Welcome to our digital detoxing series! A series on how to stop addictions to Fortnite,Facebook,Instagram,porn,Netflix, Youtube,Tinder… Find all the posts about digital addiction. Today, let’s talk about how to quit the robinhood addiction.

- What’s the robinhood addiction?

- Addiction to robinhood, a “real” addiction?

- What’s considered robinhood addiction

- How much robinhood is too much?

- Some technology addiction facts & statistics

- Symptoms & Causes of the robinhood addiction

- Why is robinhood so addictive?

- Possible causes of robinhood dependency

- Symptoms, Causes and Signs of robinhood addiction

- Problems, impacts & bad effects of robinhood

- Some benefits of robinhood

- health problems

- impact on brain & mental health

- impact on relationships

- How to stop & quit your robinhood addiction

- Main steps and solutions to break the robinhood addiction

- Best robinhood blocker apps & functionalities

- where to seek extra help?

- Conclusion

- To Go Further

- How to help someone with robinhood addiction

- Best books about technology addiction

- Research about technology addiction

What is the robinhood addiction?

About robinhood

Robinhood is a commission-free stock trading app that allows users to buy and sell stocks, ETFs, and options without any fees or commissions.

Addiction to robinhood, a “real” addiction?

Officially an addiction?

First, let’s have a look to the DSM-5,the Diagnostic and Statistical Manual of Mental Disorders. Does it includes robinhood addiction?

No, Robinhood addiction is not listed in the DSM-5. The DSM-5 is the Diagnostic and Statistical Manual of Mental Disorders, which is the main reference used by mental health professionals to diagnose mental health disorders. While there is currently no specific diagnosis for Robinhood addiction, the behavior associated with excessive trading and investing can be indicative of other disorders, such as gambling disorder or obsessive-compulsive disorder.

So what means “robinhood addiction”?

Robinhood addiction refers to a compulsive and excessive use of the Robinhood trading app, which allows users to buy and sell stocks, cryptocurrencies, and other financial assets with ease. Individuals who become addicted to using Robinhood may spend hours each day monitoring their investments, checking stock prices, and making trades. This behavior can lead to financial losses, social isolation, and mental health issues such as anxiety and depression. Robinhood addiction can be particularly dangerous as it can lead to impulsive and risky investment decisions that can result in significant financial harm.

What is considered robinhood addiction?

Here are some potential signs or criteria that may indicate a possible addiction to the Robinhood trading app:

- 1. Obsessive use of the Robinhood app:Spending an excessive amount of time using the app, checking stock prices, and making trades.

- 2. Neglecting responsibilities:Prioritizing the app over daily responsibilities such as work, school, or family obligations.

- 3. Loss of control:Being unable to stop using the app or cutting back on trading despite negative consequences like financial losses or emotional distress.

- 4. Preoccupation with trading:Constantly thinking about the stock market, obsessively checking stock prices, and feeling anxious or restless when away from the app.

- 5. Financial problems:Gambling with money that cannot be afforded, borrowing money to continue trading, or neglecting bills and expenses to invest more money.

- 6. Withdrawal symptoms:Feeling anxious, irritable, or depressed when not using the app or unable to trade.

It’s important to note that addiction is a complex issue and should be diagnosed by a qualified healthcare professional. If you or someone you know is struggling with addiction, seeking professional help is recommended.

How much robinhood is too much?

If trading is interfering with daily responsibilities or causing financial stress, it may be time to reevaluate the amount of time spent on the app. It’s essential to maintain a healthy balance between trading and other important aspects of life, such as work, family, and personal well-being.

Some technology addiction facts & statistics

Technology addiction is a growing concern in today’s world. Here are some statistics related to technology addiction:

- 1. According to a 2019 survey by Common Sense Media,50% of teens feel addicted to their mobile devices.

- 2. A study conducted by the Pew Research Center found that 28% of adults in the US feel they are constantly online.

- 3. A survey conducted by the American Psychological Association found that 43% of Americans are constantly checking their electronic devices for email, texts, or social media updates.

- 4. A survey conducted by the Royal Society of Public Health in the UK found that social media is the most addictive technology,with 63% of respondents reporting that they check their social media accounts at least once a day.

- 5. In a study conducted by the University of Maryland,students were asked to give up all technology for 24 hours. Many of the participants experienced withdrawal symptoms such as anxiety, irritability, and even physical symptoms such as headaches.

- 6. A study conducted by the University of Gothenburg in Sweden found that excessive use of mobile phones can lead to sleep disorders,depression, and anxiety.

- 7. According to the World Health Organization,internet addiction disorder (IAD) is a real condition that can have serious negative consequences on an individual’s mental and physical health.

Is the robinhood addiction widespread?

There have been reports and concerns about the potential for addiction to trading apps and platforms like Robinhood, as they can provide a constant stream of market data and opportunities for trading. Addiction to trading can lead to financial problems, emotional distress, and other negative consequences. It is important for individuals to monitor their usage of these platforms and seek help if they feel they are developing an addiction.

Symptoms, Causes and Signs of robinhood addiction

Why is robinhood so addictive?

Robinhood is addictive for several reasons:

- 1. User-Friendly Interface: Robinhood has a user-friendly interface that is easy to navigate. The app makes it easy for users to buy and sell stocks, and it provides a clear and concise overview of their portfolio.

- 2. Free Trades:Robinhood offers free trades, which is a huge selling point for users. This makes it more accessible for people who may not have a lot of money to invest.

- 3. Gamification:Robinhood uses gamification techniques to make investing more engaging and fun. Users are rewarded for their activity and can earn badges and other incentives.

- 4. Social Features:Robinhood has a social aspect to it, allowing users to follow other investors and see what they are investing in. This creates a sense of community and encourages users to stay engaged with the app.

- 5. Immediate Gratification:Robinhood provides users with immediate feedback on their investments. Users can see their gains or losses in real-time, which can be addictive for some people.

Overall, the combination of a user-friendly interface, free trades, gamification, social features, and immediate gratification make Robinhood addictive for many users.

Possible causes of robinhood dependency

Robinhood addiction, also known as day trading addiction, can have various causes, including:

- 1. Dopamine rush:Day trading can provide a quick and intense dopamine rush, making it addictive for some people. The adrenaline rush from making a successful trade can trigger the reward system in the brain, leading to a cycle of seeking that feeling again and again.

- 2. Social and cultural factors:The rise of social media and the glamorization of day trading by influencers and celebrities can make it seem like an exciting and lucrative activity. This can lead to people feeling pressure to participate in day trading and feeling left out if they don’t.

- 3. Easy access:Online trading platforms like Robinhood have made trading more accessible than ever before. With just a few clicks, anyone can start trading from their phone. This ease of access can make it more tempting to engage in day trading.

- 4. Lack of knowledge:Many people may start trading without fully understanding the risks involved. They may not have a clear understanding of the market or the impact of economic events on their investments. This lack of knowledge can lead to poor decision-making and financial losses, which may further fuel the addiction.

It’s important to note that day trading addiction can have serious consequences, including financial ruin and mental health issues. Seeking professional help is essential for those struggling with this addiction.

Signs & Symptoms of robinhood addiction

Now let’s see if you have the robinhood addiction problem.

- 1. Checking the app multiple times a day:If you find yourself constantly refreshing the Robinhood app to check the stock prices and your portfolio, it could be a sign of addiction.

- 2. Obsessing over stock market news:If you find yourself constantly reading stock market news and obsessing over the latest trends, it could be a sign that you are addicted to Robinhood.

- 3. Spending more time trading than working:If you find yourself spending more time trading on Robinhood than working or taking care of your daily responsibilities, you may have a problem.

- 4. Constantly thinking about your portfolio:If you find yourself constantly thinking about your portfolio and how to make it grow, it could be a sign that you are addicted to Robinhood.

- 5. Taking unnecessary risks:If you find yourself taking unnecessary risks and making impulsive trades, it may be a sign of addiction to the Robinhood app.

- 6. Neglecting other aspects of your life:If you find yourself neglecting other aspects of your life, such as your relationships or hobbies, in favor of trading on Robinhood, it could be a sign of addiction.

- 7. Feeling anxious or stressed when you can’t access the app: If you feel anxious or stressed when you cannot access the Robinhood app, it could be a sign of addiction.

Problems, impacts & bad effects of robinhood: should you quit?

What are some benefits of robinhood

There are several pros and advantages of Robinhood that make it a popular choice among investors:

- 1. Commission-free trading: Robinhood allows users to trade stocks, ETFs, options, and cryptocurrencies without paying any commissions or fees.

- 2. User-friendly platform: Robinhood’s platform is intuitive and easy to use, making it accessible to beginner investors.

- 3. Fractional shares:Robinhood allows users to buy fractional shares, which means they can invest in expensive stocks without having to buy a full share.

- 4. Free stock for new users:Robinhood offers a free stock to new users who sign up for the platform.

