Welcome to our digital detoxing series! A series on how to stop addictions to Fortnite,Facebook,Instagram,porn,Netflix, Youtube,Tinder… Find all the posts about digital addiction. Today, let’s talk about how to quit the forex addiction.

- What’s the forex addiction?

- Addiction to forex, a “real” addiction?

- What’s considered forex addiction

- How much forex is too much?

- Some technology addiction facts & statistics

- Symptoms & Causes of the forex addiction

- Why is forex so addictive?

- Possible causes of forex dependency

- Symptoms, Causes and Signs of forex addiction

- Problems, impacts & bad effects of forex

- Some benefits of forex

- health problems

- impact on brain & mental health

- impact on relationships

- How to stop & quit your forex addiction

- Main steps and solutions to break the forex addiction

- Best forex blocker apps & functionalities

- where to seek extra help?

- Conclusion

- To Go Further

- How to help someone with forex addiction

- Best books about technology addiction

- Research about technology addiction

What is the forex addiction?

About forex

Forex is the market where currencies are traded. It is the largest and most liquid financial market in the world.

Addiction to forex, a “real” addiction?

Officially an addiction?

First, let’s have a look to the DSM-5,the Diagnostic and Statistical Manual of Mental Disorders. Does it includes forex addiction?

No, forex addiction is not listed in the DSM-5.

So what means “forex addiction”?

Forex addiction is a form of gambling addiction caused by an obsession with trading foreign currencies on the foreign exchange market (Forex). It is characterized by an inability to resist the urge to make multiple trades, usually with high amounts of leverage, in the hopes of quick returns. People who suffer from forex addiction often experience a heightened sense of euphoria when trading and are unable to resist the urge to continue trading despite losses.

Additionally, those addicted to forex may experience financial losses due to their inability to stop trading and their unwillingness to take a break from the market.

What is considered forex addiction?

- 1. You find yourself spending more and more time trading or researching the forex market.

- 2. You feel an urge to make more trades,even though you know the risks.

- 3. You start to ignore the risks associated with trading and focus solely on potential profits.

- 4. You become obsessed with watching the ticker and tracking price movements.

- 5. Your trading decisions become emotional rather than logical.

- 6. You start to neglect other areas of your life,such as family, friends, and work.

- 7. You find yourself trading outside of your normal risk tolerance.

- 8. You experience withdrawal symptoms when you cannot access the forex market.

- 9. You experience financial losses due to excessive trading.

- 10. You experience stress or anxiety due to trading.

How much forex is too much?

This is completely subjective and depends on the individual trader. If you find that you are spending too much time thinking and worrying about the markets, then it may be time to step back and reassess your trading strategy. Ultimately, the best way to decide how much time to spend on forex trading is to assess how much time you can realistically spend, and then try to stick to that amount.

Some technology addiction facts & statistics

Technology addiction is a growing concern in today’s world. Here are some statistics related to technology addiction:

- 1. According to a 2019 survey by Common Sense Media,50% of teens feel addicted to their mobile devices.

- 2. A study conducted by the Pew Research Center found that 28% of adults in the US feel they are constantly online.

- 3. A survey conducted by the American Psychological Association found that 43% of Americans are constantly checking their electronic devices for email, texts, or social media updates.

- 4. A survey conducted by the Royal Society of Public Health in the UK found that social media is the most addictive technology,with 63% of respondents reporting that they check their social media accounts at least once a day.

- 5. In a study conducted by the University of Maryland,students were asked to give up all technology for 24 hours. Many of the participants experienced withdrawal symptoms such as anxiety, irritability, and even physical symptoms such as headaches.

- 6. A study conducted by the University of Gothenburg in Sweden found that excessive use of mobile phones can lead to sleep disorders,depression, and anxiety.

- 7. According to the World Health Organization,internet addiction disorder (IAD) is a real condition that can have serious negative consequences on an individual’s mental and physical health.

Is the forex addiction widespread?

Like any form of trading or gambling, it is possible for individuals to become addicted to the emotional highs and lows of the market, leading to compulsive and risky behavior. It is important for traders to maintain discipline and manage their emotions while engaging in forex trading.

Symptoms, Causes and Signs of forex addiction

Why is forex so addictive?

Forex is so addictive because it can provide traders with great potential for financial gain and exciting, fast-paced trading. It is also accessible to traders of all levels, from beginners to experienced professionals. The markets always move quickly and there is always something new to learn, which keeps the traders engaged and wanting to trade more. The potential to make money quickly and the ever-changing nature of the markets can create an addictive environment for traders.

Possible causes of forex dependency

- 1. Greed:The desire to make large profits from small investments can lead to excessive and risky trading.

- 2. Lack of Knowledge:Trading without understanding the markets and the risks involved can lead to losses and an addiction to trading.

