emotional Regulation: Many individuals use shopping as a way to cope with negative emotions such as stress, anxiety, depression, or loneliness. The act of purchasing can provide a temporary mood boost or sense of control, which reinforces the behavior.

- 2. Low Self-Esteem: People with low self-esteem may shop to enhance their self-image or to gain social approval. Buying new items can provide a temporary sense of worth or identity, which can become addictive.

- 3. Social and Cultural Influences: Societal pressures and cultural norms that equate material possessions with success and happiness can drive compulsive buying. Advertising and social media often exacerbate these pressures by promoting consumerism.

- 4. Psychological Disorders: Spending addiction can co-occur with other psychological disorders, such as anxiety, depression, or obsessive-compulsive disorder (OCD). These conditions can exacerbate compulsive buying behaviors.

- 5. Impulse Control Issues: Some individuals have difficulty controlling their impulses, leading to compulsive behaviors, including excessive spending. This can be related to neurological factors affecting decision-making and self-control.

- 6. Genetic and Biological Factors: There may be a genetic predisposition to addictive behaviors, including spending addiction. Neurotransmitter imbalances, particularly involving dopamine, can also play a role in reinforcing the rewarding aspects of shopping.

- 7. Boredom and Lack of Fulfillment: For some, shopping provides excitement or a sense of purpose that may be lacking in other areas of their life. This can lead to habitual spending as a way to fill a void or alleviate boredom.

- 8. Financial Mismanagement: Poor financial literacy or mismanagement can lead to compulsive spending. Without understanding budgeting or the consequences of debt, individuals may fall into patterns of excessive spending.

- 9. Family and Childhood Influences: Growing up in an environment where spending is used as a reward or coping mechanism can influence future spending habits.

Additionally, witnessing financial instability or compulsive buying in family members can contribute to similar behaviors.

Addressing spending addiction often requires a multifaceted approach, including therapy, financial counseling, and support groups. Cognitive-behavioral therapy (CBT) is particularly effective in helping individuals understand and change their spending habits by addressing underlying emotional and cognitive triggers.

Signs & Symptoms of spending addiction

Now let’s see if you have the spending addiction problem.

Identifying spending addiction can be challenging, as it often masquerades as normal consumer behavior. However, being aware of the signs can help you recognize and address the issue before it spirals out of control. Here are seven signs that you might be a spending addict:

- 1. Compulsive Shopping: One of the most telling signs of a spending addiction is the compulsion to shop frequently, even when you don’t need anything. If you find yourself shopping to cope with stress, boredom, or emotional distress, it might indicate a deeper issue.

- 2. Financial Secrecy: If you often hide purchases from family or friends, or feel embarrassed about your spending habits, this secrecy can be a red flag. Concealing receipts, lying about how much you spent, or having secret credit cards are common behaviors among spending addicts.

- 3. Mounting Debt: Regularly maxing out credit cards, taking out loans to cover other debts, or constantly juggling bills to make ends meet can indicate a spending problem. If your debt is growing faster than your ability to pay it off, it’s time to reassess your financial habits.

- 4. Impulse Buying: Frequently making unplanned purchases, especially of items you don’t need or use, is a classic sign of spending addiction. If you often buy things on a whim and later regret the purchase, it may be time to evaluate your spending triggers.

- 5. Emotional Purchases: Using shopping as a way to deal with emotions such as sadness, anger, or loneliness can be a sign of addiction. If you notice that shopping temporarily boosts your mood but leaves you feeling guilty or anxious afterward, it may indicate a problem.

- 6. Neglecting Responsibilities: If your spending habits are causing you to neglect important financial obligations, such as paying bills or saving for the future, this could be a sign of addiction. Prioritizing shopping over essential expenses can lead to serious financial consequences.

- 7. Failed Attempts to Control Spending: Repeatedly trying and failing to cut back on spending is a common sign of addiction. If you’ve set budgets or spending limits but consistently exceed them, it may be time to seek help or adopt more structured financial management strategies.

Recognizing these signs is the first step toward addressing a spending addiction. If you identify with several of these behaviors, consider seeking professional help or joining a support group to regain control over your finances and improve your overall well-being.

Try our digital habit & screen addiction test:

Problems, impacts & bad effects of spending: should you quit?

What are some benefits of spending

Spending, when done wisely and within one’s means, can offer a variety of benefits that contribute to personal satisfaction, economic growth, and overall well-being. Here are some of the pros and advantages of spending:

- 1. Economic Growth: Spending stimulates the economy by increasing demand for goods and services. This, in turn, encourages businesses to produce more, hire additional workers, and potentially innovate, contributing to overall economic health.

- 2. Improved Quality of Life: Spending on necessities such as food, housing, healthcare, and education enhances quality of life. It ensures that basic needs are met and can lead to improved health, knowledge, and living conditions.

- 3. Access to Experiences: Spending on experiences, such as travel, dining out, or attending events, can enrich life by creating memories, fostering relationships, and providing relaxation and enjoyment.

- 4. Convenience and Efficiency: Spending on technology and services can save time and effort. For example, investing in a reliable vehicle or home appliances can make daily tasks more efficient, freeing up time for other activities.

- 5. Supporting Innovation: Consumer spending encourages businesses to innovate and improve their products and services. This can lead to technological advancements and new solutions that benefit society as a whole.

- 6. Job Creation: When people spend money, businesses grow, leading to job creation. This can help reduce unemployment and improve the standard of living for many individuals and families.

- 7. Personal Fulfillment: Spending on hobbies and interests can lead to personal fulfillment and happiness. Whether it’s buying art supplies, musical instruments, or sports equipment, investing in passions can enhance life satisfaction.

- 8. Social Connections: Spending on social activities, such as dining out with friends or hosting gatherings, can strengthen relationships and build a sense of community.

- 9. Investment in Future: Spending on education and professional development is an investment in one’s future. It can lead to better job prospects, higher income, and personal growth.

- 10. Charitable Giving: Spending in the form of donations to charities and non-profits can have a positive impact on society by supporting causes and helping those in need.

- 11. Boosting Confidence: Purchasing items that improve personal appearance or living spaces can boost confidence and self-esteem, contributing to mental well-being.

While spending has many advantages, it’s important to balance it with saving and investing to ensure long-term financial stability. Responsible spending involves making informed decisions, budgeting, and prioritizing needs over wants to maximize the benefits while minimizing potential downsides.But on the other hand, what are some spending addiction problems that addicts suffer from?

General health problems

Spending habits can significantly impact an individual’s health, both positively and negatively. Here are some ways in which spending can affect health:

- 1. Nutrition and Diet:

– Positive Impact: Investing in healthy foods, such as fresh fruits, vegetables, lean proteins, and whole grains, can lead to better nutrition and overall health. Spending on organic or locally sourced foods can also reduce exposure to pesticides and support sustainable practices.

– Negative Impact: Spending on processed foods, fast foods, and sugary beverages can lead to poor nutrition, weight gain, and related health issues like obesity, diabetes, and heart disease.

- 2. Healthcare Access:

– Positive Impact: Allocating funds for regular medical check-ups, preventive screenings, and vaccinations can lead to early detection of diseases and better health outcomes. Spending on health insurance can also provide access to necessary medical services without financial strain.

– Negative Impact: Skimping on healthcare due to financial constraints can lead to untreated health conditions, worsening of diseases, and higher medical costs in the long run.

- 3. Physical Activity:

– Positive Impact: Investing in gym memberships, fitness classes, sports equipment, or personal trainers can encourage regular physical activity, improving cardiovascular health, strength, and mental well-being.

– Negative Impact: Spending too little on physical activity, or choosing sedentary entertainment options, can contribute to a sedentary lifestyle, increasing the risk of chronic diseases.

- 4. Mental Health:

– Positive Impact: Spending on mental health services, such as therapy, counseling, or stress-relief activities like yoga and meditation, can enhance mental well-being and resilience.

– Negative Impact: Neglecting mental health spending can lead to untreated mental health issues, impacting overall quality of life and physical health.

- 5. Living Environment:

– Positive Impact: Investing in a safe, clean, and comfortable living environment can reduce stress and exposure to health hazards. Spending on air purifiers, ergonomic furniture, and home safety features can further enhance health.

– Negative Impact: Spending too little on housing can lead to living in substandard conditions, which may expose individuals to pollutants, allergens, and unsafe environments.

- 6. Education and Knowledge:

– Positive Impact: Spending on health education, whether through courses, books, or workshops, can empower individuals to make informed health decisions and adopt healthier lifestyles.

– Negative Impact: Lack of investment in health education can lead to misinformation and poor health choices.

- 7. Social Connections and Activities:

– Positive Impact: Spending on social activities and maintaining connections with family and friends can improve mental health and provide emotional support, reducing stress and loneliness.

– Negative Impact: Excessive spending on social activities that involve unhealthy behaviors, such as excessive alcohol consumption, can negatively affect health.

In conclusion, thoughtful and balanced spending can enhance health and well-being, while neglect or misallocation of financial resources can lead to adverse health outcomes. It is important to prioritize spending that supports a healthy lifestyle and addresses both physical and mental health needs.

spending and sleep disorders

Spending itself is not directly linked to the physiological mechanisms that cause sleep disorders or sleep problems. However, financial stress and anxiety, which can arise from spending habits, may contribute to sleep disturbances. Here’s how spending might indirectly impact sleep:

- 1. Financial Stress: Excessive spending can lead to financial strain, resulting in stress and anxiety about debt, bills, or financial security. This stress can make it difficult to fall asleep or stay asleep, leading to insomnia or other sleep issues.

- 2. Anxiety and Worry: Concerns about money and financial stability can cause anxiety, which is a common contributor to sleep problems. People may find themselves lying awake at night worrying about their finances.

- 3. Lifestyle Choices: Spending on lifestyle choices, such as late-night entertainment or dining out, can disrupt sleep patterns. Late-night activities may lead to irregular sleep schedules, making it harder to maintain a consistent sleep routine.

- 4. Technology and Gadgets: Spending on technology, such as smartphones, tablets, or other electronic devices, can negatively impact sleep. The blue light emitted by screens can interfere with the body’s natural sleep-wake cycle, making it harder to fall asleep.

- 5. Substance Use: Spending on substances like alcohol or caffeine can also affect sleep. While alcohol might initially make you feel drowsy, it can disrupt sleep later in the night. Similarly, caffeine consumption, especially in the afternoon or evening, can interfere with the ability to fall asleep.

- 6. Healthcare Costs: Concerns about affording healthcare, including treatments for sleep disorders, can add to stress and anxiety, potentially exacerbating sleep problems.

To mitigate these issues, individuals can adopt healthier spending habits, such as budgeting and financial planning, to reduce financial stress.

Additionally, establishing a consistent sleep routine, limiting screen time before bed, and being mindful of substance use can help improve sleep quality. If sleep problems persist, consulting a healthcare professional or sleep specialist is advisable.

spending affecting your brain & mental health: bad for brain and mental health?

Some effects of spending on your brain

The Bad Effects of Overspending on Your Brain

Spending money is a normal part of life, but when it gets out of control, it can negatively impact your brain health. Here are some of the main ways overspending can affect your mind:

- 1. Increased Stress and Anxiety

– Financial Worries: Constantly worrying about bills and debt can elevate your stress levels.

– Mental Strain: The pressure to keep up with spending can lead to chronic anxiety.

- 2. Impaired Decision-Making

– Poor Choices: Overspending can cloud your judgment, making it harder to make smart financial decisions.

– Impulse Buying: You might find yourself making purchases without thinking them through, leading to regret later.

- 3. Mental Fatigue

– Cognitive Overload: Managing excessive spending and debt can tire out your brain, making it harder to concentrate and think clearly.

– Reduced Productivity: Mental exhaustion can decrease your ability to perform daily tasks effectively.

- 4. Mood Swings and Depression

– Emotional Toll: Financial problems caused by overspending can lead to feelings of sadness, hopelessness, and even depression.

– Isolation: You might withdraw from social activities to hide financial issues, worsening your mood and mental state.

- 5. Addiction-Like Behaviors

– Compulsive Spending: Some people develop a habit of spending that feels uncontrollable, similar to addictive behaviors.

– Brain Chemistry Changes: This pattern can alter how your brain handles rewards and pleasure, making it harder to break the cycle.

Takeaway

Being mindful of your spending habits is crucial not just for your wallet but also for your brain health. If you find it challenging to control your spending, seeking support from a financial advisor or a mental health professional can make a big difference.

Remember, taking small steps towards better financial management can lead to a healthier, happier mind!

Some effects of spending on your mental health

Spending money can be a necessary and often enjoyable part of life, but when it becomes excessive or mismanaged, it can have detrimental effects on mental health. Here are some of the negative impacts that spending can have on mental well-being:

- 1. Financial Stress: Overspending can lead to financial strain, which is a significant source of stress. Constant worry about bills, debts, and financial obligations can lead to anxiety and depression.

- 2. Guilt and Shame: Impulsive or unnecessary purchases often lead to feelings of guilt and shame, especially if they result in financial difficulties. These emotions can erode self-esteem and contribute to a negative self-image.

- 3. Relationship Strain: Financial issues are a common source of conflict in relationships. Disagreements about spending habits can lead to arguments, resentment, and even the breakdown of relationships, further impacting mental health.

- 4. Increased Anxiety: The uncertainty and lack of control associated with financial instability can heighten anxiety levels. This can manifest in constant worry about the future and an inability to enjoy the present.

- 5. Depression: Chronic financial problems can lead to feelings of hopelessness and helplessness, which are key indicators of depression. The burden of debt and financial mismanagement can make individuals feel trapped and overwhelmed.

- 6. Reduced Quality of Life: Excessive spending can lead to a reduction in the quality of life, as individuals may have to cut back on essential expenses or miss out on important life experiences due to financial constraints.

- 7. Impulse Control Issues: Compulsive spending can be a symptom of underlying mental health issues, such as obsessive-compulsive disorder or bipolar disorder. It can exacerbate these conditions, leading to a cycle of spending and regret.

- 8. Isolation: Financial problems can lead to social withdrawal. Individuals may avoid social situations due to embarrassment about their financial status or the inability to afford social activities, leading to feelings of loneliness and isolation.

- 9. Sleep Disturbances: Financial worries can lead to sleep disturbances, including insomnia. Lack of sleep can further exacerbate mental health issues, creating a vicious cycle of stress and fatigue.

- 10. Decreased Productivity: The mental burden of financial stress can lead to decreased focus and productivity at work or school, potentially affecting career progression and academic performance.

To mitigate these negative effects, it is essential to develop healthy spending habits, create a realistic budget, and seek professional financial advice if needed.

Additionally, addressing any underlying mental health issues with the help of a mental health professional can be crucial in breaking the cycle of stress and financial mismanagement.

Does spending cause stress and anxiety?

Yes, spending can indeed cause stress or anxiety for many individuals. This emotional response can stem from various factors related to personal finances and the broader economic environment. Here are some reasons why spending might lead to stress or anxiety:

- 1. Budget Constraints: For individuals on a tight budget, any unplanned or excessive spending can lead to immediate stress. Concerns about meeting essential expenses, such as rent, utilities, and groceries, can create anxiety when discretionary spending threatens these necessities.

- 2. Debt Accumulation: Spending beyond one’s means often results in accumulating debt, such as credit card debt, which can be a significant source of stress. The pressure of high-interest rates, monthly payments, and the potential for financial instability can weigh heavily on individuals.

- 3. Financial Goals: People who are saving for specific financial goals, such as buying a home, funding education, or retirement, may experience anxiety when spending interferes with their ability to save. The fear of not achieving these goals can lead to stress.

- 4. Economic Uncertainty: Broader economic factors, such as job insecurity, inflation, and market volatility, can exacerbate stress related to spending. In uncertain economic times, individuals may worry about their financial future, making them more anxious about their current spending habits.

- 5. Social Pressure: The desire to keep up with peers or maintain a certain lifestyle can lead to overspending and subsequent stress. Social media and societal expectations often amplify this pressure, causing individuals to spend beyond their comfort level.

- 6. Emotional Spending: Some individuals use spending as a coping mechanism for emotional distress, such as depression or anxiety. While it may provide temporary relief, it can lead to guilt and increased stress when financial realities set in.

- 7. Lack of Financial Literacy: A lack of understanding about personal finance management can contribute to stress. Without the knowledge to create and stick to a budget, manage debt, or invest wisely, individuals may feel overwhelmed by their financial situation.

- 8. Unexpected Expenses: Sudden, unexpected expenses, such as medical emergencies or car repairs, can disrupt financial stability and cause significant stress, especially if there are no savings to fall back on.

To mitigate stress related to spending, individuals can take proactive steps such as creating a realistic budget, building an emergency fund, seeking financial education, and practicing mindful spending.

Additionally, seeking support from financial advisors or mental health professionals can provide valuable guidance and coping strategies.

Can spending addiction lead to sadness and depression?

Yes, spending addiction can indeed lead to sadness and depression. This type of addiction, often referred to as compulsive buying disorder (CBD), is characterized by an overwhelming urge to shop and spend money, often leading to negative consequences in various aspects of life. Here’s how it can contribute to emotional distress:

- 1. Financial Stress: One of the most immediate impacts of spending addiction is financial strain. Compulsive spending can lead to mounting debts, depleted savings, and even bankruptcy. The stress of managing these financial burdens can be overwhelming and lead to feelings of hopelessness and despair.

- 2. Relationship Strain: Spending addiction can put significant strain on personal relationships. Partners, family members, and friends may become frustrated or angry about the financial instability caused by excessive spending. This can lead to conflicts, broken trust, and isolation, all of which can contribute to feelings of sadness and depression.

- 3. Guilt and Shame: Individuals with spending addiction often experience intense feelings of guilt and shame about their behavior. They may feel embarrassed about their lack of control and the consequences of their actions, which can erode self-esteem and contribute to a negative self-image.

- 4. Loss of Control: The inability to control spending can lead to a sense of powerlessness. This loss of control can be distressing and contribute to anxiety and depression, as individuals feel trapped in a cycle they cannot break.

- 5. Emotional Void: Many people with spending addiction use shopping as a way to cope with negative emotions or to fill an emotional void. When the temporary high from shopping fades, the underlying issues remain, often exacerbating feelings of emptiness and depression.

- 6. Impact on Mental Health: The stress and emotional turmoil associated with spending addiction can exacerbate existing mental health issues or contribute to the development of new ones. Depression and anxiety are common among those struggling with compulsive buying.

Addressing spending addiction requires a multifaceted approach. Therapy, particularly cognitive-behavioral therapy (CBT), can be effective in helping individuals understand the underlying causes of their addiction and develop healthier coping mechanisms. Financial counseling may also be beneficial in managing debt and creating a sustainable financial plan. Support groups can provide a sense of community and understanding, reducing feelings of isolation.

Overall, while spending addiction can lead to sadness and depression, seeking help and implementing strategies to manage the addiction can significantly improve emotional well-being and quality of life.

Dopamine and spending

Dopamine, often referred to as the “feel-good” neurotransmitter, plays a significant role in how we experience pleasure and reward. It is intricately linked to motivation, reward-seeking behavior, and decision-making processes, all of which can influence spending habits.

### The Role of Dopamine in Spending

- 1. Reward System Activation: When we anticipate or receive a reward, such as purchasing a desired item, dopamine levels in the brain increase. This surge creates a feeling of pleasure and satisfaction, reinforcing the behavior. This is why shopping can be so enjoyable for many people.

- 2. Impulse Purchases: The anticipation of a reward can sometimes lead to impulsive buying. The immediate gratification from a purchase can trigger dopamine release, making it difficult to resist the temptation of buying something on a whim.

- 3. Addictive Shopping Behaviors: For some individuals, shopping can become an addictive behavior, similar to gambling or substance abuse. The repeated dopamine rush from purchasing can lead to compulsive buying habits, where the individual continues to shop despite negative consequences.

- 4. Marketing and Advertising: Companies often leverage the dopamine-driven reward system through strategic marketing and advertising. Limited-time offers, discounts, and exclusive products can create a sense of urgency and excitement, stimulating dopamine release and encouraging spending.

- 5. Social Influence: Social media platforms can also play a role in dopamine-driven spending. The constant exposure to curated lifestyles and products can trigger a desire to purchase items that promise to enhance one’s status or happiness, driven by the dopamine reward system.

### Managing Dopamine-Driven Spending

- 1. Mindful Spending: Being aware of the emotional triggers that lead to spending can help individuals make more conscious purchasing decisions. Practicing mindfulness can reduce impulsive buying by allowing individuals to consider whether a purchase aligns with their long-term goals.

- 2. Setting Budgets: Establishing a budget can help manage spending by setting clear limits on how much can be spent in different categories. This can help mitigate the impulsive urges driven by dopamine.

- 3. Delayed Gratification: Implementing a waiting period before making a purchase can help reduce impulsive spending. This delay allows the initial dopamine-driven excitement to subside, enabling more rational decision-making.

- 4. Alternative Rewards: Finding non-monetary ways to experience pleasure and reward can help reduce reliance on shopping for dopamine boosts. Activities such as exercise, hobbies, or socializing can provide similar feelings of satisfaction.

Understanding the relationship between dopamine and spending can empower individuals to make more informed financial decisions, leading to healthier spending habits and improved financial well-being.

spending effects on focus, productivity, attention span, academic performance…

Absolutely, spending habits can have a significant impact on your focus, productivity, attention span, and even academic performance. Let’s break down how this happens:

###

- 1. Financial Stress and Focus

When you spend beyond your means, it can lead to financial stress. Worries about bills, debts, or unexpected expenses consume mental energy that could otherwise be directed toward studying or work. This constant stress makes it difficult to concentrate, leading to reduced focus and lower productivity.

###

- 2. Mindful Spending Enhances Productivity

On the flip side, being strategic with your spending can boost your productivity. Investing in the right tools—like a comfortable workspace, quality study materials, or even a good chair—can create an environment that supports better focus and efficiency. When you have what you need to succeed, it’s easier to stay on task and achieve your goals.

###

- 3. Attention Span and Distractions

Excessive spending, especially on gadgets and entertainment, can lead to increased distractions. Constant notifications from your phone or spending hours on social media can fragment your attention span. This scattered focus makes it harder to dive deep into tasks, whether it’s studying for exams or completing work projects.

###

- 4. Academic Performance

Your spending habits can directly influence your academic performance. If you allocate money towards educational resources like tutoring, online courses, or books, you’re likely to see an improvement in your grades and understanding of subjects. Conversely, spending on non-essential items might take away from funds that could support your education, potentially hindering your academic progress.

###

- 5. Mental Well-Being

Healthy spending habits contribute to overall mental well-being. When you manage your finances wisely, you feel more in control and less anxious. This positive mindset is crucial for maintaining attention and staying productive in both academic and professional settings.

### Tips for Balancing Spending and Productivity:

– Create a Budget: Outline your income and expenses to ensure you’re not overspending.

– Prioritize Needs Over Wants: Focus on spending money on what truly benefits your studies or work.

– Limit Distractions: Reduce spending on gadgets or subscriptions that distract you from your goals.

– Invest in Yourself: Spend on resources that enhance your knowledge and skills.

By being mindful of how and where you spend your money, you can create a positive ripple effect on your focus, productivity, attention span, and academic performance. It’s all about finding the right balance that supports your goals and well-being!

A word about ADHD and spending

Attention Deficit Hyperactivity Disorder (ADHD) is a neurodevelopmental disorder characterized by symptoms such as inattention, hyperactivity, and impulsivity. These symptoms can influence various aspects of an individual’s life, including financial behaviors and spending habits. Here’s how people with ADHD might interact differently with spending:

1. Impulsive Purchases: One of the hallmark symptoms of ADHD is impulsivity. This can lead individuals to make spontaneous purchases without thoroughly considering the consequences or necessity of the items. The immediate gratification from buying something new can be particularly appealing.

2. Difficulty with Budgeting: People with ADHD may struggle with planning and organization, which are critical skills for effective budgeting. They might find it challenging to track expenses, pay bills on time, or adhere to a financial plan, leading to overspending.

3. Procrastination: Procrastination is common among those with ADHD, which can affect financial management. Delaying bill payments or neglecting to review financial statements can result in late fees or missed opportunities for savings.

4. Sensitivity to Marketing: Individuals with ADHD may be more susceptible to marketing tactics and promotions. The allure of sales, discounts, or limited-time offers can trigger impulsive buying decisions.

5. Emotional Spending: People with ADHD might engage in emotional spending as a way to cope with stress, boredom, or emotional distress. Shopping can serve as a temporary mood booster, leading to unnecessary purchases.

6. Lack of Financial Education: ADHD can impact academic performance and attention to detail, which might result in a lack of financial literacy. Without a solid understanding of financial principles, individuals may find it harder to manage money effectively.

7. Preference for Immediate Rewards: ADHD is often associated with a preference for immediate rewards over long-term benefits. This can lead to prioritizing short-term spending over long-term financial goals, such as saving for retirement.

8. Difficulties with Long-Term Planning: The executive function deficits associated with ADHD can make long-term planning challenging. This might result in a focus on immediate needs rather than future financial security.

9. Potential for Debt: Due to impulsive spending and challenges with budgeting, individuals with ADHD may be at a higher risk of accumulating debt. Credit cards can be particularly problematic, as they offer the ability to spend without immediate financial consequences.

10. Seeking Professional Help: Some individuals with ADHD may benefit from working with financial advisors or therapists who specialize in ADHD to develop strategies for managing their finances effectively.

Understanding these tendencies can help individuals with ADHD, and those around them, develop strategies to mitigate the impact of ADHD on financial behaviors. This might include setting up automatic payments, using budgeting apps, seeking financial counseling, or implementing accountability systems to support better financial management.

Affecting your relationships

spending and self-esteem

How Spending Affects Self-Esteem

Hey there! Let’s talk about something we all do every day—spending money. Believe it or not, the way we spend can have a big impact on how we feel about ourselves. Let’s dive into how your spending habits might be influencing your self-esteem.

###

- 1. Buying Items That Boost Confidence

Ever bought something that made you feel awesome? Maybe a new outfit for a special occasion or a gadget you’ve been eyeing. Purchasing things that align with your values and make you happy can boost your confidence. It’s like giving yourself a little reward, reminding you that you deserve good things.

###

- 2. Avoiding Impulse Purchases

On the flip side, making spontaneous purchases, especially those you don’t really need, can sometimes lead to regret. This might make you feel guilty or question your self-control, which can dip your self-esteem. Planning your purchases helps you feel more in control and positive about your choices.

###

- 3. Spending to Connect with Others

Spending money on experiences with friends and family, like going out for dinner or attending events together, can strengthen relationships. These positive interactions boost your sense of belonging and worth, enhancing your self-esteem.

###

- 4. Financial Stress and Self-Worth

Struggling to manage finances can weigh heavily on your mind. Worrying about bills or debt might make you feel inadequate or stressed. Taking steps to manage your money wisely can alleviate these feelings and improve how you see yourself.

###

- 5. Investing in Yourself

Spending on personal growth, like education, hobbies, or self-care, signals that you value yourself. This investment can lead to personal achievements and a stronger sense of identity, positively impacting your self-esteem.

###

- 6. Comparison with Others

It’s easy to fall into the trap of comparing your spending to others, especially with social media around. Feeling like you need to keep up can lead to unnecessary stress and lower self-worth. Remember, everyone’s financial journey is unique, and true self-esteem comes from within, not from what you own.

###

- 7. Charitable Giving

Helping others through donations or volunteering can enhance your self-esteem. Knowing you’re making a positive impact can boost your feelings of purpose and self-worth.

### Final Thoughts

Your spending habits are more than just transactions; they reflect your values, priorities, and how you view yourself. By being mindful about where your money goes, you can enhance your self-esteem and build a healthier relationship with both your finances and yourself.

Remember, it’s not about how much you spend, but how you spend that matters! Take small steps towards mindful spending and watch how it positively influences your self-esteem.

Stay positive and happy spending!

spending addiction leads to isolation and loneliness?

.jpg)

Yes, spending addiction, also known as compulsive buying disorder, can indeed lead to isolation and loneliness. This condition is characterized by an overwhelming urge to shop and spend money, often leading to financial difficulties and emotional distress. Here are several ways in which spending addiction can contribute to feelings of isolation and loneliness:

- 1. Financial Strain: Compulsive spending can result in significant financial problems, including debt and bankruptcy. This financial strain can cause individuals to withdraw from social activities that require spending money, such as dining out or traveling, leading to isolation.

- 2. Shame and Guilt: Many individuals with spending addiction experience feelings of shame and guilt about their behavior. This can lead them to hide their spending habits from friends and family, creating a barrier to open communication and increasing feelings of loneliness.

- 3. Relationship Strain: The financial and emotional consequences of spending addiction can put a strain on personal relationships. Trust issues may arise, and conflicts over money can lead to arguments and even estrangement from loved ones.

- 4. Loss of Control: The compulsive nature of the disorder can lead to a loss of control over spending, which can be distressing and isolating. Individuals may feel misunderstood by those who do not recognize the seriousness of their addiction.

- 5. Emotional Dependence: Some individuals use shopping as a way to cope with negative emotions or fill an emotional void. Over time, this can lead to a reliance on shopping for emotional satisfaction, reducing the motivation to seek out genuine social interactions.

- 6. Avoidance of Social Situations: To avoid judgment or questions about their spending habits, individuals may begin to avoid social situations altogether. This avoidance can lead to a cycle of loneliness and further isolation.

- 7. Mental Health Issues: Spending addiction is often associated with other mental health issues, such as anxiety and depression, which can exacerbate feelings of loneliness and isolation.

Addressing spending addiction typically requires a multifaceted approach, including financial counseling, therapy, and support groups. By seeking help, individuals can work towards regaining control over their spending, repairing relationships, and reducing feelings of isolation.

Effects of spending on your relationships

Spending money can significantly impact relationships in both positive and negative ways. Understanding these effects can help individuals navigate their financial behaviors to foster healthier, more balanced relationships.

### Positive Effects

- 1. Shared Experiences: Spending money on activities such as dining out, traveling, or attending events can create memorable experiences that strengthen bonds. These shared moments can enhance communication and understanding between partners, friends, or family members.

- 2. Gift-Giving: Thoughtful gifts can express love, appreciation, and care. When done with genuine intent, gift-giving can reinforce emotional connections and show that you value the relationship.

- 3. Reduced Stress: Financial stability, achieved through responsible spending, can reduce stress in relationships. When basic needs and some desires are met, couples and families may experience fewer conflicts related to financial insecurity.

- 4. Investment in Relationship Growth: Spending on relationship-building activities, such as couple’s therapy, workshops, or classes, can improve communication and understanding, leading to stronger, more resilient relationships.

- 5. Celebrating Milestones: Investing in celebrations for birthdays, anniversaries, or achievements can reinforce the importance of these milestones and create a sense of shared joy and accomplishment.

### Negative Effects

- 1. Financial Strain: Overspending or mismanaging finances can lead to debt and financial stress, which are common sources of conflict in relationships. Disagreements over money can erode trust and lead to resentment.

- 2. Materialism: Placing too much emphasis on material possessions can detract from the emotional and personal aspects of a relationship. It may lead to shallow connections based on what is bought rather than shared values or experiences.

- 3. Unequal Contribution: Disparities in spending power can create imbalances in relationships, leading to feelings of inadequacy or resentment. This is especially true if one partner consistently spends more or contributes less financially.

- 4. Dependency: Excessive financial support can foster dependency, where one partner relies heavily on the other for financial stability. This can lead to power imbalances and limit personal growth and independence.

- 5. Misaligned Priorities: Differences in spending habits and financial priorities can lead to conflicts. If one partner values saving while the other prefers spending, it can create tension and misunderstandings.

### Conclusion

While spending can enhance relationships by creating shared experiences and reducing stress, it can also introduce challenges such as financial strain and dependency. Open communication about financial goals and priorities is crucial in maintaining a healthy balance. By understanding the potential impacts of spending, individuals can make informed decisions that support and strengthen their relationships.

How To Stop & Quit Your spending Addiction

Finally, you think you are addicted to spending and you are wondering how to quit it? How to break and overcome your cravings for spending?

Here are the best solutions, steps, supports, resources, and help you can get to treat your spending addiction.

Main steps and solutions to break the spending addiction

Overcoming a spending addiction is a challenging but achievable goal. It requires a combination of self-awareness, discipline, and support. Here are the main steps to help you get started:

1. Acknowledge the Problem: The first step is to recognize and admit that you have a spending addiction. This involves being honest with yourself about your spending habits and their impact on your life.

2. Identify Triggers: Understand what triggers your urge to spend. It could be emotional factors like stress or boredom, or external influences like sales and advertisements. Keeping a spending diary can help you identify patterns.

3. Set Clear Goals: Establish specific, realistic financial goals. These could include paying off debt, saving for a significant purchase, or building an emergency fund. Having clear objectives can motivate you to change your habits.

4. Create a Budget: Develop a detailed budget that outlines your income, expenses, and savings goals. Stick to this budget to help control impulsive spending. Use budgeting tools or apps to track your progress.

5. Implement Spending Controls: Limit access to credit cards or online shopping accounts. Consider using cash for purchases to make spending more tangible. Set daily, weekly, or monthly spending limits.

6. Seek Support: Talk to friends, family, or support groups about your spending issues. Sharing your struggles can provide emotional support and accountability. Consider professional help from a financial advisor or therapist specializing in addiction.

7. Develop Healthy Habits: Replace shopping with healthier activities that fulfill the same emotional needs, such as exercise, hobbies, or socializing. This can help reduce the urge to spend as a coping mechanism.

8. Educate Yourself: Learn about personal finance and money management. Understanding the long-term consequences of spending addiction can reinforce your commitment to change.

9. Monitor Progress: Regularly review your financial situation to assess your progress. Celebrate small victories to stay motivated and adjust your strategies as needed.

10. Practice Patience and Persistence: Overcoming spending addiction is a gradual process. Be patient with yourself and remain committed to your goals, even if setbacks occur.

By following these steps and maintaining a proactive approach, you can gradually gain control over your spending habits and work towards a healthier financial future.Actually, that’s what most documentation out there is about… However, quitting a digital addiction can be a bit trickier than that.

So our team, after testing many ways, designed a bulletproof way to overcome them. Here are some clear and practical steps that are very powerful to quit a digital addiction, including spending:

1. Purge temptations: Get rid of spending

First, cleaning your life from temptations is much easier than resisting them. Disable or delete your spending accounts, change the password and hide it somewhere you can’t access easily, keep your phone / computer far away… Out of sight, out of mind.

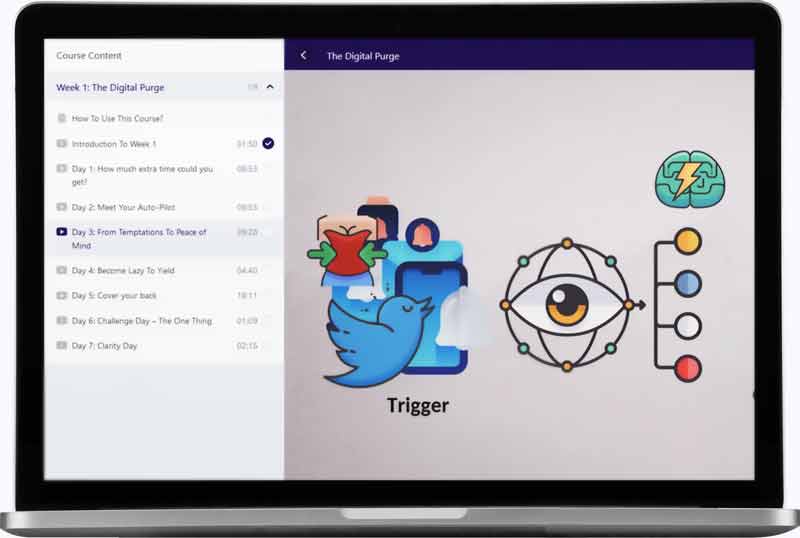

Here is a video from our course The Digital Purge. on how to add resistance to your temptations, so you become so lazy to engage with them that you give them up:

2. Spot & Reveal your emotional triggers

Second, there are some reasons, often hidden ones, that your brain and your heart love so much spending. Those reasons act as triggers to pull your cravings. Rather than chasing the addiction, it’s a more efficient strategy to look at the feelings driving you toward it. That way you can cure and heal the feeling. You’ll feel better, and the cravings will magically disappear. Just get away.

3. Rewire to life

An addiction FOMO (fear of missing out) can be huge and really painful to resist, especially if it was here for a long time. However, learning to live with it is necessary to build a life full of peace and joy. Strategies to fight FOMO and rewire to life include meditation, nature activities, social interaction, intellectual and creative projects, meaningful adventures… basically anything that fills your soul.

4. How to not relapse and fully recover from spending?

Finally, it’s important to acknowledge that quitting may take days, weeks, months, or even years. Getting over and quitting spending forever can be difficult. You may relapse a few times, but the most important thing is that you keep engaging less and less with spending. Each day you resist it is a day weakening your brain connections with spending. From your patience and discipline will arise incredible mind strength, hope, and wisdom.

Best spending blocker apps & functionalities

Additionally, you can increase your chance of withdrawal by limiting or blocking access to spending using these apps.

They will help you filter, reduce, or block spending:

Online shopping can be both a convenience and a temptation, leading many to seek tools that help manage or limit their spending habits. Here are five of the best apps designed to help users limit or block online shopping access:

- 1. Freedom

Freedom is a versatile app that allows users to block distracting websites and apps across all devices. With Freedom, you can create custom blocklists that include specific online shopping sites. The app also offers scheduling features, enabling users to set specific times when shopping sites are inaccessible. Its cross-platform functionality ensures that your shopping restrictions are consistent across all your devices.

- 2. Cold Turkey Blocker

Cold Turkey Blocker is a robust tool for those looking to curb their online shopping habits. It allows users to block websites, including shopping sites, on a schedule or indefinitely. The app is known for its strict blocking features, making it difficult to bypass once a block is set. This makes it an ideal choice for those who need strong measures to control their online spending.

- 3. StayFocusd

StayFocusd is a Chrome extension designed to increase productivity by limiting the amount of time you can spend on time-wasting websites, including online shopping sites. Users can set daily limits on specific sites or block them entirely. The extension is highly customizable, allowing you to tailor it to your specific needs and shopping habits.

- 4. LeechBlock NG

LeechBlock NG is a simple yet effective browser extension for Firefox and Chrome that helps users block access to distracting websites, including shopping platforms. You can specify which sites to block and when, making it easy to create a tailored shopping restriction plan. The extension also offers advanced options like password protection and lockdown mode for added security.

- 5. SelfControl

SelfControl is a free and open-source application for macOS that allows users to block access to specific websites, including online shopping sites, for a set period. Once the timer is set, it cannot be undoneCheck our full online shopping addiction tool list (ranked):

Where to seek extra help?

Do you need some support and help to stop, overcome, and recover from your spending addiction? If you or someone you know is struggling with spending addiction, there are a few places to seek help.

The Ultimate Rewiring Program For spending Addicts

Our course The Digital Purge. This course has already helped many digital addicts to rewire to what matters.

Is there a “treatment” to cure online shopping addiction?

Absolutely, overcoming an online shopping addiction is entirely possible with the right strategies and support! Here are some effective approaches that can help:

###

- 1. Recognize the Problem

The first step is acknowledging that online shopping has become a compulsive behavior affecting your life. Being honest with yourself is crucial.

###

- 2. Set Clear Goals

Decide what you want to achieve. Whether it’s reducing the amount you spend or limiting the frequency of your shopping, having specific goals can guide your actions.

###

- 3. Create a Budget

Establishing a monthly budget can help you keep track of your expenses. Allocate a certain amount for non-essential purchases and stick to it.

###

- 4. Unsubscribe and Delete

Unsubscribe from promotional emails and notifications from online stores. Removing tempting apps from your phone can also reduce the urge to shop impulsively.

###

- 5. Find Alternatives

Engage in activities that bring you joy and fulfillment without spending money. Hobbies like reading, exercising, or painting can divert your attention away from shopping.

###

- 6. Seek Professional Help

Therapists, especially those specializing in cognitive-behavioral therapy (CBT), can provide strategies to manage compulsive behaviors. Counseling can help address the underlying emotions driving the addiction.

###

- 7. Join Support Groups

Connecting with others who are facing similar challenges can offer encouragement and accountability. Sharing experiences can make the journey easier.

###

- 8. Mindfulness and Stress Management

Practicing mindfulness techniques, such as meditation or deep breathing, can help you stay present and reduce the impulse to shop when stressed or anxious.

###

- 9. Limit Payment Options

Using cash instead of credit cards can make purchases feel more tangible, helping you think twice before buying something you don’t need.

###

- 10. Reflect on Purchases

Before making a purchase, take a moment to ask yourself if it’s something you truly need or just an impulse buy. This pause can prevent unnecessary spending.

Remember, it’s okay to seek help, and taking small steps can lead to significant positive changes. You’re not alone, and with determination and the right support, you can manage and overcome an online shopping addiction!

Does online shopping therapy exist?

Yes, therapy for online shopping addiction does exist. Online shopping addiction, also known as compulsive buying disorder (CBD), can be addressed through various therapeutic approaches. Here are some common methods used to treat this condition:

- 1. Cognitive Behavioral Therapy (CBT): CBT is one of the most effective treatments for shopping addiction. It helps individuals identify and change negative thought patterns and behaviors associated with compulsive shopping. By addressing the underlying triggers and developing healthier coping mechanisms, CBT can reduce the urge to engage in excessive shopping.

- 2. Motivational Interviewing (MI): This approach helps individuals explore their motivations for shopping and encourages them to find intrinsic reasons to change their behavior. It is particularly useful for enhancing a person’s motivation to seek change and commit to treatment.

- 3. Group Therapy: Support groups or group therapy sessions provide a platform for individuals to share their experiences and learn from others facing similar challenges. This communal support can be instrumental in overcoming feelings of isolation and fostering accountability.

- 4. Mindfulness-Based Interventions: Mindfulness techniques, such as meditation and mindfulness-based stress reduction (MBSR), can help individuals become more aware of their shopping triggers and develop better emotional regulation skills.

- 5. Financial Counseling: Since shopping addiction often leads to financial problems, working with a financial counselor can help individuals create a budget, manage debt, and develop healthier spending habits.

- 6. Pharmacotherapy: In some cases, medication may be prescribed to address underlying issues such as depression, anxiety, or impulse control disorders that contribute to compulsive shopping behaviors.

- 7. Psychoeducation: Educating individuals about the nature of their addiction and its consequences can empower them to make informed decisions about their behavior and treatment.

It’s important for individuals struggling with online shopping addiction to seek help from a qualified mental health professional who can tailor a treatment plan to their specific needs. Early intervention and a comprehensive approach can significantly improve outcomes for those dealing with this condition.

Where to find support groups if you are addicted to spending?

If you’re looking for support groups for online shopping addiction, there are several resources you can explore:

- 1. Online Forums and Communities: Websites like Reddit have communities such as r/shoppingaddiction where individuals share their experiences and support each other. These forums can provide a sense of community and understanding.

- 2. Facebook Groups: Search for groups related to shopping addiction on Facebook. Many private groups offer a safe space for members to discuss their challenges and successes.

- 3. Therapy and Counseling Platforms: Websites like BetterHelp and Talkspace offer access to licensed therapists who specialize in addiction, including shopping addiction. They may also host group sessions.

- 4. Gamblers Anonymous: While primarily for gambling addiction, some local chapters or online meetings may address compulsive shopping as a related behavior.

- 5. Meetup: Check Meetup.com for local or virtual support groups focused on shopping addiction. These groups may offer regular meetings and activities to help manage the addiction.

- 6. Mental Health Organizations: Organizations such as the National Alliance on Mental Illness (NAMI) may offer resources or referrals to support groups for behavioral addictions.

- 7. Local Community Centers: Some community centers or hospitals offer support groups for various addictions, including shopping addiction. Contact them to see if they have any relevant programs.

- 8. Self-Help Books and Resources: While not a support group, books on shopping addiction can provide guidance and strategies for overcoming the addiction. Authors often have online communities or forums where readers can connect.

It’s important to find a group or resource that feels right for you, where you can openly share your experiences and receive support from others who understand what you’re going through.

But other spending addiction solutions exist

If you’re seeking help with spending addiction and prefer not to engage with support groups, there are several other avenues you can explore:

- 1. Financial Advisor or Planner: A financial advisor can help you create a budget, manage your finances, and develop strategies to control spending. They can provide personalized advice tailored to your financial situation.

- 2. Psychologist or Therapist: A mental health professional, particularly one who specializes in addiction or behavioral therapy, can help address the underlying emotional and psychological factors contributing to your spending habits.

- 3. Certified Credit Counselor: Credit counseling services can offer guidance on managing debt and improving your financial literacy. They can help you understand your spending patterns and create a plan to reduce debt.

- 4. Life Coach: A life coach can assist in setting personal goals and developing self-discipline, which can be beneficial in overcoming spending addiction.

- 5. Accountability Partner: This could be a trusted friend or family member who can help you stay accountable to your financial goals. They can provide support and encouragement as you work to change your spending habits.

- 6. Financial Educator: Enrolling in financial education courses or workshops can enhance your understanding of money management and help you develop healthier financial habits.

- 7. Behavioral Economist: Consulting with a behavioral economist can provide insights into the psychological factors influencing your spending decisions and help you develop strategies to modify your behavior.

Each of these professionals can offer different perspectives and tools to help you address spending addiction effectively.

Conclusion

In conclusion, overcoming spending addiction is a challenging yet achievable journey that requires self-awareness, discipline, and support. By acknowledging the problem and understanding the emotional triggers that lead to excessive spending, individuals can begin to regain control over their financial habits. Implementing practical strategies such as budgeting, tracking expenses, and setting financial goals can help create a sustainable path towards healthier spending behaviors.

Additionally, seeking support from friends, family, or professional counselors can provide the necessary encouragement and accountability. Remember, progress may be gradual, and setbacks can occur, but with perseverance and commitment, financial freedom and a more balanced lifestyle are within reach. Embracing this journey not only improves financial well-being but also enhances overall mental and emotional health, paving the way for a more fulfilling and secure future.

To go further, please check our course The Digital Purge.Here is the trailer:

To Go Further

Take our 4-min test

How to help someone with spending addiction?

Helping someone with a spending addiction can be a delicate process, as it involves addressing both emotional and financial issues. Here are some steps you can take to support them:

- 1. Educate Yourself: Learn about spending addiction, also known as compulsive buying disorder. Understanding the psychological and emotional aspects can help you approach the issue with empathy.

- 2. Open a Dialogue: Initiate a conversation in a non-judgmental and supportive manner. Express your concerns about their spending habits and how it affects their well-being.