- 5. No account minimum:Users can start investing with any amount of money, making it accessible to individuals with limited funds.

- 6. Advanced trading features:Robinhood offers advanced trading features, such as options trading, which makes it appealing to more experienced investors.

Overall, Robinhood’s commission-free trading, user-friendly platform, and advanced trading features make it a great option for investors of all levels.But at the opposite, what can be some robinhood addiction problems addicts suffer from?

general health problems

We can provide general information on how using Robinhood may affect one’s health:

Using Robinhood may have both positive and negative effects on one’s health. On the positive side, it can help individuals to learn about investing and potentially improve their financial well-being, leading to reduced stress and anxiety related to money management.

However, excessive use of Robinhood or other investment apps can lead to addiction and compulsive behavior, which can adversely affect mental health. It may also lead to financial stress and loss of money, which can cause anxiety and depression.

Additionally, staring at a screen for extended periods of time can cause eye strain, headaches, and neck pain. Poor posture, lack of physical activity or movement, and prolonged sitting can also lead to musculoskeletal problems such as back pain, neck pain, and carpal tunnel syndrome.

Overall, it is important to use Robinhood and other investment apps in moderation, take breaks, maintain good posture, and engage in physical activity to minimize any negative effects on health. It is also important to seek help if one experiences any negative mental health symptoms related to investing.

robinhood and sleep disorder

There is no evidence to suggest that Robinhood or any other stock trading app can directly cause sleep disorders or sleep problems. However, excessive use or obsession with trading can lead to stress and anxiety, which can in turn affect sleep patterns.

Additionally, if someone spends a significant amount of time trading late at night or early in the morning, it can disrupt their sleep schedule and lead to sleep deprivation. It is important to maintain a healthy balance between trading and restful sleep to avoid any negative effects on mental and physical health.

robinhood affecting your brain & mental health: bad for brain and mental health?

Some effects of robinhood on your brain

We can provide information on the potential negative effects of the Robinhood app on the human brain.

- 1. Addiction:The Robinhood app is designed to be easy to use, and it can quickly become addictive to check your investments and make trades. This constant need for stimulation can lead to addiction-like behavior and can take a toll on your brain.

- 2. Impulsive behavior:Robinhood’s user interface encourages impulsive behavior, such as buying and selling stocks quickly without much research or thought. This can lead to poor financial decisions and loss of money.

- 3. Stress and anxiety:The stock market can be unpredictable, and the constant ups and downs can cause stress and anxiety. This can be amplified by the ease of access to the Robinhood app, making it easy to obsess over your investments.

- 4. Overconfidence:Robinhood can give users a false sense of confidence in their ability to make smart financial decisions. This can lead to overconfidence, which can be dangerous when it comes to investing.

- 5. Risky behavior:The app’s gamification features, such as confetti when a trade is made or ranking users against each other, can encourage risky behavior. This can lead to users taking unnecessary risks with their investments.

It’s important to be aware of these potential negative effects and to use the Robinhood app responsibly. It’s always a good idea to do your research and consult with a financial advisor before making any significant investments.

Some effects of robinhood on your mental health

- 1. Addiction:Robinhood can be addictive due to its easy-to-use interface and the thrill of investing in the stock market. This can lead to compulsive behavior and obsession with checking stock prices, causing anxiety and stress.

- 2. Fear of Missing Out (FOMO): Robinhood’s social media-like features, such as news feeds and notifications of other users’ trades, can create a fear of missing out on opportunities. This can lead to impulsive decisions and anxiety about making the wrong investment choices.

- 3. Loss Aversion:Robinhood’s focus on short-term gains and losses can create a loss aversion mindset, where investors become overly risk-averse and panic when they see losses. This can lead to anxiety and stress, as well as poor decision-making.

- 4. Information Overload:Robinhood provides investors with a wealth of information, including real-time stock prices, news feeds, and market analysis. This can be overwhelming and lead to decision paralysis and anxiety about making the wrong investment choices.

- 5. Financial Pressure:Robinhood’s focus on short-term gains and the potential for quick profits can create pressure to constantly check investments and make trades. This can lead to financial stress and anxiety, as well as poor decision-making.

Does robinhood cause stress and anxiety?

Yes, Robinhood trading platform can potentially cause stress or anxiety for some people. The fast-paced nature of trading and the potential for significant financial losses can be overwhelming for some users.

Additionally, the constant monitoring of stock prices and making quick decisions can be stressful for those who may not have extensive trading experience. It is important for users to be aware of their own limits and take breaks when necessary to avoid burnout or anxiety.