- 3. Poor Risk Management:A lack of risk management can lead to an addiction to trading as losses can mount quickly.

- 4. Lack of Discipline:Trading without following a plan or taking regular breaks can lead to an addiction.

- 5. Trading to Escape:Some people may trade forex as a way to escape from their problems or to try to forget their worries.

- 6. Excessive Leverage:Using too much leverage can lead to large losses and an addiction to trading.

- 7. Market Manipulation:Some traders may manipulate the market in order to make large profits, which can lead to an addiction.

Signs & Symptoms of forex addiction

Now let’s see if you have the forex addiction problem.

- 1. You check the markets every chance you get.

- 2. You spend hours watching charts and analyzing news.

- 3. You’re always talking about the latest market trends.

- 4. You have multiple accounts and are always trying to find the best trade.

- 5. You find yourself counting pips in your sleep.

- 6. You’re constantly looking for an edge in the markets.

- 7. You know the forex market like the back of your hand.

Problems, impacts & bad effects of forex: should you quit?

What are some benefits of forex

Pros:

- 1. High Liquidity – Forex markets are widely known for their high liquidity, which means that traders can enter and exit a position at any time during trading hours. This means that they can take advantage of short-term market movements and maximize their profits.

- 2. Low Transaction Costs – Forex trading is relatively inexpensive compared to other financial markets. Transaction costs are low because the market is over-the-counter, meaning it is not regulated by any single authority or exchange.

- 3. Leverage – Forex brokers provide traders with leverage, allowing them to trade with more money than they have in their trading accounts. This increases their buying power and helps them to make larger profits. However, leverage can also increase losses if the market moves against them.

- 4. Variety of Instruments – Forex traders have access to a wide variety of currency pairs, commodities, indices, and stocks. This means that traders can diversify their portfolios to reduce risk and take advantage of global market movements.

- 5. Accessibility – Forex markets are open 24 hours a day, five days a week, so traders can take advantage of any market movements at any time. This makes it easy for traders to act quickly and capitalize on opportunities as they arise.

But at the opposite, what can be some forex addiction problems addicts suffer from?

general health problems

- 1. Stress:Forex trading is a risky and stressful activity. It can cause increased levels of stress and anxiety, leading to physical and mental health issues.

- 2. Lack of Sleep:When you are trading on the foreign exchange market, you may have difficulty sleeping due to the constant vigilance needed to spot trends and capitalize on them.

- 3. Fatigue:Spending extended periods of time in front of the computer can lead to fatigue and exhaustion, which can have an effect on your overall health and wellbeing.

- 4. Poor Diet:When trading, it is easy to become so focused on the task at hand that you forget to take care of yourself and your diet. Poor nutrition can lead to a weakened immune system and other health issues.

forex and sleep disorder

Forex trading itself cannot create sleep disorders or sleep problems. However, the stress and emotions associated with trading can lead to sleep disturbances. Forex trading can be a high-stress activity, with frequent fluctuations in the market and the potential for large financial losses. This stress can lead to difficulty falling or staying asleep, as well as other sleep disorders such as insomnia or sleep apnea.

Additionally, trading at night or during odd hours can disrupt the body’s natural circadian rhythm, further contributing to sleep problems. It is important for traders to manage stress and prioritize healthy sleep habits to prevent sleep disorders from developing.

forex affecting your brain & mental health: bad for brain and mental health?

Some effects of forex on your brain

- 1. Stress:Forex trading can become highly stressful, especially when traders become too attached to their investments. This can lead to increased levels of anxiety, depression, and even cognitive impairment.

- 2. Risk of Loss:Forex trading involves a high degree of risk, which can result in substantial losses for investors who are not well informed or experienced.

- 3. Cognitive Overload:As the forex market is constantly changing, traders must constantly monitor and adjust their trading strategies. This can lead to cognitive overload, which can negatively impact decision-making and impair judgment.

- 4. Poor Decision-Making: Without proper knowledge and experience, traders may make hasty decisions that can lead to losses. Poor decision-making can lead to further losses and an inability to recover.

Some effects of forex on your mental health

- 1. Stress:Trading in the Forex market can be an extremely stressful experience. Market volatility, financial losses, and the fast-paced nature of trading can cause anxiety and lead to mental health issues such as depression and burnout.

- 2. Impulsive Behaviour:The pressure to make quick decisions in a fast-paced environment can lead to impulsive behavior, which can result in costly trading mistakes.

- 3. Loss of Objectivity:It can be difficult to remain objective when trading in the Forex market. Overconfidence, fear, and other emotions can cloud judgment and lead to bad decisions.

- 4. Addiction:Trading in the Forex market can become addictive, especially if traders are not using sound money management techniques. This can lead to overtrading and trading on impulse, which can result in large losses.

Does forex cause stress and anxiety?

Yes, forex trading can potentially cause stress and anxiety for some traders. Forex trading involves significant risk and uncertainty, and traders are constantly making decisions based on changing market conditions. This pressure can lead to feelings of stress and anxiety, especially when traders are dealing with large sums of money.

Additionally, traders may experience fear of missing out (FOMO), fear of loss, and other emotional responses that can negatively impact their decision-making abilities. It is important for traders to manage their emotions and use effective risk management strategies to minimize the potential for stress and anxiety.

Can forex addiction lead to sadness and depression?

Yes, forex addiction can lead to sadness and depression. Forex addiction is a type of behavioral addiction that can lead to excessive and compulsive trading, leading to a loss of control over one’s actions and negative consequences. When traders experience losses, they may feel a sense of hopelessness, frustration, and despair, leading to feelings of sadness and depression.

Additionally, forex addiction can cause individuals to neglect their personal and social lives, leading to feelings of isolation and loneliness, which can also contribute to depression. It is important to seek professional help if you or someone you know is struggling with forex addiction and experiencing negative emotional effects.

Dopamine and forex

Dopamine is a neurotransmitter that plays a crucial role in the brain’s reward system. It is often associated with feelings of pleasure, motivation, and satisfaction. In the context of forex trading, dopamine can have a significant impact on a trader’s behavior and decision-making.

When traders are successful in making profitable trades, dopamine is released in the brain, which can lead to feelings of happiness and satisfaction. This can create a positive feedback loop, where traders become more motivated to continue trading and taking risks in order to experience that same feeling of pleasure again.

However, this can also be dangerous, as traders may become addicted to the thrill of trading and take on unnecessary risks in order to chase that feeling of reward. This can lead to impulsive decision-making and poor risk management, which can ultimately lead to significant losses.

Therefore, it is important for traders to be aware of the role of dopamine in their trading behavior and to practice discipline and risk management in order to avoid falling into the trap of addiction and impulsive decision-making.

forex effects on Focus, productivity, attention span, academic performance…

Forex trading can potentially affect focus, productivity, attention span, and academic performance if an individual becomes too consumed with trading activities and neglects other important aspects of their life such as work, study, and personal relationships.

If an individual spends too much time and energy monitoring the forex market, they may become distracted and lose focus on their other responsibilities. This can lead to decreased productivity and a shorter attention span, making it harder to complete tasks efficiently and effectively.

Additionally, if an individual becomes too emotionally invested in their forex trades, they may experience stress and anxiety, which can negatively impact their academic performance. Stress and anxiety can lead to decreased concentration, memory problems, and difficulty retaining information, all of which can affect academic success.

Overall, while forex trading can be a profitable and exciting activity, it is important to maintain a healthy balance and prioritize other important aspects of life to avoid negative effects on focus, productivity, attention span, and academic performance.

A word about ADHD and forex

People with ADHD may interact differently with forex trading compared to individuals without ADHD. ADHD can affect an individual’s attention span, impulsivity, and decision-making abilities, which can impact their trading decisions. For instance, individuals with ADHD may struggle to maintain focus for extended periods, leading to impulsive trades or missing critical market movements.

However, some individuals with ADHD may thrive in the fast-paced and highly stimulating forex trading environment. They may be able to leverage their hyperfocus and creativity to identify unique market opportunities and develop innovative trading strategies.

It is essential to note that every individual with ADHD is unique, and the impact of ADHD on their forex trading may vary. Suppose you have ADHD and are interested in forex trading. In that case, it is crucial to seek professional guidance and develop strategies that work for you to manage any symptoms that may impact your trading decisions.

affecting your relationships

forex and self-esteem

Forex trading can have both positive and negative effects on self-esteem. Here are some ways how forex affects self-esteem:

Positive effects:

– Success in forex trading can increase self-esteem as it provides a sense of accomplishment and pride.

– Making profitable trades can lead to a feeling of competence and confidence in one’s abilities.

– Being able to manage one’s emotions and handle stress while trading can also boost self-esteem.

Negative effects:

– Losing money in forex trading can lead to a decrease in self-esteem as it can make one feel incompetent or inadequate.

– Making poor trading decisions or failing to follow one’s trading plan can also lead to feelings of self-doubt and low self-esteem.

– Comparing oneself to other successful traders can also cause a decrease in self-esteem if one feels they are not measuring up.

Overall, it is important for traders to maintain a healthy perspective and not let their self-esteem be solely determined by their success or failures in forex trading. It is important to remember that trading is a learning process and mistakes can be valuable lessons for growth and improvement.

forex addiction leads to isolation and loneliness?

.jpg)

Yes, forex addiction can potentially lead to isolation and loneliness. This is because forex addiction can cause individuals to become so consumed with trading and monitoring the market that they may neglect other areas of their life, such as socializing and maintaining relationships. They may also spend long periods of time alone, staring at a computer screen, and become disconnected from their social support networks.

Additionally, if the individual experiences financial losses due to forex trading, they may feel embarrassed or ashamed to reach out to others for support, further contributing to their isolation and loneliness. It is important for individuals to maintain a healthy balance between their forex trading activities and their social and emotional well-being.

Effects of forex on your relationship

Positive effects of forex on your relationship:

- 1. Increased Financial Stability:Forex trading can provide a steady source of income that can improve your financial stability and reduce stress in your relationship.

- 2. Shared Goals:Forex trading can help you and your partner work towards shared financial goals, which can strengthen your relationship.

- 3. Improved Communication:Trading forex requires constant communication, which can improve your communication skills with your partner.

- 4. Increased Knowledge:Trading forex can help you and your partner learn more about the markets and economic trends, which can be beneficial in making informed financial decisions.

Negative effects of forex on your relationship:

- 1. Time Consuming:Trading forex requires a lot of time and attention, which can take away from the time you spend with your partner.

- 2. Financial Risk:Forex trading involves financial risk, which can put a strain on your relationship if you experience significant losses.

- 3. Stressful:Trading forex can be stressful and emotionally draining, which can lead to tension in your relationship.

- 4. Addiction:Forex trading can become addictive, which can lead to neglecting your relationship and other important aspects of your life.

How To Stop & quit Your forex Addiction

Finally you think you are addicted to forex and you are wondering how to quit it? How to break and overcome your cravings for forex?

Here are the best solutions, steps, supports, resources and help you can get to treat your forex addiction.

Main steps and solutions to break the forex addiction

- 1. Acknowledge the Problem:The first step to overcoming forex addiction is to admit that there is a problem. Acknowledge the fact that you are trading too much and that it is having a negative impact on your life.

- 2. Set Boundaries:Once you have acknowledged the problem, it is important to set boundaries for yourself. Decide ahead of time how much time and money you are willing to spend on trading. Set a daily or weekly limit for yourself and stick to it.

- 3. Take a Break:Taking a break from trading can help you to gain perspective on the situation. Take a few days off from trading and focus on other activities.

- 4. Seek Professional Help:If you find that you are unable to control your trading, it may be time to seek professional help. A therapist or support group can help you to manage your addiction and get your life back on track.

- 5. Find New Hobbies:Once you have taken a break from trading, it is important to find new hobbies and activities to occupy your time. Find something that you enjoy doing and focus on that instead of trading.

Actually, that’s what most documentation out there is about… However, quitting a digital addiction can be a bit trickier than that.

So our team, after testing many ways, designed a bulletproof way to overcome them. Here are some clear and practical steps that are very powerful to quit a digital addiction, including forex:

1. Purge temptations: Get rid of forex

First, cleaning your life from temptations is much easier than resisting to them. Disable or delete your forex accounts, change the password and hide it somewhere you can’t access easily, keep your phone / computer far away… Out of sight out of mind.

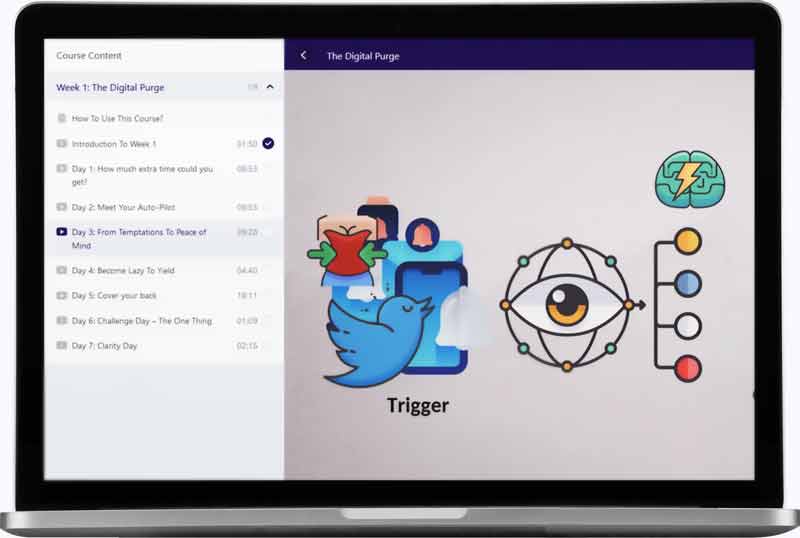

Here is a video from our course the The Digital Purge. on how to add resistance to your temptations, so you become so lazy to engage with them that you give them up: