Trying to quit crypto addiction? Welcome to our digital detox series! This series focuses on how to stop digital and screen addictions. Findall our posts about digital addictions. Today, let’s talk about how to quit the crypto addiction.

- What’s the crypto addiction?

- Addiction to crypto, a “real” addiction?

- What’s considered crypto addiction?

- How much crypto is too much?

- Some technology addiction facts & statistics

- Symptoms & Causes of the crypto addiction

- Why is crypto so addictive?

- Possible causes of crypto dependency

- Symptoms, Causes, and Signs of crypto addiction

- Problems, impacts & bad effects of crypto

- Some benefits of crypto

- Health problems

- Impact on brain & mental health

- Impact on relationships

- How to stop & quit your crypto addiction

- Main steps and solutions to break the crypto addiction

- Best crypto blocker apps & functionalities

- Where to seek extra help?

- Conclusion

- To Go Further

- How to help someone with crypto addiction

- Best books about technology addiction

- Research about technology addiction

What is the crypto addiction?

About crypto

Cryptocurrency is a digital or virtual form of currency that uses cryptography for security. It operates on decentralized networks based on blockchain technology, enabling secure, transparent, and immutable transactions without the need for intermediaries like banks.

Addiction to crypto, a “real” addiction?

Officially an addiction?

First, let’s have a look at the DSM-5,the Diagnostic and Statistical Manual of Mental Disorders. Does it include crypto addiction?

As of my last update, the DSM-5 (Diagnostic and Statistical Manual of Mental Disorders, Fifth Edition) does not specifically list “crypto addiction” as a recognized disorder. The DSM-5 is a publication by the American Psychiatric Association that categorizes and defines mental health disorders. While it includes criteria for various addictive behaviors, such as gambling disorder, it does not have a separate entry for addiction to cryptocurrencies or trading them.

However, behaviors related to excessive cryptocurrency trading could potentially be categorized under broader behavioral addiction frameworks, similar to gambling disorder. Mental health professionals might assess such behaviors using criteria for gambling disorder or other impulse-control disorders, focusing on the impact on an individual’s life, such as financial distress, relationship issues, or neglect of responsibilities.

It’s important to note that the understanding and classification of behavioral addictions are evolving, and future editions of the DSM may address new types of addictive behaviors as more research becomes available. If you or someone you know is struggling with behaviors related to cryptocurrency trading, consulting a mental health professional can provide guidance and support tailored to the specific situation.

So what does “crypto addiction” mean?

What is Crypto Addiction?

Crypto addiction refers to the compulsive and excessive behavior related to buying, trading, or obsessively following cryptocurrencies like Bitcoin, Ethereum, and others. Just like other forms of addiction, it can negatively impact a person’s daily life, relationships, and financial well-being. Here are some key aspects of crypto addiction:

- 1. Constant Monitoring: Feeling the need to constantly check cryptocurrency prices, market trends, and news updates, even during work or social activities.

- 2. Impulsive Investments: Making hasty investment decisions without proper research or consideration, often driven by the fear of missing out (FOMO).

- 3. Financial Strain: Spending more money than intended on buying cryptocurrencies, leading to financial stress or debt.

- 4. Neglecting Responsibilities: Prioritizing crypto activities over important tasks, work, or personal relationships.

- 5. Emotional Rollercoaster: Experiencing extreme emotions like euphoria when prices rise and anxiety or depression when they fall.

- 6. Difficulty Stopping: Struggling to reduce or control cryptocurrency-related activities despite recognizing the negative consequences.

If you or someone you know is showing signs of crypto addiction, it might be helpful to seek support from a mental health professional or join a support group to regain a healthy balance with cryptocurrency activities.

What is considered crypto addiction?

Diagnosing a crypto addiction, much like diagnosing other behavioral addictions, involves identifying patterns of behavior that indicate a problematic relationship with cryptocurrency trading or investing. While cryptocurrency addiction is not formally recognized in diagnostic manuals like the DSM-5, mental health professionals often draw parallels with gambling addiction to identify potential cases. Here are some criteria that might be considered when diagnosing a crypto addiction:

- 1. Preoccupation with Cryptocurrency: Constantly thinking about cryptocurrency, planning the next trading session, or anticipating the next market move. This preoccupation often dominates thoughts and conversations.

- 2. Loss of Control: Inability to control, cut back, or stop cryptocurrency trading despite repeated attempts and a desire to do so.

- 3. Tolerance: Needing to invest increasing amounts of money in cryptocurrency to achieve the desired excitement or financial gain.

- 4. Withdrawal Symptoms: Experiencing restlessness, irritability, or other negative emotions when unable to trade or monitor cryptocurrency markets.

- 5. Chasing Losses: Continuously investing more money to try and recover losses incurred in previous trading activities.

- 6. Neglecting Responsibilities: Ignoring work, educational, or family responsibilities due to time spent trading or thinking about cryptocurrency.

- 7. Relationship Problems: Experiencing conflicts or deterioration in relationships due to the time and resources devoted to cryptocurrency activities.

- 8. Deceptive Behavior: Lying to family members, therapists, or others to conceal the extent of involvement with cryptocurrency.

- 9. Financial Problems: Experiencing significant financial issues as a result of cryptocurrency trading, including borrowing money or selling possessions to fund trading activities.

- 10. Escapism: Using cryptocurrency trading as a way to escape from problems or to relieve feelings of helplessness, guilt, anxiety, or depression.

- 11. Failed Attempts to Stop: Repeated unsuccessful efforts to reduce or stop cryptocurrency trading.

- 12. Impact on Mental Health: Experiencing increased anxiety, depression, or stress as a result of cryptocurrency trading activities.

Diagnosis should be conducted by a qualified mental health professional who can assess the severity and impact of these behaviors on an individual’s life. Treatment options may include cognitive-behavioral therapy, support groups, and, in some cases, medication to address underlying mental health issues.

How much crypto is too much?

Determining how much time spent on cryptocurrency activities is too much can vary greatly depending on individual circumstances, goals, and responsibilities. However, there are several factors to consider that can help gauge whether the time spent is excessive:

- 1. Impact on Responsibilities: If time spent on cryptocurrency activities is interfering with work, family responsibilities, or other important obligations, it might be excessive. Balancing these aspects is crucial to maintaining a healthy lifestyle.

- 2. Mental Health: Constant engagement with crypto markets, especially due to their volatility, can lead to stress and anxiety. If you find yourself feeling overwhelmed or anxious due to market fluctuations or investment decisions, it might be time to reassess your involvement.

- 3. Social Life: If your social interactions and relationships are being neglected because of your focus on cryptocurrencies, it may be a sign that you’re spending too much time on it.

- 4. Financial Health: Spending excessive time on crypto can sometimes lead to impulsive financial decisions. If you notice that your financial health is suffering due to frequent trading or over-investment, it may be time to step back.

- 5. Sleep and Physical Health: If your sleep patterns or physical health are being disrupted because you’re staying up late to monitor markets or neglecting exercise and nutrition, this could be a sign of excessive involvement.

- 6. Opportunity Cost: Consider what other productive activities you might be missing out on. If cryptocurrency activities are taking time away from personal development, education, or other hobbies, it might be worth reassessing your time allocation.

- 7. Addictive Behavior: If you find it difficult to step away from crypto-related activities or feel compelled to constantly check prices and news, this might indicate an unhealthy level of engagement.

Ultimately, moderation and balance are key. Setting specific time limits for crypto activities, maintaining a diversified set of interests, and ensuring that your involvement aligns with your broader life goals can help maintain a healthy relationship with cryptocurrency. If you’re unsure about your level of involvement, seeking advice from a mental health professional or financial advisor may provide additional guidance.

Some technology addiction facts & statistics

Technology addiction, often referred to as digital addiction or internet addiction, has become an increasingly prevalent issue in our modern society. As technology continues to evolve and integrate into daily life, understanding the statistics surrounding this phenomenon is crucial. Here are some key statistics and insights related to technology addiction:

1. Prevalence of Internet Addiction:

– Studies suggest that approximately 6% to 10% of internet users globally may be affected by internet addiction. This percentage can vary significantly depending on the region and the criteria used for diagnosis.

2. Smartphone Addiction:

– A survey conducted by Pew Research Center found that about 81% of Americans own a smartphone, and a significant portion of these users report feeling addicted to their devices.

– Research indicates that around 50% of teenagers in the United States feel addicted to their smartphones, with similar trends observed in other developed countries.

3. Social Media Addiction:

– Social media platforms are a major contributor to technology addiction. A report from GlobalWebIndex found that the average user spends about 2 hours and 31 minutes on social media each day.

– Approximately 5% to 10% of social media users are believed to exhibit addictive behaviors, such as compulsively checking notifications or spending excessive time online.

4. Gaming Addiction:

– The World Health Organization (WHO) has recognized gaming disorder as a mental health condition. It is estimated that 1% to 3% of gamers worldwide may suffer from gaming addiction.

– In South Korea, a country known for its gaming culture, about 10% of adolescents are considered to be at risk of gaming addiction.

5. Impact on Mental Health:

– Excessive use of technology has been linked to various mental health issues, including anxiety, depression, and sleep disturbances. For instance, heavy smartphone use is associated with increased levels of anxiety and lower quality of sleep.

– A study published in the journal *Computers in Human Behavior* found that individuals with higher levels of internet addiction also reported higher levels of loneliness and depression.

6. Age and Gender Differences:

– Younger individuals, particularly teenagers and young adults, are more prone to technology addiction due to their higher engagement with digital platforms.

– Some studies suggest that males may be more susceptible to gaming addiction, while females may be more prone to social media addiction.

7. Economic Impact:

– Technology addiction can lead to decreased productivity, which has economic implications. Employers report losses in productivity due to employees spending time on non-work-related digital activities.

8. Efforts to Combat Technology Addiction:

– Various initiatives have been launched to address technology addiction, including digital detox programs, awareness campaigns, and the development of apps that help monitor and limit screen time.

Understanding these statistics is essential for developing effective strategies to mitigate the negative impacts of technology addiction. As technology continues to advance, ongoing research and awareness are crucial in addressing this growing concern.

Is the crypto addiction widespread?

The rise of cryptocurrencies has indeed led to a significant number of individuals becoming deeply engaged with, and in some cases, addicted to crypto trading and investing. This phenomenon can be attributed to several factors:

- 1. Volatility and Potential for High Returns: Cryptocurrencies are known for their extreme price volatility, which can lead to substantial gains (or losses) in a short period. This potential for high returns can be enticing and may lead some individuals to engage in compulsive trading behaviors.

- 2. 24/7 Market: Unlike traditional stock markets, cryptocurrency markets operate 24/7. This constant availability can lead to individuals constantly checking prices and trading at all hours, contributing to addictive behaviors.

- 3. Gambling-like Experience: The unpredictability and high-risk nature of crypto trading can resemble gambling. For some, this can trigger similar psychological responses, leading to addiction.

- 4. Social Influence and FOMO: The fear of missing out (FOMO) is prevalent in the crypto community, driven by social media and online forums where success stories are frequently shared. This can pressure individuals to invest impulsively.

- 5. Anonymity and Accessibility: Cryptocurrencies offer a level of anonymity and are easily accessible, making it simpler for individuals to engage in trading without the same barriers present in traditional finance.

- 6. Lack of Regulation: The relatively unregulated nature of the crypto market can make it easier for individuals to engage in risky behaviors without the same oversight present in other financial markets.

While not everyone who invests in or trades cryptocurrencies becomes addicted, there is growing concern among mental health professionals about the potential for addiction. Some treatment centers have begun offering programs specifically for crypto addiction, recognizing the unique challenges it presents.

It’s important for individuals involved in crypto trading to be aware of the signs of addiction, such as neglecting responsibilities, financial distress, and withdrawal from social activities, and to seek help if needed. Balancing investments with other aspects of life and maintaining a healthy approach to trading can help mitigate the risk of addiction.

Symptoms, Causes, and Signs of crypto addiction

Why is crypto so addictive?

Absolutely, crypto can be surprisingly addictive, and here’s why:

- 1. High Volatility Excitement: Cryptocurrency markets are known for their rapid price swings. This unpredictability can create a thrilling rollercoaster of emotions, making each uptrend feel like a jackpot and each dip a nail-biting moment. The constant movement keeps you coming back for more to see what’s next.

- 2. Potential for Big Gains: The stories of early investors making huge profits are everywhere. This potential for significant returns can be incredibly motivating, encouraging people to invest more time and money in hopes of striking it rich.

- 3. 24/7 Market: Unlike traditional stock markets, crypto never sleeps. This nonstop trading environment means there’s always something happening, allowing enthusiasts to engage with the market at any time, which can easily become a daily habit.

- 4. Community and Social Interaction: The crypto space has a vibrant, passionate community. Engaging with like-minded individuals through forums, social media, and events can be highly rewarding, fostering a sense of belonging and shared excitement.

- 5. Gamification Elements: Many crypto platforms incorporate game-like features such as rewards, challenges, and leaderboards. These elements make investing feel more interactive and fun, similar to playing a game, which can be quite addictive.

- 6. Continuous Learning Curve: The ever-evolving nature of cryptocurrency means there’s always something new to learn. This constant influx of information and the need to stay updated can keep enthusiasts hooked as they strive to understand the latest trends and technologies.

- 7. Decentralization Appeal: The idea of decentralization and having control over your own finances without traditional intermediaries is empowering. This sense of autonomy can make participation in crypto feel more engaging and personally rewarding.

In summary, the combination of excitement, potential rewards, community engagement, and the dynamic nature of the crypto world creates a highly addictive environment for many enthusiasts. Just remember to stay balanced and invest wisely!

Possible causes of crypto dependency

Crypto addiction, much like other forms of behavioral addiction, is a complex issue influenced by various psychological, social, and economic factors. Here are some of the primary causes:

- 1. Volatility and Excitement: The cryptocurrency market is known for its high volatility, which can lead to significant price swings in short periods. This unpredictability can create a sense of excitement and adrenaline rush similar to gambling, making it addictive for some individuals.

- 2. Potential for High Rewards: The stories of people making substantial profits from early investments in cryptocurrencies can create a perception of easy wealth. This potential for high returns can be alluring and lead individuals to continuously engage with the market in hopes of replicating such success.

- 3. 24/7 Market Access: Unlike traditional stock markets, cryptocurrency markets operate 24/7, allowing individuals to trade at any time. This constant availability can lead to compulsive behavior, as there is always an opportunity to engage with the market.

- 4. Social Influence and Community: The crypto community is highly active on social media platforms and forums. This sense of community can create peer pressure and fear of missing out (FOMO), encouraging individuals to invest more time and money into cryptocurrencies.

- 5. Technological Engagement: The use of digital platforms and apps for trading cryptocurrencies can be engaging and immersive. The gamification of trading apps can make the process more addictive, as users are drawn to the interactive and visually stimulating interfaces.

- 6. Psychological Escape: For some individuals, engaging with cryptocurrencies can serve as an escape from stress, anxiety, or other personal issues. The focus on trading and market analysis can provide a temporary distraction from real-world problems.

- 7. Lack of Regulation: The relatively unregulated nature of the cryptocurrency market can contribute to addictive behaviors. Without strict oversight, individuals may engage in risky trading practices without fully understanding the consequences.

- 8. Cognitive Biases: Cognitive biases, such as overconfidence and the illusion of control, can lead individuals to believe they can predict market movements or that they have special insight, fueling continued engagement with the market.

- 9. Financial Instability: Individuals facing financial difficulties may turn to cryptocurrencies as a perceived quick solution to their problems. The hope of rapid financial gain can lead to compulsive trading behavior.

Addressing crypto addiction requires a multi-faceted approach, including education, awareness, and potentially seeking professional help for those affected. Understanding the underlying causes can be the first step in developing strategies to mitigate the risks associated with this emerging issue.

Signs & Symptoms of crypto addiction

Now let’s see if you have the crypto addiction problem.

Cryptocurrency has taken the financial world by storm, captivating the attention of millions. While many people dabble in crypto trading or investing, some find themselves deeply engrossed, often to the point of addiction. Here are seven signs that you might be a crypto addict:

- 1. Constant Market Monitoring: If you find yourself incessantly checking the prices of Bitcoin, Ethereum, and other cryptocurrencies throughout the day and night, you might be more than just a casual investor. This constant need to stay updated can interrupt daily activities and even affect sleep patterns.

- 2. Emotional Roller Coaster: The crypto market is notoriously volatile. If your mood swings are directly tied to the rise and fall of crypto prices, it could indicate an unhealthy emotional investment. Experiencing intense euphoria during market highs and severe anxiety or depression during downturns is a red flag.

- 3. Neglecting Responsibilities: When crypto trading or researching new coins takes precedence over work, family, or social obligations, it’s a clear sign of addiction. Missing deadlines, ignoring personal relationships, or skipping important events to focus on crypto activities can have long-term consequences.

- 4. Financial Overextension: Investing more money than you can afford to lose is a dangerous habit. If you’re taking out loans, using credit cards, or dipping into savings to fund your crypto investments, it’s a sign that you’re overcommitted and potentially addicted.

- 5. Obsessive Research and Analysis: Spending excessive amounts of time reading whitepapers, analyzing charts, and participating in crypto forums can indicate an obsession. While staying informed is important, when it becomes all-consuming, it might be time to reassess your priorities.

- 6. Ignoring Risks: A crypto addict often downplays or ignores the inherent risks of the market. If you find yourself dismissing warnings about scams, regulatory changes, or market crashes, you may be too caught up in the potential rewards to see the bigger picture.

- 7. Withdrawal Symptoms: Just like with any addiction, stepping away from the crypto world can lead to withdrawal symptoms. If taking a break from trading or checking prices causes you stress, anxiety, or irritability, it’s a sign that your relationship with crypto might be unhealthy.

Recognizing these signs is the first step toward regaining balance. If you identify with several of these behaviors, consider seeking support to help manage your crypto activities and ensure they remain a healthy part of your life.

Try our digital habit & screen addiction test:

Problems, impacts & bad effects of crypto: should you quit?

What are some benefits of crypto

Cryptocurrency has emerged as a revolutionary financial technology, offering a myriad of advantages that appeal to a wide range of users, from individual investors to large institutions. Here are some of the key pros and advantages of cryptocurrencies:

- 1. Decentralization: Most cryptocurrencies operate on decentralized networks based on blockchain technology. This means they are not controlled by any central authority, such as a government or financial institution, reducing the risk of manipulation or interference.

- 2. Security and Transparency: Cryptocurrencies use cryptographic techniques to secure transactions and control the creation of new units. The blockchain ledger is immutable and transparent, allowing anyone to verify transactions, which enhances trust and reduces the risk of fraud.

- 3. Lower Transaction Costs: Traditional financial transactions often involve intermediaries, which can increase costs. Cryptocurrency transactions can reduce or eliminate these intermediaries, leading to lower transaction fees.

- 4. Speed and Accessibility: Cryptocurrency transactions can be processed quickly, often within minutes, regardless of the participants’ locations. This is particularly beneficial for international transactions, which can be slow and expensive through traditional banking systems.

- 5. Financial Inclusion: Cryptocurrencies provide access to financial services for individuals who are unbanked or underbanked, especially in developing regions where traditional banking infrastructure is limited.

- 6. Ownership and Control: Cryptocurrency holders have full control over their assets. They can send and receive funds without relying on a third party, which empowers users with greater autonomy over their finances.

- 7. Innovation and Potential for Growth: The underlying blockchain technology of cryptocurrencies has spurred innovation across various sectors, from finance to supply chain management. Cryptocurrencies themselves offer potential for significant investment returns, although they come with high volatility.

- 8. Privacy: While not all cryptocurrencies are completely anonymous, many offer enhanced privacy features compared to traditional financial systems. Users can conduct transactions without revealing personal information, which can protect against identity theft.

- 9. Programmability and Smart Contracts: Cryptocurrencies like Ethereum support smart contracts, which are self-executing contracts with the terms directly written into code. This enables automated and trustless execution of agreements, reducing the need for intermediaries.

- 10. Diversification: Cryptocurrencies offer a new asset class for investors, providing an opportunity to diversify portfolios beyond traditional stocks and bonds.

- 11. Inflation Resistance: Some cryptocurrencies, like Bitcoin, have a capped supply, which can make them resistant to inflation. This contrasts with fiat currencies, which can be subject to inflationary pressures due to government monetary policies.

While cryptocurrencies offer numerous advantages, it’s important to recognize that they also come with risks, such as regulatory uncertainty, market volatility, and security challenges. As with any financial decision, potential users and investors should conduct thorough research and consider their risk tolerance before engaging with cryptocurrencies.But on the other hand, what are some crypto addiction problems that addicts suffer from?

General health problems

The rise of cryptocurrency has not only transformed the financial landscape but has also had various effects on individuals’ health, both mental and physical. While the direct impact of cryptocurrency on physical health is limited, the indirect effects, particularly on mental well-being, can be significant. Here are some of the key ways in which engagement with cryptocurrency can affect health:

### Mental Health Effects

- 1. Stress and Anxiety:

– Volatility: The cryptocurrency market is notoriously volatile, with prices that can swing dramatically in a short period. This unpredictability can lead to significant stress and anxiety for investors who are constantly monitoring market conditions.

– Fear of Missing Out (FOMO): The rapid rise in the value of certain cryptocurrencies can create a fear of missing out, prompting individuals to make impulsive investment decisions. This can lead to regret and anxiety if investments do not perform as expected.

- 2. Addiction:

– Trading Addiction: Similar to gambling, the excitement and potential for high returns can lead to compulsive trading behaviors. This addiction can consume significant amounts of time and attention, detracting from other important life activities and responsibilities.

– Screen Time: Excessive screen time spent monitoring markets and trading can lead to digital addiction, impacting sleep and overall mental health.

- 3. Depression:

– Financial Losses: Significant financial losses, which are common in the volatile crypto market, can lead to depression and a sense of hopelessness. The emotional impact of losing substantial investments can be profound.

– Isolation: The intense focus on cryptocurrency trading can lead to social isolation, as individuals may prioritize trading over social interactions and relationships.

### Physical Health Effects

- 1. Sleep Disruption:

– 24/7 Market: Unlike traditional stock markets, cryptocurrency markets operate 24/7, which can lead to disrupted sleep patterns as individuals may feel compelled to monitor prices at all hours.

– Blue Light Exposure: Prolonged exposure to screens, especially before bedtime, can interfere with the body’s natural sleep-wake cycle, leading to poor sleep quality.

- 2. Sedentary Lifestyle:

– Lack of Physical Activity: The sedentary nature of trading and monitoring markets can contribute to a lack of physical activity, which is associated with various health issues, including obesity, cardiovascular disease, and musculoskeletal problems.

### Coping Strategies

- 1. Set Boundaries:

– Establish specific times for trading and market monitoring to prevent it from consuming all your time and mental energy.

- 2. Practice Mindfulness:

– Engage in mindfulness practices such as meditation or yoga to manage stress and maintain a balanced perspective.

- 3. Diversify Interests:

– Balance your interest in cryptocurrency with other hobbies and activities that promote physical and mental well-being.

- 4. Seek Support:

– If you find that cryptocurrency trading is negatively impacting your mental health, consider seeking support from mental health professionals or support groups.

- 5. Educate Yourself:

– Make informed decisions by educating yourself about the market, which can help reduce anxiety related to uncertainty and volatility.

In conclusion, while cryptocurrency offers exciting financial opportunities, it is crucial to be mindful of its potential impact on health. By adopting healthy habits and setting boundaries, individuals can mitigate the negative effects and maintain a balanced lifestyle.

crypto and sleep disorders

The relationship between cryptocurrency and sleep disorders is not direct, but there are several factors related to the crypto market that could potentially contribute to sleep problems. Here are some ways in which involvement in the cryptocurrency space might impact sleep:

- 1. Market Volatility: Cryptocurrencies are known for their extreme volatility. Prices can fluctuate dramatically within short periods, leading to stress and anxiety for investors. This financial stress can translate into difficulty falling asleep or staying asleep, as individuals may be preoccupied with their investments.

- 2. 24/7 Trading: Unlike traditional stock markets, cryptocurrency markets operate 24/7. This constant availability can lead to compulsive checking of prices and trading at all hours, disrupting normal sleep patterns. The temptation to stay up late or wake up in the middle of the night to monitor the market can lead to sleep deprivation.

- 3. Screen Time: Engaging with cryptocurrency often involves significant screen time, whether it’s through computers, smartphones, or other devices. Excessive screen time, especially before bed, can interfere with the production of melatonin, the hormone responsible for regulating sleep-wake cycles, leading to difficulty falling asleep.

- 4. Stress and Anxiety: The high-risk nature of cryptocurrency investments can lead to increased stress and anxiety. Concerns about potential losses, market crashes, or missing out on investment opportunities (FOMO) can result in restless nights and poor sleep quality.

- 5. Cognitive Overload: The cryptocurrency market is complex and rapidly evolving. Keeping up with the latest trends, news, and technological developments can be mentally exhausting. This cognitive overload can make it difficult to relax and unwind, affecting sleep quality.

- 6. Social Influence: The crypto community is active on social media platforms, where discussions and debates are ongoing. Engaging in these conversations can be stimulating and lead to heightened emotional responses, making it harder to wind down for sleep.

To mitigate these potential sleep problems, individuals involved in the cryptocurrency market can adopt several strategies:

– Set Boundaries: Establish specific times for checking the market and avoid doing so right before bed.

– Practice Relaxation Techniques: Engage in relaxation exercises, such as deep breathing or meditation, to reduce stress and anxiety.

– Limit Screen Time: Reduce screen exposure in the evening and consider using blue light filters on devices.

– Create a Sleep-Conducive Environment: Ensure your bedroom is dark, quiet, and cool to promote better sleep.

– Stay Informed, Not Obsessed: Balance staying informed about the market with other activities and interests to prevent cognitive overload.

By being mindful of these factors and implementing healthy habits, individuals can reduce the risk of sleep disorders associated with their involvement in the cryptocurrency market.

crypto affecting your brain & mental health: bad for brain and mental health?

Some effects of crypto on your brain

### The Hidden Side of Crypto: How It Might Affect Your Brain

Cryptocurrency has taken the world by storm, offering exciting opportunities for investment and innovation. But while diving into the crypto craze can be thrilling, it’s essential to be aware of how it might impact your brain. Here are some potential negative effects to consider:

####

- 1. Increased Stress and Anxiety

The crypto market is notoriously volatile. Prices can skyrocket one day and plummet the next, leading to constant ups and downs. This unpredictability can create significant stress and anxiety, especially if you’re heavily invested or constantly monitoring the market.

####

- 2. Sleep Disruptions

Staying up late to track market movements or manage your crypto portfolio can interfere with your sleep patterns. Lack of proper rest can lead to fatigue, decreased cognitive function, and overall poor mental health.

####

- 3. Decision Fatigue

With so many investment choices, trading decisions, and market analyses, your brain can become overwhelmed. Making frequent decisions can lead to decision fatigue, where your ability to make choices deteriorates over time, potentially resulting in poor investment choices.

####

- 4. Addictive Behavior

The thrill of trading and the possibility of high returns can be addictive. Some individuals may find themselves obsessively checking prices, seeking the next big win, or feeling anxious when not engaged with crypto activities.

####

- 5. Reduced Attention Span

Constantly switching between crypto charts, news updates, and trading platforms can fragment your attention. This scattered focus might make it harder to concentrate on other tasks, both professionally and personally.

####

- 6. Emotional Rollercoaster

The highs of significant gains and the lows of unexpected losses can lead to emotional instability. This emotional rollercoaster can affect your mood, relationships, and overall well-being.

### Tips to Protect Your Brain While Engaging with Crypto

– Set Boundaries: Allocate specific times for checking your investments to avoid constant monitoring.

– Educate Yourself: Understanding the market can reduce anxiety caused by uncertainty.

– Take Breaks: Step away from crypto activities regularly to rest your mind.

– Seek Support: If you find crypto trading affecting your mental health, consider talking to a professional.

### Final Thoughts

While cryptocurrency offers exciting opportunities, it’s crucial to approach it mindfully. Being aware of its potential effects on your brain can help you maintain a healthy balance between your investment activities and overall well-being. Remember, your mental health should always take priority over any financial venture.

Some effects of crypto on your mental health

The rapid rise of cryptocurrencies has captured the imagination of investors, technologists, and the general public alike. However, the volatile nature of the crypto market and the intense focus it demands can have significant negative effects on mental health. Here are some of the ways in which engaging with cryptocurrencies can impact mental well-being:

- 1. Stress and Anxiety: The crypto market is notoriously volatile, with prices that can swing dramatically within short periods. This unpredictability can lead to heightened stress and anxiety, particularly for those who have invested significant amounts of money. The constant need to monitor market trends can create a sense of unease and tension.

- 2. Obsessive Behavior: The 24/7 nature of cryptocurrency trading can lead to obsessive behavior. Investors may find themselves compulsively checking prices, news updates, and social media, which can disrupt daily routines and lead to sleep disturbances. This constant engagement can be mentally exhausting and lead to burnout.

- 3. Fear of Missing Out (FOMO): The fear of missing out on potential gains can drive individuals to make impulsive decisions. This FOMO can lead to risky investments without proper research or understanding, resulting in financial losses and subsequent regret, which can exacerbate feelings of anxiety and depression.

- 4. Financial Stress: The potential for significant financial gain is a major draw of cryptocurrencies, but the risk of loss is equally high. Financial stress from losses can lead to feelings of guilt, shame, and hopelessness, impacting self-esteem and overall mental health.

- 5. Isolation: Engaging heavily in the crypto market can lead to social isolation. Individuals may prioritize screen time over personal relationships, leading to a disconnect from family and friends. This isolation can contribute to feelings of loneliness and depression.

- 6. Addiction: The thrill of potential gains and the dynamic nature of trading can lead to addictive behaviors. Crypto trading can become a compulsive activity, similar to gambling, where individuals chase losses or continuously seek the high of a successful trade, impacting their mental health and personal lives.

- 7. Cognitive Overload: The complexity of the crypto market, with its technical jargon and rapid developments, can be overwhelming. Trying to keep up with the constant flow of information can lead to cognitive overload, resulting in mental fatigue and decreased cognitive function.

- 8. Emotional Volatility: The emotional highs and lows associated with crypto trading can lead to mood swings. The excitement of a market surge can quickly turn to despair if prices plummet, leading to emotional instability and increased stress.

- 9. Imposter Syndrome: With the rise of crypto influencers and success stories, individuals may feel inadequate or doubt their abilities if they do not achieve similar success. This imposter syndrome can lead to self-doubt and decreased self-worth.

- 10. Regret and Rumination: Reflecting on past decisions, especially those that led to losses, can lead to rumination. This constant focus on negative experiences can contribute to anxiety and depression, making it difficult to move forward.

To mitigate these negative effects, it’s important for individuals to set boundaries around their engagement with cryptocurrencies, seek support from mental health professionals if needed, and maintain a balanced lifestyle that includes social interaction and physical activity. Understanding the risks and approaching crypto investments with caution can also help protect mental well-being.

Does crypto cause stress and anxiety?

Cryptocurrency, while offering exciting opportunities for investment and innovation, can indeed be a source of stress and anxiety for many individuals. Here’s a closer look at how crypto can affect mental health:

- 1. Market Volatility: Cryptocurrencies are known for their extreme price volatility. The value of a digital currency can swing dramatically within a short period, leading to significant financial gains or losses. This unpredictability can cause stress and anxiety, especially for those heavily invested or reliant on their crypto holdings for financial security.

- 2. Lack of Regulation: The relatively unregulated nature of the cryptocurrency market can add to the anxiety. Investors may feel uneasy about the potential for fraud, hacking, or other security breaches, which can lead to the loss of their investments.

- 3. Information Overload: The rapid pace of developments in the crypto world can be overwhelming. Keeping up with news, technological advancements, and market trends requires constant attention, which can be mentally exhausting and lead to anxiety.

- 4. Fear of Missing Out (FOMO): The fear of missing out on potentially lucrative investment opportunities can drive individuals to make impulsive decisions. This FOMO can lead to stress, especially if investments do not perform as expected.

- 5. Social Pressure: With the rise of social media and online forums, there is significant social pressure to invest in cryptocurrencies. Seeing others boast about their crypto successes can lead to feelings of inadequacy or pressure to achieve similar results, contributing to stress and anxiety.

- 6. Financial Pressure: For some, the pressure to recover losses or achieve financial goals through crypto investments can be intense. This financial pressure can exacerbate stress and lead to unhealthy investment behaviors.

- 7. Uncertainty and Complexity: The complexity of blockchain technology and the uncertainty surrounding the future of cryptocurrencies can be daunting. For those not well-versed in the technical aspects, this can lead to feelings of confusion and anxiety.

- 8. Security Concerns: The responsibility of managing private keys and ensuring the security of digital wallets can be stressful. The fear of losing access to one’s assets or falling victim to scams can contribute to anxiety.

To mitigate these stressors, individuals can adopt strategies such as diversifying their investments, setting clear financial goals, staying informed through reliable sources, and practicing mindfulness and stress management techniques.

Additionally, seeking professional financial advice can provide guidance and reassurance in navigating the complex world of cryptocurrency.

Can crypto addiction lead to sadness and depression?

Cryptocurrency, with its rapid rise and volatile nature, has captured the attention of millions worldwide. While many have benefited from its potential for high returns, there is a growing concern about the addictive nature of crypto trading and its potential impact on mental health, leading to sadness and depression.

### Understanding Crypto Addiction

Crypto addiction can be likened to gambling addiction. The constant monitoring of market prices, the thrill of high-risk investments, and the potential for significant financial gain can create a cycle of compulsive behavior. This addiction is characterized by an overwhelming urge to trade, even at the expense of personal relationships, financial stability, and mental well-being.

### The Link Between Crypto Addiction and Mental Health

- 1. Volatility and Anxiety: Cryptocurrencies are notoriously volatile. This unpredictability can lead to heightened anxiety as individuals constantly worry about market fluctuations and the potential loss of their investments.

- 2. Financial Stress: Many people invest in cryptocurrencies with the hope of quick profits. However, significant losses can lead to financial stress, which is a known contributor to depression.

- 3. Isolation: Those addicted to crypto trading may spend excessive amounts of time online, neglecting social interactions and real-world relationships. This isolation can exacerbate feelings of loneliness and sadness.

- 4. Sleep Disruption: The 24/7 nature of crypto markets can lead to disrupted sleep patterns as individuals stay up late to monitor prices or make trades. Lack of sleep is closely linked to mood disorders, including depression.

- 5. Obsessive Behavior: The compulsive need to check prices and make trades can consume an individual’s thoughts, leading to neglect of other important life activities. This obsessive behavior can result in a sense of loss of control, contributing to feelings of hopelessness and depression.

### Recognizing the Signs

It’s crucial for individuals and their loved ones to recognize the signs of crypto addiction. These may include:

– Preoccupation with crypto trading

– Lying about trading activities or losses

– Neglecting personal and professional responsibilities

– Experiencing withdrawal symptoms when unable to trade

– Continuing to trade despite negative consequences

### Seeking Help

If you or someone you know is struggling with crypto addiction, it’s important to seek help. Therapy, particularly cognitive-behavioral therapy (CBT), can be effective in addressing addictive behaviors and underlying mental health issues. Support groups and financial counseling can also provide guidance and support.

### Conclusion

While the world of cryptocurrency offers exciting opportunities, it’s essential to approach it with caution and awareness of its potential impact on mental health. By recognizing the signs of addiction and seeking appropriate help, individuals can mitigate the risks of sadness and depression associated with crypto trading. Balancing investments with a healthy lifestyle and maintaining open communication with loved ones can further support mental well-being in the face of crypto’s challenges.

Dopamine and crypto

Dopamine and Cryptocurrency: Understanding the Psychological Connection

The world of cryptocurrency is not just a financial revolution; it’s a psychological phenomenon. At the heart of this intersection between finance and psychology lies dopamine, a neurotransmitter often associated with pleasure and reward. Understanding how dopamine influences behavior can provide insights into why cryptocurrencies captivate so many people and why they can sometimes lead to impulsive decisions.

### The Role of Dopamine

Dopamine is a chemical messenger in the brain that plays a crucial role in how we feel pleasure. It is released during activities that are perceived as rewarding, such as eating, exercising, or achieving a goal. This release reinforces behaviors, encouraging repetition. In the context of investing, the anticipation of financial gain can trigger dopamine release, creating a cycle of excitement and reward.

### Cryptocurrency and Dopamine

- 1. Volatility and Reward: Cryptocurrencies are known for their extreme volatility. This unpredictability can lead to significant financial gains or losses over short periods. The potential for high returns can trigger dopamine release, making the act of trading or investing in cryptocurrencies exhilarating.

- 2. Instant Gratification: Unlike traditional investments, cryptocurrencies can be traded 24/7. This constant availability means that investors can experience the highs and lows of the market at any time, providing continuous opportunities for dopamine-driven behavior.

- 3. Social Influence: The crypto community is vibrant and highly active on social media platforms. Positive reinforcement from peers, success stories, and the fear of missing out (FOMO) can amplify dopamine-driven behavior, pushing individuals to make impulsive investment decisions.

- 4. Gamification of Trading: Many cryptocurrency platforms incorporate elements of gamification, such as leaderboards, achievements, and rewards for frequent trading. These features can enhance the dopamine response, making trading feel like a game rather than a financial decision.

### The Risks of Dopamine-Driven Investing

While dopamine can drive engagement and interest, it can also lead to impulsive and irrational decision-making. The thrill of potential gains can overshadow the risks, leading to:

– Overtrading: Frequent buying and selling based on short-term market movements rather than long-term strategy.

– Emotional Decision-Making: Allowing emotions rather than rational analysis to guide investment choices.

– Addiction: The continuous pursuit of the dopamine rush can lead to compulsive trading behaviors, similar to gambling addiction.

### Strategies for Managing Dopamine-Driven Behavior

- 1. Education and Awareness: Understanding the psychological factors at play can help investors make more informed decisions. Recognizing the role of dopamine can encourage more deliberate and strategic investing.

- 2. Setting Limits: Establishing clear financial goals and limits on trading activities can prevent impulsive decisions driven by dopamine.

- 3. Mindfulness and Reflection: Regularly reflecting on investment decisions and their outcomes can help investors stay grounded and focused on long-term objectives.

- 4. Diversification: Spreading investments across different asset classes can reduce the emotional impact of cryptocurrency volatility.

### Conclusion

The interplay between dopamine and cryptocurrency highlights the importance of understanding the psychological aspects of investing. While the thrill of the market can be enticing, maintaining a balanced and informed approach is crucial. By recognizing the influence of dopamine, investors can better navigate the dynamic world of cryptocurrencies, making decisions that align with their financial goals and risk tolerance.

crypto effects on focus, productivity, attention span, academic performance…

Absolutely, diving into the world of cryptocurrency can have various effects on your focus, productivity, attention span, and even academic performance. Let’s break it down:

### Focus

Positive Impact: Engaging with crypto projects can enhance your ability to concentrate, especially if you’re involved in research or development. Learning about blockchain technology requires deep focus and critical thinking.

Negative Impact: On the flip side, the volatile nature of crypto markets can be distracting. Constantly checking prices or news updates might pull your attention away from other tasks.

### Productivity

Boost in Productivity: If you’re passionate about crypto, it can motivate you to learn new skills, join communities, or even start your own projects. This enthusiasm can translate into higher productivity in areas you care about.

Possible Decline: However, obsession with trading or mining crypto can consume a lot of your time, leading to procrastination or neglect of other responsibilities.

### Attention Span

Improvement: Engaging with complex crypto concepts can train your brain to handle intricate information, potentially improving your attention to detail.

Reduction: The fast-paced updates and the lure of constant information in the crypto space might make it harder to maintain long-term focus, as your brain gets used to switching tasks frequently.

### Academic Performance

Enhancement: Studying crypto and blockchain can complement your academic pursuits, especially if you’re in fields like computer science, finance, or economics. It can provide practical knowledge that enriches your coursework.

Challenges: If crypto-related activities become a distraction, they might interfere with your study time, leading to lower grades or incomplete assignments.

### Final Thoughts

Like any interest or hobby, cryptocurrency has its pros and cons. It’s all about finding a balance. Stay informed, manage your time wisely, and ensure that your passion for crypto enhances rather than hinders your overall well-being and responsibilities.

Remember, moderation is key! 🚀

A word about ADHD and crypto

The relationship between individuals with Attention Deficit Hyperactivity Disorder (ADHD) and their interaction with cryptocurrencies is an intriguing topic that intersects psychology, finance, and technology. While there is limited specific research directly linking ADHD with cryptocurrency behavior, we can explore some potential interactions based on known characteristics of ADHD and the nature of cryptocurrency markets.

### Characteristics of ADHD

ADHD is a neurodevelopmental disorder characterized by symptoms such as inattention, hyperactivity, and impulsivity. These traits can influence how individuals engage with various activities, including financial investments.

- 1. Impulsivity and Risk-Taking:

– Crypto Market Volatility: Cryptocurrencies are known for their high volatility and speculative nature. Individuals with ADHD may be more inclined to engage in impulsive trading due to their propensity for risk-taking and seeking novel experiences.

– Quick Decision-Making: The fast-paced environment of crypto trading might appeal to those with ADHD, who may prefer quick decision-making and immediate results.

- 2. Inattention and Focus:

– Research and Analysis: The need for thorough research and analysis in crypto investing might be challenging for individuals with ADHD, who may struggle with sustained attention and detailed analysis.

– Distraction by New Trends: The constant emergence of new cryptocurrencies and technologies can be both exciting and distracting, potentially leading individuals with ADHD to frequently shift their focus and investments.

- 3. Hyperfocus:

– Deep Engagement: On the flip side, individuals with ADHD can experience hyperfocus, where they become deeply engrossed in activities of interest. This could lead to an intense and prolonged focus on cryptocurrency markets, research, and trading strategies.

- 4. Emotional Regulation:

– Market Stress: The emotional highs and lows associated with crypto market fluctuations can be particularly challenging for those with ADHD, who may already experience difficulties with emotional regulation.

### Potential Benefits and Challenges

– Benefits:

– The dynamic and fast-moving nature of the crypto market might provide the stimulation that individuals with ADHD find engaging.

– Opportunities for innovation and creativity in blockchain technology can be appealing to those with ADHD who thrive in environments that reward out-of-the-box thinking.

– Challenges:

– The lack of regulatory oversight in many crypto markets can increase the risk of impulsive decisions leading to significant financial losses.

– The need for constant monitoring and rapid response to market changes can be overwhelming and may lead to burnout.

### Conclusion

While ADHD can influence how individuals interact with cryptocurrencies, it is important to note that each person’s experience is unique. Some may find the crypto market’s volatility and innovation stimulating and rewarding, while others may struggle with the impulsivity and emotional regulation challenges it presents. As with any investment, individuals with ADHD should consider their personal strengths and challenges, seek professional financial advice, and implement strategies to manage risk effectively.

Affecting your relationships

crypto and self-esteem

How Crypto Can Impact Your Self-Esteem

Hey there, crypto enthusiasts and curious minds! 🌟 If you’ve dipped your toes into the world of cryptocurrency, you might have noticed not just fluctuations in your digital wallet but also in how you feel about yourself. Let’s break down how engaging with crypto can influence your self-esteem in both positive and challenging ways.

###

- 1. Boosting Confidence Through Knowledge

Diving into crypto requires learning about blockchain, trading strategies, and market trends. As you grasp these complex topics, your confidence grows. Each new piece of knowledge empowers you, making you feel more capable and informed.

###

- 2. The Thrill of Success

Watching your investments grow can be exhilarating. Celebrating gains and smart moves boosts your self-worth and reinforces your decision-making abilities. Those ‘winning’ moments remind you of your savvy and strategic thinking.

###

- 3. Handling Volatility and Building Resilience

Crypto markets are known for their ups and downs. Navigating this volatility teaches resilience. Every dip you withstand or recover from reinforces your ability to handle stress and uncertainty, strengthening your self-esteem over time.

###

- 4. Community and Connection

Joining crypto communities, whether online or offline, connects you with like-minded individuals. Feeling part of a supportive group can enhance your sense of belonging and validate your interests, positively impacting how you view yourself.

###

- 5. Facing Challenges and Overcoming Setbacks

Not every trade is a win, and losses can be tough. Facing these challenges head-on and finding ways to bounce back builds perseverance. Overcoming setbacks shows you’re capable and adaptable, which can significantly boost your self-esteem.

###

- 6. Setting and Achieving Goals

Whether it’s reaching a certain portfolio value or mastering a new crypto tool, setting goals gives you direction. Achieving these milestones provides a sense of accomplishment and reinforces your belief in your abilities.

###

- 7. Balancing Risk and Self-Worth

While taking risks can be empowering, it’s essential to ensure that your self-worth isn’t tied solely to your crypto successes. Maintaining a healthy perspective helps you stay confident without letting market outcomes dictate how you feel about yourself.

### Final Thoughts

Engaging with cryptocurrency can be a rollercoaster for your self-esteem, offering opportunities for growth, confidence, and connection. By embracing both the highs and lows, you can harness crypto’s potential to enhance your self-worth while building resilience and a supportive community around you. Happy trading, and remember to take care of your well-being along the way!

crypto addiction leads to isolation and loneliness?

.jpg)

Cryptocurrency addiction is an emerging concern in the digital age, paralleling other forms of behavioral addictions such as gambling. This addiction can indeed lead to isolation and loneliness, affecting individuals’ personal and professional lives.

### Understanding Crypto Addiction

Crypto addiction is characterized by an obsessive engagement with cryptocurrency trading and monitoring, often at the expense of other life activities. The volatile nature of the crypto market can create a cycle of highs and lows, similar to gambling, where individuals are constantly chasing the next big win or trying to recover from losses.

### Impact on Social Connections

- 1. Time Consumption: Engaging in cryptocurrency trading can be incredibly time-consuming. The 24/7 nature of crypto markets means that individuals may feel the need to be constantly online, monitoring prices and news. This can lead to neglect of social relationships and responsibilities.

- 2. Emotional Rollercoaster: The emotional highs and lows associated with crypto trading can strain relationships. Individuals may become irritable or withdrawn, focusing more on their trading activities than on interacting with friends and family.

- 3. Financial Stress: The financial risks associated with crypto trading can lead to significant stress and anxiety. This stress can contribute to social withdrawal, as individuals may feel embarrassed or ashamed about their financial situation.

- 4. Obsessive Behavior: Similar to other addictions, crypto addiction can lead to obsessive behavior, where the individual prioritizes trading over social interactions. This can result in a decrease in social activities and increased isolation.

### Psychological Effects

– Loneliness: As individuals become more isolated due to their trading activities, feelings of loneliness can intensify. The lack of social interaction can exacerbate mental health issues, such as depression and anxiety.

– Reduced Social Skills: Over time, the lack of social engagement can lead to a decline in social skills, making it more challenging for individuals to reconnect with others.

### Mitigating the Effects

- 1. Setting Boundaries: Establishing clear boundaries for trading activities, such as specific times for trading and breaks, can help maintain a healthier balance between trading and social life.

- 2. Seeking Support: Engaging with support groups or therapy can provide individuals with the tools to manage their addiction and rebuild social connections.

- 3. Fostering Offline Activities: Encouraging participation in offline hobbies and activities can help individuals reconnect with others and reduce their reliance on digital interactions.

- 4. Education and Awareness: Increasing awareness about the risks of crypto addiction can help individuals recognize the signs early and seek help before the addiction leads to severe isolation.

In conclusion, while cryptocurrency offers exciting opportunities, it is crucial to approach it with caution and awareness. Recognizing the signs of addiction and taking proactive steps can prevent the negative consequences of isolation and loneliness associated with crypto addiction.

Effects of crypto on your relationships

Cryptocurrency has become a significant part of modern finance and technology, influencing various aspects of life, including personal relationships. Here are some positive and negative effects of cryptocurrency on relationships:

### Positive Effects

- 1. Shared Interests and Goals:

– Bonding Over Investments: Couples or friends who share an interest in cryptocurrency can bond over their investments, research, and market strategies. This shared interest can strengthen relationships through common goals and activities.

– Learning Together: Exploring the complexities of blockchain technology and cryptocurrency can be an educational journey that partners or friends embark on together, fostering intellectual growth and mutual support.

- 2. Financial Empowerment:

– Increased Financial Literacy: Getting involved in cryptocurrency often requires learning about finance, economics, and technology, which can empower individuals and couples to make more informed financial decisions.

– Diversified Income: Successful investments in cryptocurrency can lead to financial gains, providing additional resources for shared experiences, such as travel or purchasing a home.

- 3. Innovation and Adaptability:

– Encouraging Innovation: Being involved in the crypto space can encourage individuals to be more open to innovation and technological advancements, promoting a forward-thinking mindset that can benefit relationships.

### Negative Effects

- 1. Financial Stress:

– Market Volatility: The highly volatile nature of cryptocurrency markets can lead to significant financial stress, affecting personal relationships. Losses can create tension, blame, and anxiety within couples or among friends.

– Risk of Addiction: The excitement and potential for quick gains in crypto trading can lead to addictive behaviors, which may detract from time and attention given to relationships.

- 2. Differing Attitudes Toward Risk:

– Conflict Over Investment Strategies: Partners may have differing risk tolerances or investment strategies, leading to disagreements and conflicts about financial decisions.

– Trust Issues: If one partner is heavily involved in crypto investments without the other’s knowledge or consent, it can lead to trust issues and feelings of betrayal.

- 3. Time Consumption:

– Neglect of Personal Time: The fast-paced nature of crypto markets can lead to individuals spending excessive time monitoring investments, which may result in neglecting personal relationships and responsibilities.

– Distraction from Relationship Priorities: The focus on crypto investments can sometimes overshadow relationship priorities, causing partners to feel undervalued or ignored.

- 4. Security Concerns:

– Privacy and Security Risks: The digital nature of cryptocurrency involves risks such as hacking and scams, which can lead to financial losses and stress within relationships.

In conclusion, while cryptocurrency can offer opportunities for financial growth and shared interests, it also poses challenges that can strain relationships. Effective communication, mutual understanding, and setting boundaries are essential to navigating the impact of cryptocurrency on personal relationships.

How To Stop & Quit Your crypto Addiction

Finally, you think you are addicted to crypto and you are wondering how to quit it? How to break and overcome your cravings for crypto?

Here are the best solutions, steps, supports, resources, and help you can get to treat your crypto addiction.

Main steps and solutions to break the crypto addiction

Overcoming a crypto addiction, like any other form of addiction, requires a structured approach and often professional support. Here are the main steps to consider:

1. Acknowledgment: The first step is recognizing and admitting that there is a problem. This involves understanding how crypto trading or investing is negatively impacting your life, relationships, or finances.

2. Education: Learn about crypto addiction and its psychological effects. Understanding the nature of the addiction can help in developing strategies to combat it.

3. Set Clear Goals: Establish what you want to achieve by overcoming the addiction. This could include financial stability, improved mental health, or better relationships.

4. Limit Exposure: Reduce or eliminate access to trading platforms, crypto news, and communities that encourage excessive trading. This might involve uninstalling apps, unsubscribing from newsletters, or blocking websites.

5. Seek Professional Help: Consider consulting with a therapist or counselor who specializes in addiction. Cognitive Behavioral Therapy (CBT) and other therapeutic approaches can be effective.

6. Join Support Groups: Engage with support groups, either online or in-person, where you can share experiences and gain insights from others facing similar challenges.

7. Develop Healthy Habits: Replace the time spent on crypto activities with healthier habits such as exercise, meditation, or hobbies that do not involve screens.

8. Financial Counseling: If financial losses are part of the addiction, seek advice from a financial counselor to help manage debts and create a sustainable budget.

9. Mindfulness and Stress Management: Practice mindfulness techniques and stress management to reduce the urge to engage in impulsive trading as a coping mechanism.

10. Monitor Progress: Keep track of your progress and setbacks. Regularly review your goals and adjust your strategies as needed.

11. Build a Support Network: Surround yourself with friends and family who understand your goals and can offer support and encouragement.

12. Stay Informed: Keep abreast of developments in the crypto world, but do so in a controlled manner to avoid relapse into compulsive behavior.

Remember, overcoming addiction is a long-term process that requires patience, commitment, and sometimes professional intervention.Actually, that’s what most documentation out there is about… However, quitting a digital addiction can be a bit trickier than that.

So our team, after testing many ways, designed a bulletproof way to overcome them. Here are some clear and practical steps that are very powerful to quit a digital addiction, including crypto:

1. Purge temptations: Get rid of crypto

First, cleaning your life from temptations is much easier than resisting them. Disable or delete your crypto accounts, change the password and hide it somewhere you can’t access easily, keep your phone / computer far away… Out of sight, out of mind.

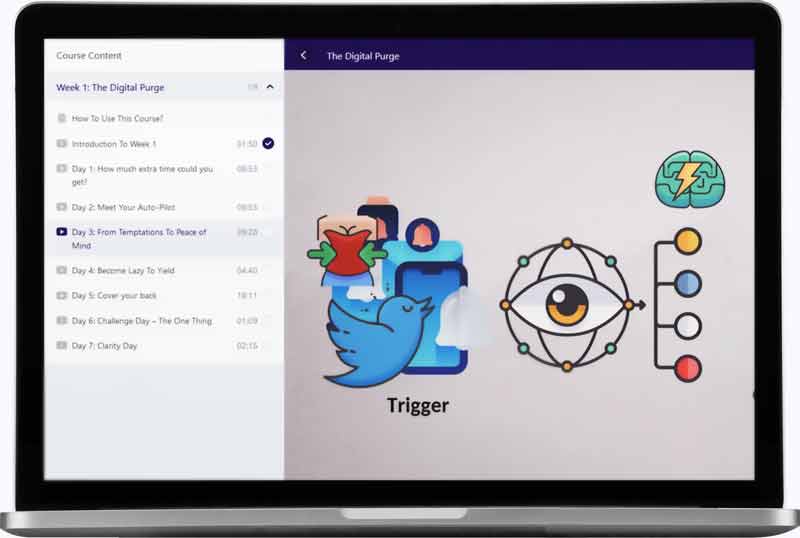

Here is a video from our course The Digital Purge. on how to add resistance to your temptations, so you become so lazy to engage with them that you give them up:

2. Spot & Reveal your emotional triggers

Second, there are some reasons, often hidden ones, that your brain and your heart love so much crypto. Those reasons act as triggers to pull your cravings. Rather than chasing the addiction, it’s a more efficient strategy to look at the feelings driving you toward it. That way you can cure and heal the feeling. You’ll feel better, and the cravings will magically disappear. Just get away.

3. Rewire to life

An addiction FOMO (fear of missing out) can be huge and really painful to resist, especially if it was here for a long time. However, learning to live with it is necessary to build a life full of peace and joy. Strategies to fight FOMO and rewire to life include meditation, nature activities, social interaction, intellectual and creative projects, meaningful adventures… basically anything that fills your soul.

4. How to not relapse and fully recover from crypto?

Finally, it’s important to acknowledge that quitting may take days, weeks, months, or even years. Getting over and quitting crypto forever can be difficult. You may relapse a few times, but the most important thing is that you keep engaging less and less with crypto. Each day you resist it is a day weakening your brain connections with crypto. From your patience and discipline will arise incredible mind strength, hope, and wisdom.

Best crypto blocker apps & functionalities

Additionally, you can increase your chance of withdrawal by limiting or blocking access to crypto using these apps.

They will help you filter, reduce, or block crypto:

In today’s digital age, managing screen time and limiting access to technology has become increasingly important for maintaining a healthy balance between online and offline activities. Whether you’re looking to boost productivity, improve mental well-being, or ensure your children aren’t spending too much time on their devices, there are several apps designed to help you limit or block technology access. Here are five of the best apps available:

- 1. Freedom

*Freedom* is a versatile app that allows users to block websites, apps, and even the entire internet if needed. It works across various devices, including Windows, macOS, iOS, and Android. Users can schedule sessions in advance or start a block session on demand. Its simplicity and effectiveness make it a favorite among those looking to enhance productivity and reduce distractions.

- 2. Forest

For those who want to stay focused while also contributing to a good cause, *Forest* offers a unique approach. The app encourages users to stay off their phones by growing virtual trees. If you leave the app to check social media or browse the web, your tree dies. Over time, users can grow a forest of trees, and the app partners with a real-tree-planting organization to plant actual trees, making it both a productive and environmentally friendly choice.

- 3. Cold Turkey

*Cold Turkey* is a robust app designed for those who need to take drastic measures to curb their digital habits. It can block websites, applications, and even the entire internet on Windows and macOS devices. With its “Frozen Turkey” feature, users can lock themselves out of their computers for a specified period, ensuring they stay focused on their tasks.

- 4. StayFocusd

Available as a Chrome browser extension, *StayFocusd* is perfect for those who find themselves spending too much time on distracting websites. Users can set daily limits on how long they can spend on particular sites, after which the sites become inaccessible. It’s a straightforward tool for anyoneCheck our full technology addiction tool list (ranked):

Where to seek extra help?

Do you need some support and help to stop, overcome, and recover from your crypto addiction? If you or someone you know is struggling with crypto addiction, there are a few places to seek help.

The Ultimate Rewiring Program For crypto Addicts

Our course The Digital Purge. This course has already helped many digital addicts to rewire to what matters.

Is there a “treatment” to cure technology addiction?

Absolutely, there are effective ways to address and overcome technology addiction! Here are some approaches that can help:

- 1. Cognitive-Behavioral Therapy (CBT): This type of therapy helps you understand the thoughts and behaviors driving your tech use. It teaches strategies to change unhealthy patterns.

- 2. Set Boundaries: Establish specific times when you limit or avoid using devices. For example, no phones during meals or before bedtime.

- 3. Digital Detox: Take breaks from technology by having tech-free days or weekends. This helps reset your habits and reduces dependency.

- 4. Mindfulness Practices: Techniques like meditation can increase your awareness of how and why you use technology, making it easier to manage your usage.

- 5. Create a Routine: Develop a daily schedule that includes time for activities away from screens, such as reading, exercising, or hobbies.

- 6. Seek Support: Joining support groups or talking to a mental health professional can provide guidance and encouragement as you work towards reducing your tech use.

Remember, it’s okay to ask for help. If you find that technology is impacting your daily life significantly, reaching out to a healthcare professional can provide personalized strategies to help you regain balance.

Does technology therapy exist?

Yes, therapy to address technology addiction does exist and is becoming increasingly recognized as a necessary form of treatment in our digital age. Technology addiction, often referred to as internet addiction or digital addiction, can manifest in various forms, including excessive use of social media, online gaming, streaming services, or general internet browsing. This type of addiction can lead to negative impacts on mental health, personal relationships, and daily functioning.

Several therapeutic approaches are used to treat technology addiction:

- 1. Cognitive Behavioral Therapy (CBT): CBT is one of the most common methods used to treat technology addiction. It focuses on identifying and changing negative thought patterns and behaviors associated with technology use. CBT helps individuals develop healthier coping mechanisms and establish a balanced relationship with technology.

- 2. Motivational Interviewing (MI): This approach involves working with individuals to enhance their motivation to change their technology use habits. It helps them explore the reasons behind their addiction and encourages them to set personal goals for reducing their technology use.

- 3. Family Therapy: Since technology addiction can affect family dynamics, family therapy can be beneficial. It involves working with family members to improve communication, set boundaries, and create a supportive environment for the individual struggling with addiction.

- 4. Mindfulness and Meditation: These practices can help individuals become more aware of their technology use and develop a greater sense of control over their impulses. Mindfulness techniques can reduce stress and improve focus, which can be beneficial in managing technology addiction.

- 5. Digital Detox Programs: Some treatment centers offer structured digital detox programs, where individuals spend time away from screens and technology to reset their habits and learn healthier ways to engage with digital devices.

- 6. Support Groups: Similar to other addiction support groups, there are groups specifically for technology addiction. These provide a platform for individuals to share experiences, offer support, and learn from others facing similar challenges.

It’s important for individuals who suspect they have a technology addiction to seek help from a qualified mental health professional. A tailored treatment plan can be developed based on the individual’s specific needs and circumstances. As awareness of technology addiction grows, more resources and specialized therapies are becoming available to address this modern-day challenge.

Where to find support groups if you are addicted to crypto?

Finding support groups for technology addiction can be a crucial step in managing and overcoming the challenges associated with excessive technology use. Here are several ways to find support groups:

- 1. Online Search: Use search engines to look for support groups dedicated to technology addiction. Websites like Meetup.com or Eventbrite often list local and virtual support group meetings.

- 2. Social Media: Platforms like Facebook have groups dedicated to various forms of addiction, including technology addiction. Joining these groups can provide community support and resources.

- 3. Therapy and Counseling Centers: Many mental health professionals offer group therapy sessions for technology addiction. Contact local counseling centers or therapists who specialize in addiction for recommendations.

- 4. Healthcare Providers: Speak with your doctor or a mental health professional who can refer you to local support groups or resources.

- 5. Non-Profit Organizations: Organizations such as the Center for Internet and Technology Addiction and others may offer support groups or resources for those struggling with technology addiction.

- 6. Universities and Colleges: Some educational institutions offer support groups for students dealing with technology addiction. Check with student services or the counseling center.

- 7. Libraries and Community Centers: These venues often host support groups or can guide you to local resources.

- 8. Online Forums and Communities: Websites like Reddit have communities where individuals share their experiences and support each other in managing technology addiction.

- 9. Digital Detox Programs: Some programs offer structured support groups as part of their services. Research digital detox programs that might offer group sessions or retreats.