Can robinhood addiction lead to sadness and depression?

Yes, it is possible for Robinhood addiction to lead to sadness and depression. Addiction to trading or investing can cause individuals to become overly focused on their portfolio and the stock market, leading to feelings of anxiety, stress, and a sense of being out of control. This can lead to negative impacts on mental health, including depression, irritability, and social isolation.

Additionally, if the individual experiences financial losses or fails to meet their investment goals, it can further exacerbate these negative feelings. It is important to seek help if you are experiencing symptoms of addiction or depression related to Robinhood or any other investment platform.

Dopamine and robinhood

Dopamine is a neurotransmitter in the brain that is associated with pleasure, motivation, and reward. It is released when we experience something pleasurable, such as when we eat something delicious or when we achieve a goal. Dopamine is also released in response to certain drugs, such as cocaine and amphetamines, which can create a powerful feeling of pleasure and reward.

Robinhood is a popular investment app that allows users to buy and sell stocks, options, and other investments with no commission fees. The app has gained a lot of attention in recent years, particularly among younger investors who are drawn to its user-friendly interface and low barriers to entry.

There has been some concern that using Robinhood, and other similar investment apps, can create a dopamine feedback loop. When users make a successful trade, they receive a burst of dopamine, which can make them feel good and motivate them to continue trading. This can lead to overtrading and taking unnecessary risks in the pursuit of that dopamine rush.

Additionally, some critics have argued that Robinhood’s gamification of investing, such as its use of confetti animations and push notifications celebrating successful trades, can further reinforce this dopamine feedback loop and encourage users to make impulsive decisions.

Overall, while dopamine is a natural and important part of our brain chemistry, it is important to be aware of how it can influence our behavior and decision-making, particularly when it comes to investing.

robinhood effects on Focus, productivity, attention span, academic performance…

There is no definitive answer to this question, as the impact of Robinhood on focus, productivity, attention span, and academic performance may vary depending on a variety of factors, including the individual’s personal characteristics, their level of engagement with the platform, and their overall lifestyle and habits.

Some people argue that Robinhood can be a source of distraction, as it allows users to easily access and trade stocks and other financial instruments from their mobile devices. This can potentially lead to a decrease in focus and productivity, especially if users spend too much time tracking their investments or engaging in day trading activities.

However, others argue that Robinhood can actually have a positive impact on academic performance and financial literacy, as it provides users with a convenient and accessible way to learn about the stock market and invest in their future.

Additionally, some users may find that the sense of control and empowerment they gain from managing their own investments motivates them to work harder and stay focused on their academic goals.

Ultimately, the impact of Robinhood on focus, productivity, attention span, and academic performance will depend on a variety of individual factors, and users should approach the platform with caution and balance their investment activities with other important aspects of their lives.

A word about ADHD and robinhood

Individuals with ADHD may have difficulty with impulse control and may struggle with delayed gratification, which could lead to impulsive financial decisions, including day trading or making impulsive investments without fully researching or understanding the risks involved.

Additionally, individuals with ADHD may have difficulty with organization and planning, which could make it challenging to develop and stick to a long-term investment strategy.

However, it’s important to note that ADHD affects each individual differently, and not all individuals with ADHD will have the same challenges with financial decision-making. It’s essential for individuals with ADHD to work with a financial advisor or seek out resources that can help them develop effective strategies for managing their finances.

affecting your relationships

robinhood and self-esteem

The impact of Robinhood on an individual’s self-esteem can vary depending on their experience with the platform. For some users, the ability to invest and potentially make money can boost their confidence and self-esteem. They may feel empowered and in control of their financial future.

On the other hand, if someone experiences losses or makes poor investment decisions on Robinhood, it can negatively impact their self-esteem. They may feel embarrassed or ashamed about their financial decisions and may question their abilities to manage their finances effectively.

Additionally, social comparison can play a role in self-esteem. If someone sees others on Robinhood making significant gains, they may feel inadequate or like they are not measuring up. This can further damage their self-esteem.

Overall, the impact of Robinhood on self-esteem is complex and can depend on a variety of factors, including an individual’s investment experience, financial knowledge, and ability to manage risk.

robinhood addiction leads to isolation and loneliness?

.jpg)

Yes, it is possible for Robinhood addiction to lead to isolation and loneliness. Addiction to any activity or substance can lead to neglect of social relationships and responsibilities, which can result in feelings of loneliness and isolation. If a person spends excessive amounts of time on Robinhood, they may neglect other important activities or relationships in their life, leading to social withdrawal and feelings of loneliness.

Additionally, the addictive nature of Robinhood can lead to compulsive behaviors and a lack of control, which can further exacerbate feelings of isolation and loneliness. It is important for individuals who are struggling with addiction to seek help and support from loved ones and professionals to prevent negative consequences such as loneliness and isolation.

Effects of robinhood on your relationship

Positive effects:

- 1. Financial independence:If Robinhood helps a person to invest and make money, they may feel more financially independent, which can lead to a healthier relationship dynamic.

- 2. Shared interest:If both partners are interested in investing, Robinhood can be a shared hobby that brings them closer together.

- 3. Increased communication:Discussing investments and trading strategies can lead to increased communication and deeper conversations about money and financial goals.

Negative effects:

- 1. Addiction:Robinhood can be addictive, which can lead to neglecting other aspects of life, including relationships.

- 2. Financial stress:If a person experiences financial losses through Robinhood, it can lead to financial stress and strain on the relationship.

- 3. Different investment strategies:If partners have different investment strategies, it can lead to disagreements and conflict.

How To Stop & quit Your robinhood Addiction

Finally you think you are addicted to robinhood and you are wondering how to quit it? How to break and overcome your cravings for robinhood?

Here are the best solutions, steps, supports, resources and help you can get to treat your robinhood addiction.

Main steps and solutions to break the robinhood addiction

- 1. Recognize that you have an addiction:The first step to overcoming any addiction is to acknowledge that you have a problem.

- 2. Seek professional help:Addiction can be challenging to overcome on your own. Consider seeking the help of a mental health professional or addiction specialist who can provide you with the tools and support you need to overcome your addiction.

- 3. Set realistic goals:Set realistic goals for yourself and stick to them. For example, you may want to limit the amount of time you spend on Robinhood or limit the number of trades you make per day.

- 4. Find healthier activities:Find healthier activities to replace the time you spend on the Robinhood app. Consider taking up a new hobby, exercising, or spending time with friends and family.

- 5. Stay accountable:Stay accountable to yourself and others. Consider joining a support group or sharing your progress with a trusted friend or family member.

- 6. Practice self-care: Take care of yourself physically, mentally, and emotionally. This can include getting enough sleep, eating a healthy diet, and practicing mindfulness or meditation.

Remember that overcoming an addiction takes time and effort, and it’s okay to ask for help. With the right support and resources, it’s possible to overcome a Robinhood addiction and regain control of your life.Actually, that’s what most documentation out there is about… However, quitting a digital addiction can be a bit trickier than that.

So our team, after testing many ways, designed a bulletproof way to overcome them. Here are some clear and practical steps that are very powerful to quit a digital addiction, including robinhood:

1. Purge temptations: Get rid of robinhood

First, cleaning your life from temptations is much easier than resisting to them. Disable or delete your robinhood accounts, change the password and hide it somewhere you can’t access easily, keep your phone / computer far away… Out of sight out of mind.

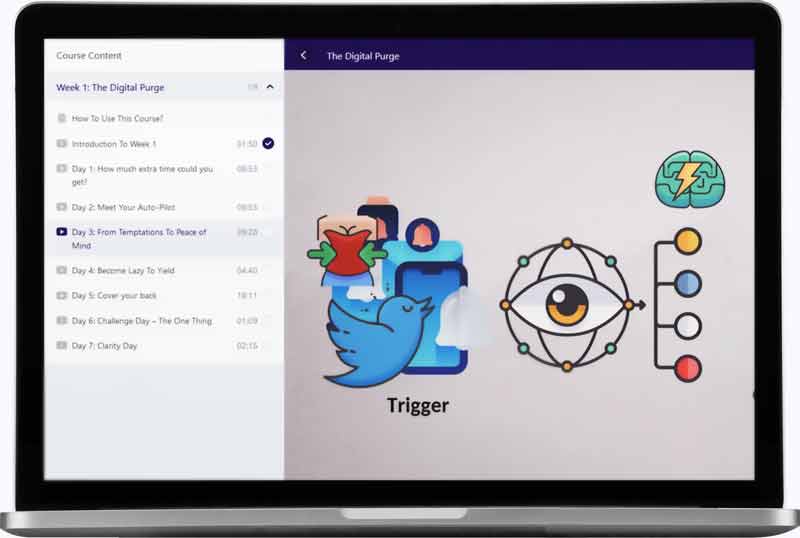

Here is a video from our course the The Digital Purge. on how to add resistance to your temptations, so you become so lazy to engage with them that you give them up: